Today we have published the latest update to our central bank gold reserves dataset, which includes data reported by the IMF for May 2020. We encourage you to download it here but we have highlighted some of the key data points below.

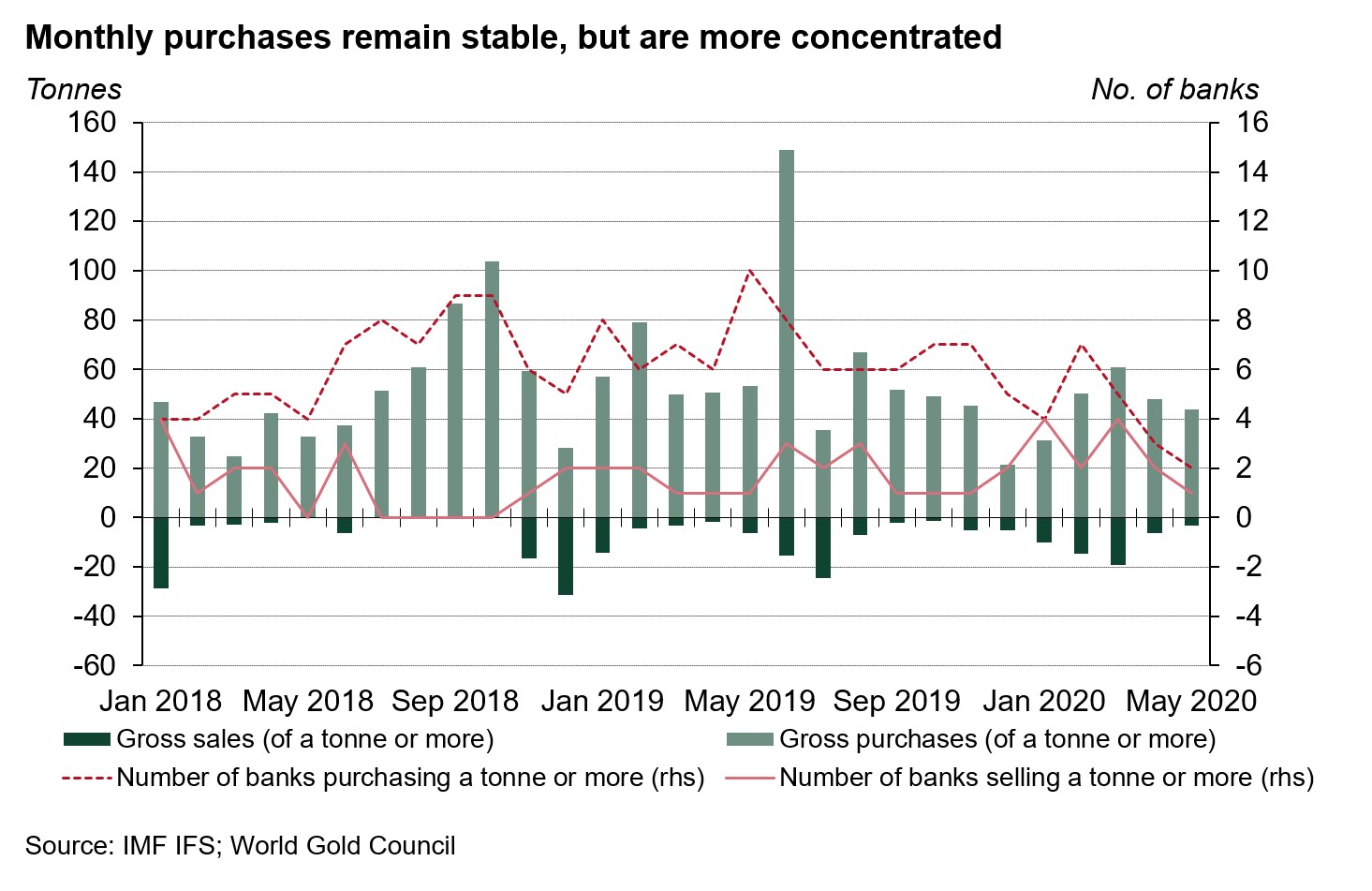

Central bank net purchases totalled 39.8t in May, in line with net purchases in March and April, and above the monthly average of 35t over the first four months of this year. On a y-t-d basis, IMF data shows that net purchases are now 181t, 31% lower than the same period in 2019.

As we have previously mentioned, we expect central banks to remain net buyers this year, but their level of purchasing will be lower than the multi-decade record levels in 2018 and 2019.1 So far, net purchases have been indeed lower, but we have seen several central banks in 2020 allocating more to gold. Y-t-d, five central banks have increased their gold reserves by a tonne or more.

Yet, the initial data for May shows that, like April, buyers were few and far between. In fact, only two banks increased their gold reserves significantly (of a tonne or more) during the month. Turkey was once again the largest purchaser, increasing reserves (ex ROM) by 36.8t.2 This takes their total gold reserves to 560.8t, 36.4% of total reserves. Uzbekistan’s gold reserves also grew during the month, rising by 6.8t to 342.8t (59.5% of total reserves).

It’s also worth paying some attention to the sales activity. In May, only Mongolia saw their gold reserves decline significantly (again, of a tonne or more), by 3.3t, and on a y-t-d basis, six central banks have now decreased their gold reserves, totalling 31.8t. The number of sellers is slightly higher than the total of five banks in 2018 and four in 2019 who reduced their gold reserves. While purchases continue to dwarf sales, we will continue to monitor developments in sales.

Look out for our summary of central bank demand during H1 in our Q2 Gold Demand Trends report which will be published at the end of July.3

Footnotes

1 https://www.gold.org/goldhub/gold-focus/2020/06/central-banks-remain-positive-towards-gold-despite-lower-buying-april

2 The Reserve Option Mechanism (ROM) – introduced in 2011 – allows commercial banks to use gold as part of the required reserves that they deposit with the Central Bank of the Republic of Turkey (CBRT).

3 https://www.gold.org/goldhub/research/gold-demand-trends