Summary

- The domestic gold price increased by 2.6% in May m-o-m and is 19.6% higher than at the end of 2019

- The Indian economy remained fragile and the stock market fell in May

- Jewellery demand improved in southern India but remained weak elsewhere

- A rising gold price, higher volatility in the equity market and safe-haven demand lured investors towards gold ETFs. Net inflows into gold ETFs in May were Rs 8.15bn, compared with Rs 7.3bn during April

- The Reserve Bank of India (RBI) added 19.9t of gold to its reserves between February and April 2020.

Economy remained fragile and stock market fell in May

Domestic economic activity has been impacted severely by the nationwide lockdown, which began on 25 March. High frequency indicators point to a collapse in consumer demand since March 2020 across both urban and rural segments. India’s largest carmaker, Maruti Suzuki, reported an 86% y-o-y fall in domestic car sales in May. Similarly, India’s top two-wheeler manufacturers, Hero MotoCorp and Bajaj Auto, reported y-o-y falls in domestic two-wheeler sales of 83% and 81% respectively during the month.1 As per the RBI Survey, the Consumer Confidence Index fell to an historic low of 63.7 in May from 85.6 in March and the one-year ahead confidence index also recorded a sharp fall.2 (Chart 1).

The nationwide lockdown and rising number of COVID-19 cases in the country spooked investors and India’s BSE Sensex fell by 3.8% m-o-m to close at 32,424 level at the end of May.

Monetary loosening and the government’s economic stimulus package will support micro, small and medium enterprises (MSME) and the rural economy

To provide stimulus to the economy amid COVID-19, the RBI cut interest rates by a cumulative 115bps during its bi-monthly monetary policy meetings: 75bps in March and 40 bps in May 2020. Together with this interest rate cut, the Central government, along with RBI, provided a Rs 20.97 tn (US$278bn) economic package. The package focuses on supporting the micro, small and medium enterprises (MSME) and the rural economy, with 18% and 22% of its value allocated to these two sectors respectively. This will help farmers and the rural economy as well as support the employment of labourers in informal sectors.

Jewellery demand improved in southern India but remained weak in other regions

Jewellery stores reopened in Kochi (state of Kerala) in the week beginning 18 May.3 From discussions with local jewellery retailers in the city, daily sales in May were reported to be ~60-70% of the comparable period of the previous year. The retailers mentioned that the majority of sales were for delivery of jewellery against advanced bookings made a few months ago and the number of new customers was low. In Tamilnadu, following the state government directive, only small jewellery stores without air-conditioning were permitted to open; large jewellery stores and shops in the mall remained closed. In accordance with this directive, jewellery stores remained closed in Coimbatore and only small jewellery stores opened in Chennai during May. Jewellery stores in the state of Karnataka reopened early in the month and retailers reported average daily sales around 25-30% of the comparable period of the previous year.

In other regions, jewellery stores remained closed in Mumbai and Ahmedabad due to the high number of COVID-19 cases.4 Regional players such as PN Gadgil & Sons, PNG Jewellers, and Waman Hari Pethe all reported better sales than single standalone stores, however daily sales in the western region were ~15-20% of the comparable period of the previous year. Jewellery retailers in the north and east region reported daily sales of ~20-25% of the comparable period of previous year.

Jewellery manufacturing activity resumed in the cities of Coimbatore and Thrissur but remained suspended in other manufacturing hubs due to the migration of artisans to their hometowns amid the virus outbreak.

Recycling volumes increased modestly with a higher propensity towards gold loans against jewellery

A significant jump in gold recycling volumes amid COVID-19 was anticipated, as consumers were expected to turn to gold recycling and take advantage of the higher gold price to meet liquidity needs in an uncertain environment. However, from discussions with the industry it appears that gold recycling increased only modestly in the month. Instead, to meet liquidity needs, consumers preferred to pledge their gold jewellery for loans. The banks have identified the financial needs of individuals and small businesses and rolled out attractive gold loan schemes in response.5

Rising gold price, volatility in the market and safe haven demand lured strong inflows into gold ETFs

The MCX Gold Spot (995 fineness) in INR ended the month 2.6% higher than at the end of April, outperforming the LBMA Gold Price AM in USD (+0.5%) over the same period.6 Against a backdrop of increasing COVID-19 cases, the volatility index in the equity market rose sharply to 43.7% on 4 May from 34% at end of April. The average volatility index in the first half of May remained elevated at 39.8% before subsiding to 33.8% in the second half of the month.7 Rising volatility, along with a higher gold price, lured investors towards gold-backed ETFs – a flight towards the safe haven. Inflows into gold-backed ETFs rose by Rs 8.15bn in May as compared to an inflow of Rs 7.3bn in April (Chart 2).

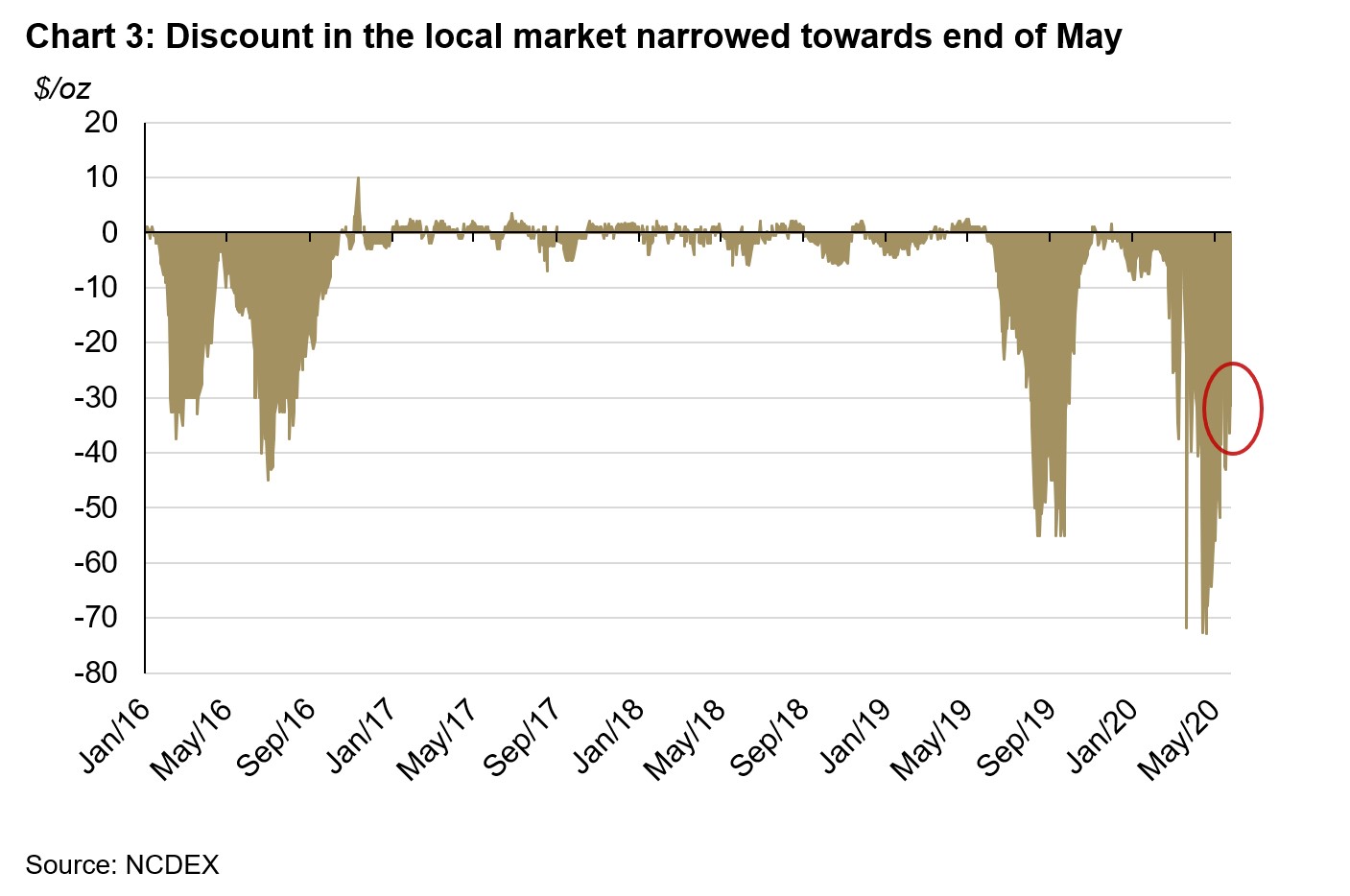

Discount in the local market narrowed in the month

The average discount in the local market was US$40/oz in May but narrowed to US$28-30/oz by the end of the month due to a mild pickup in sales activity after the opening up of jewellery stores from 18 May (Chart 3).

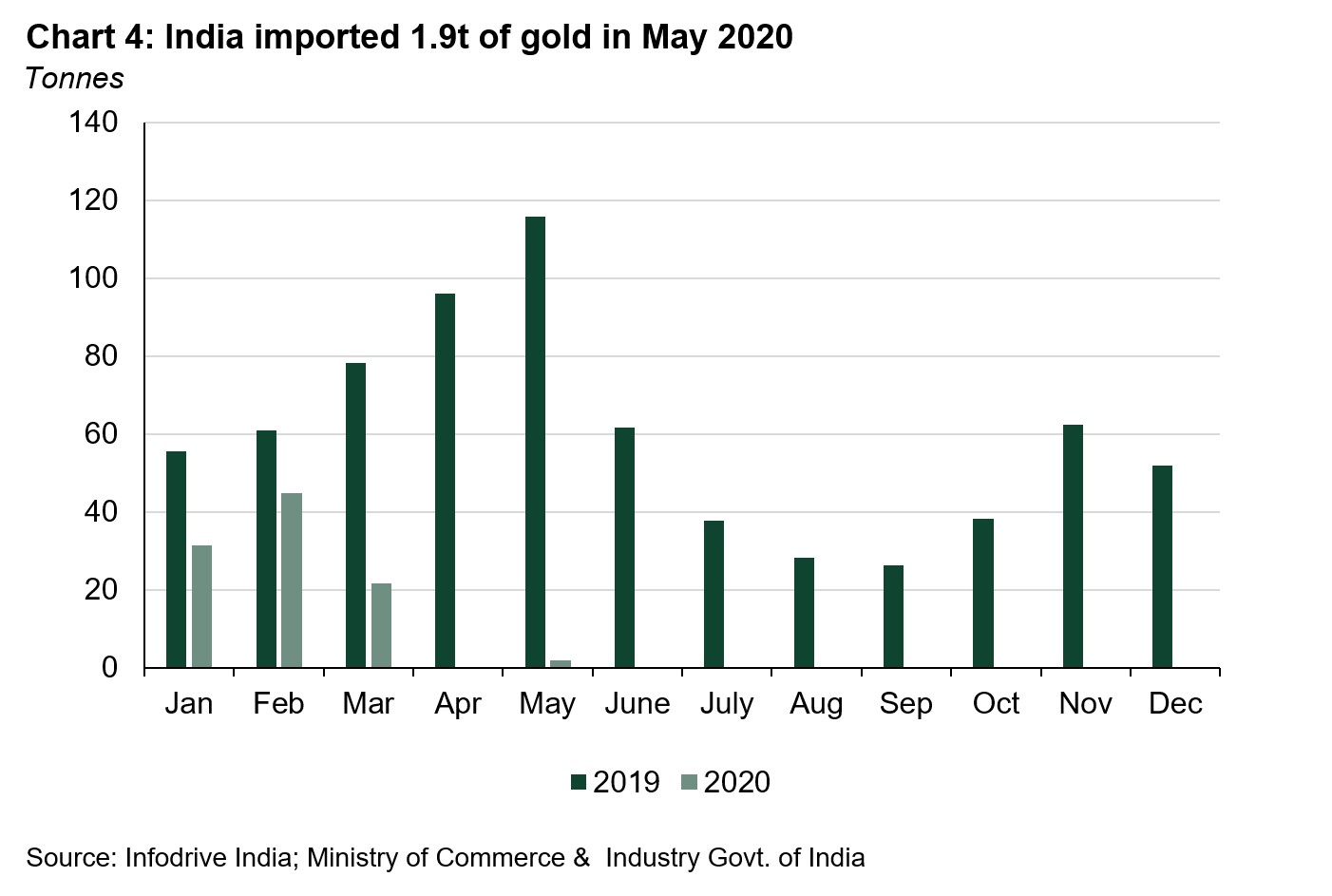

India imported 1.9t of gold in May

Indian gold imports totalled 1.9t in May 2020 – 98% lower y-o-y and 75% lower y-t-d (Chart 4). A total of three banks, nominated agencies and exporters imported 1.83t of bullion during the month, and one refinery imported 0.04t of gold doré (fine gold content).

RBI added 19.9t of gold reserves between February and April

The RBI purchased a total of 19.9t of gold between February and April, taking its total gold reserves to 654.9t by the end of April 2020 (Chart 5).8 The RBI stepped up its gold purchase to maintain the safety and liquidity of its forex reserves.

Footnotes

1 https://www.bloombergquint.com/business/may-auto-sales-live-maruti-suzukis-car-sales-slumps-86-to-18539-units

2 Consumer Confidence Index is compiled from the survey conducted by RBI on 5,300 households in 13 major cities of India during 5-17 May 2020

3 Kochi is based in the state of Kerala and the city is popular for its affinity for gold jewellery.

4 Mumbai and Ahmedabad are the major gold trading hubs in the western region

5 https://economictimes.indiatimes.com/industry/banking/finance/banking/gold-loans-catch-the-fancy-of-indian-financial-market/articleshow/75803736.cms

6 We compare the LBMA Gold Price AM with MCX Gold Spot price as their trading hours are closer to each other than the most commonly referenced LBMA Gold Price PM.

7 India VIX (NSE) is volatility index based on NIFTY Index option prices.

8 Central Bank data is taken from IMF-IFS. IFS data are two months in arrears, hence data is available until end of April. Please refer to our latest Central Bank Statistics https://www.gold.org/goldhub/data/monthly-central-bank-statistics