In this Pensions Age article, I explore the question; two-thirds of pension funds are deeply concerned about the future of the global economic and financial system: How might gold help?

Even before the Covid-19 global pandemic and its seismic impact, deep-seated concerns about the health of the global economy, historically low or negative interest rates, and geopolitical uncertainty have weighed heavily on investors’ and asset managers’ outlook for some time. Now more than ever, the question for investors and asset managers is how to chart the best course through these unprecedented times and beyond by selecting the most appropriate assets and investments.

Covid-19

The Covid-19 outbreak has become the world’s leading threat, placing additional stress on a weakened financial system, and upending financial norms and life as we know it. Central banks and governments around the world have responded to this issue head on, with a financial response on an extraordinary scale led by a raft of unscheduled rate cuts.

On top of this, central banks and governments globally are injecting trillions of dollars into their economies – far in excess of the levels seen in response to the Global Financial Crisis in 2008. But these historic actions to maintain the flow of credit, in the hope of limiting the damage to the economy, could profoundly distort asset prices and allocations in the years to come.

These concerns were highlighted by a recent survey commissioned by the World Gold Council and conducted by Pensions Age, which found that two-thirds (67 per cent) of respondents agreed that they were deeply concerned about the future of the global economic and financial system.1

Pensions funds face challenges

Questions around the challenges pension funds are facing, and their ability to meet their long-term liabilities, have been swirling for some time. As people live longer and spend more time in retirement, pension schemes have seen their liabilities grow relative to their assets. According to the SkyVal index, UK defined benefit schemes had a £290 billion shortfall at the end of March 2020.2

Heightened volatility – a prevalent feature of 2020 so far – also presents a risk for pension schemes looking to achieve their funding target and manage their costs. The low/negative interest rate environment, which has depressed yields on bonds, has inflated future liabilities. As such, pension schemes have been forced to search for returns greater than those from traditional assets, often in illiquid investments that can carry higher risk.

The role of gold

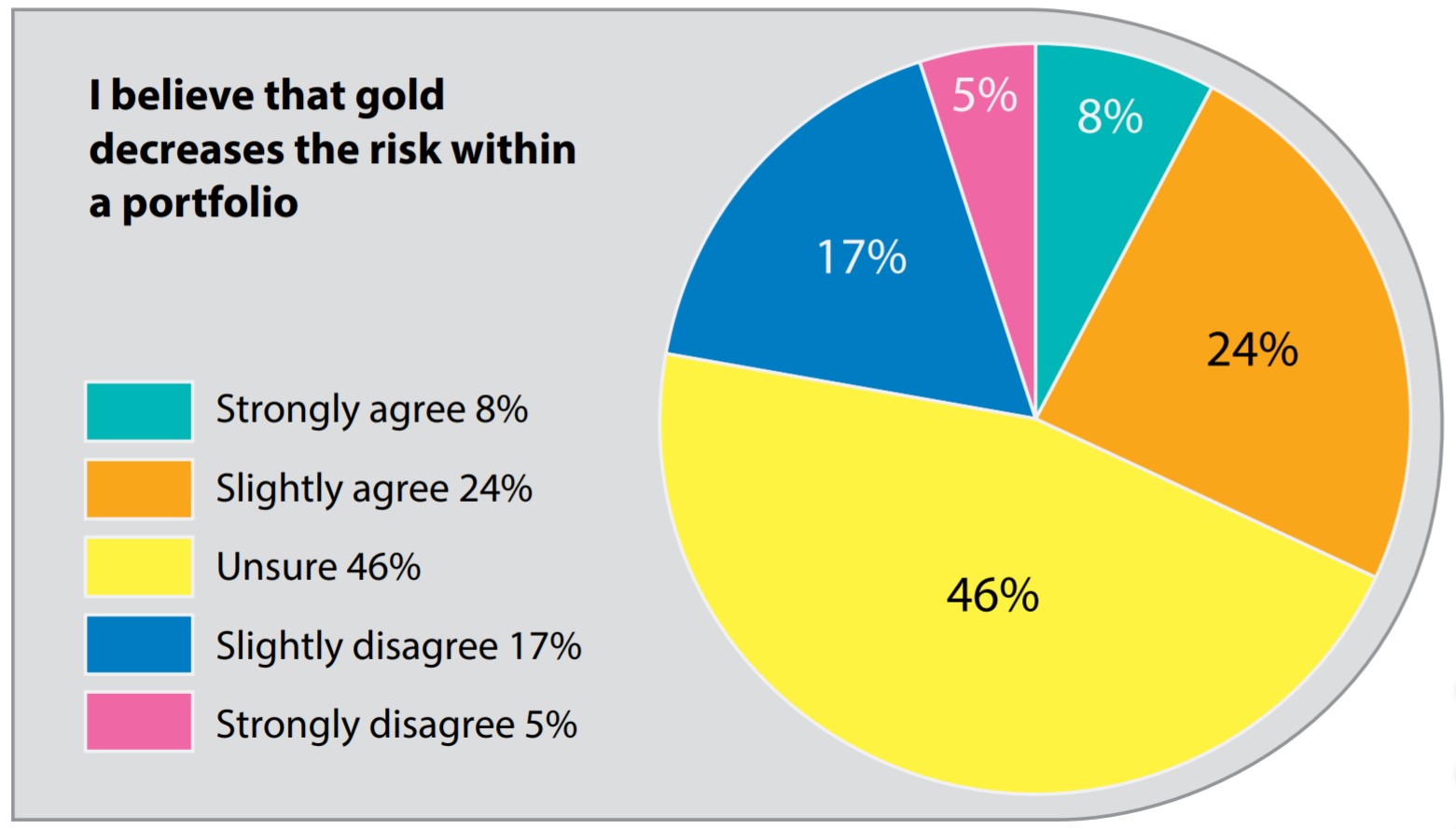

In the face of these challenges, pension schemes need ways to not just manage risk but minimise it – and this is where gold might play an instrumental role. This is reflected in the survey where nearly half (47 per cent) of respondents agreed that gold helps to decrease the risk within a portfolio.

Gold historically benefits from flight-to-quality inflows during periods of heightened risk. By providing positive returns and reducing portfolio losses, gold has been an effective diversifier during times of systemic crisis when investors tend to withdraw from equities. The large and liquid market for gold means it can be sold to meet liabilities while the values of less liquid assets correct. The greater a downturn in stocks and other risk assets, the more negative gold’s correlation to these assets becomes.

But gold’s correlation doesn’t only work in investors’ favour during periods of turmoil. Due to its dual nature as an adornment and an investment, gold’s long-term price trend is supported by income growth.

Only 28 per cent of respondents disagreed that gold delivers poor returns over the long-term, with 48 per cent holding no view. In fact, its price, measured in pound sterling, has increased by an average 11.6 per cent per year since 1971 when it began to be freely traded following the end of Bretton Woods. And it has outperformed many stock, bond and commodity indices over multiple periods since then. This is even more significant given gold does not pay a coupon or dividend because, as a hard currency, it carries no credit risk.

Gold’s price performance is a result of its multiple sources of demand. Gold is used by investors to protect and enhance wealth over the long-term, and it is no one’s liability. It is also sought after as an adornment, valued by jewellery buyers across the world. And it is a key component in electronics. These diverse sources of demand, combined with its relative scarcity, give gold a resilience: the potential to deliver returns in good times and in bad.

Like any investment, an allocation in gold is not risk-free. Its value will fluctuate in the short-term, and potentially more so than other assets. But over the long-term, its volatility has averaged 16-17 per cent, significantly less than other traditional assets such as equities or bonds

Gold goes beyond commodities

Another common belief amongst investors and investment practitioners alike is that gold is just a component of the broader commodity complex. Two-thirds (68 per cent) of survey respondents agreed they viewed gold as a subset of commodities.

While gold undoubtedly shares some similarities with commodities, a very cursory look at the make-up of supply and demand highlights that differences outnumber similarities. For example, the supply of gold comes from both mining and recycled sources, helping to quell uncertainty and volatility, while gold is not consumed like typical commodities because gold is virtually indestructible.

Gold’s unique attributes set it apart from the commodity complex. From an empirical perspective, including a distinct allocation to gold has been shown to improve the performance of portfolios with passive commodity exposures.

Gold & ESG

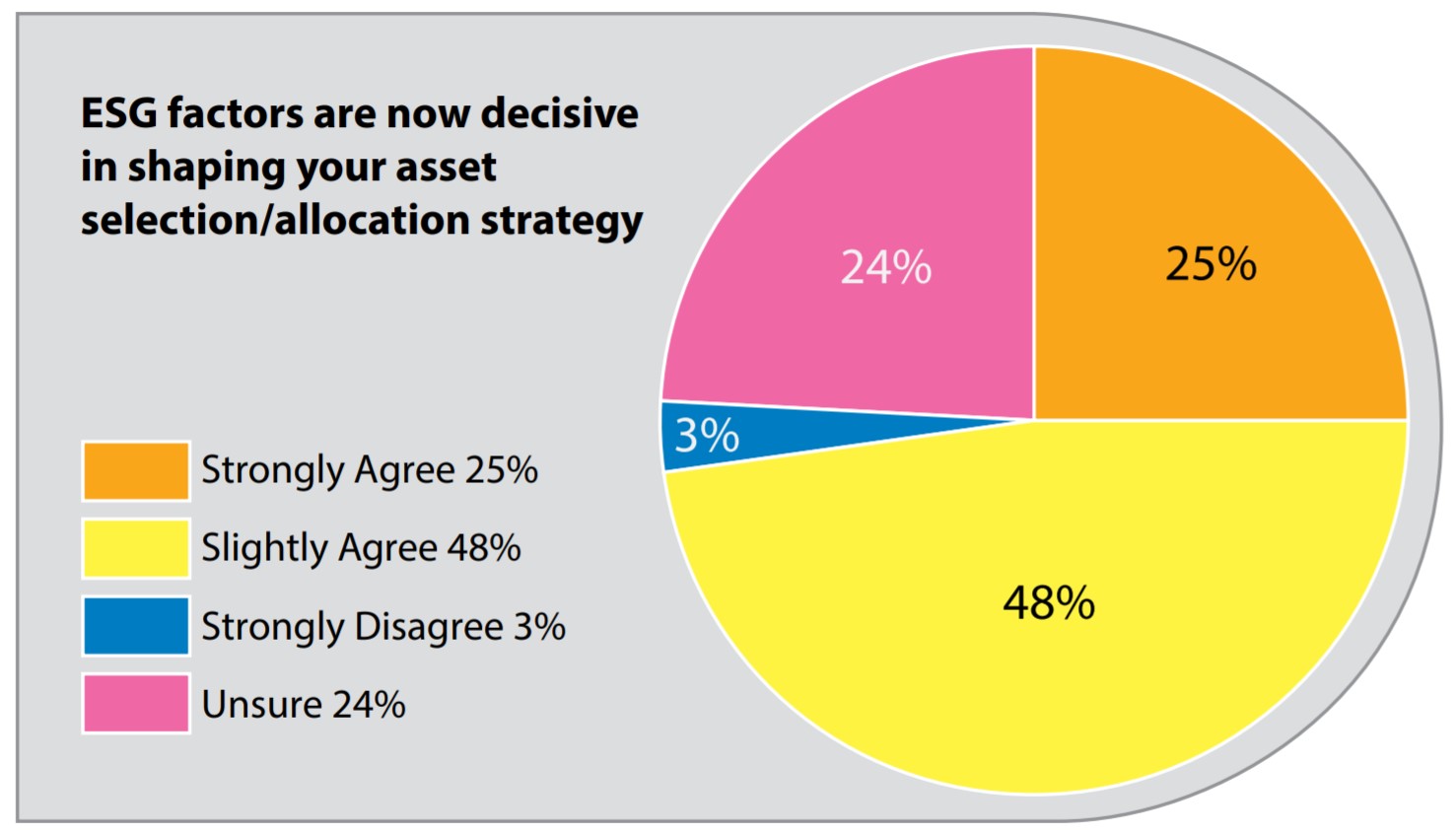

Respondents overwhelmingly agreed (85 per cent) that environmental, social and governance (ESG) issues are now decisive in shaping asset selection or strategies. This is in line with wider societal expectations but also driven by a host of legal and regulatory changes. In September of 2019, UK pension trustees became obliged to have a strategy recognising ESG factors, including climate change, as ‘financially material’ considerations. The following month, regulations were introduced requiring pension schemes with more than 100 members to disclose an understanding of the potential impacts on their investments from ESG-related risks.

The moves towards an increased understanding of this wider set of risks, and actions to mitigate their negative impacts, have also been key factors shaping the evolution of the gold supply chain, and gold’s developing role as a portfolio and risk mitigation asset.

To ensure that gold is produced sustainably and responsibly, key market participants across the supply chain have evolved a range of industry initiatives and standards to give investors greater confidence in the provenance of gold as a responsibly sourced asset.

Most recently, the World Gold Council launched the Responsible Gold Mining Principles, a comprehensive framework that sets out clear expectations for consumers, investors and the downstream gold supply chain as to what constitutes responsible gold mining.3 Independent validation of company conformance will provide further confidence to investors that the gold production process adheres to high ESG standards, reinforced by external assurance on performance, which should help minimise the risk of ‘greenwashing’.

But of all ESG risks, perhaps the most substantial and urgent are those relating to climate change. There is strong evidence that gold can play a constructive role in contributing to the mitigation of climate-related risks and support greater resilience in investment portfolios in the face of potentially destructive climate impacts. Gold has a comparatively low emissions profile and immaterial downstream impacts, potentially reducing the overall carbon footprint for an investment portfolio.4

Conclusion

The challenges and risks facing pension schemes have been mounting for some time. And this has only been exacerbated by the events of 2020 so far. But while pension schemes may be fully cognisant of these risks, they may not be fully aware of the assets which can help.

Gold’s unique portfolio characteristics, which set it apart from other mainstream assets and commodities, could be well suited to help manage those risks going forward.