When investors in Germany buy gold, they tend to do so with the intention of protecting their wealth, while also keeping one eye on making good long-term returns. That was a finding from our 2019 survey of over 2,000 German retail investors, as part of a larger global survey of more than 12,000 investors across six markets. The research revealed that almost half of German retail investors buying gold bars and coins felt that the main role of their gold investment was to protect their wealth, with around one third focusing on good long-term returns (in excess of inflation).

And, according to the recently-published results of Pro Aurum’s 2020 annual Forsa survey, greater numbers of German investors now expect gold to help them achieve these investment objectives than last year. The survey shows that 31% of respondents voted gold as the investment product most likely to generate the best returns over the next three years, ahead of stocks with 25%. The 2019 survey saw gold receive 26% of votes, second place behind stocks (28%).

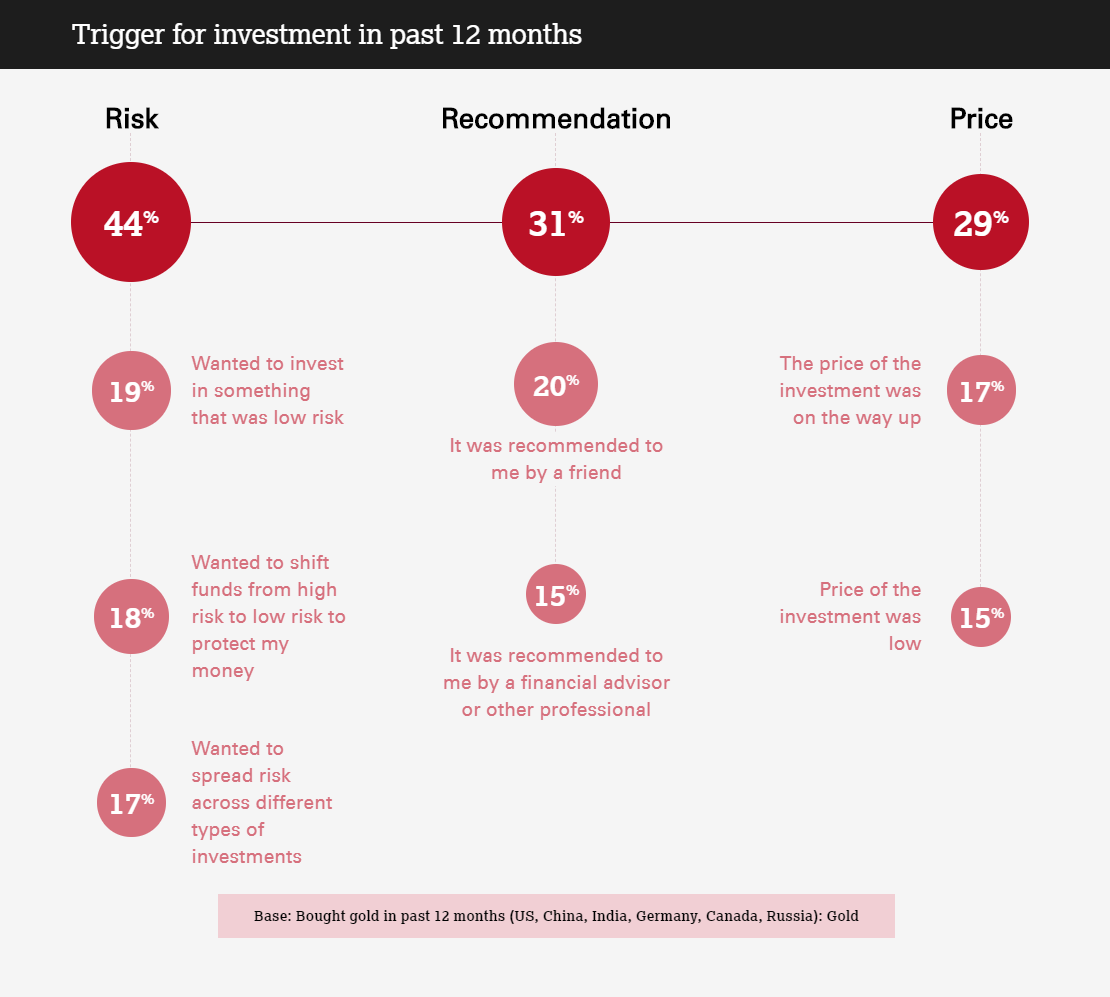

Our global survey identified that – at a global level – risk management was the key trigger for investments in gold in the 12 months preceding the survey.1

Considering the environment of sharply heightened risk that has prevailed in 2020 so far, these findings chime with the huge increase in German gold investment witnessed in recent months, with risk being one of the drivers, along with low/negative interest rates. Our Q1 Gold Demand Trends report highlighted a four-year high in bar and coin investment in Germany in the first three months of the year, following the strong December uptick noted by the Perth Mint.

As we indicate in The relevance of gold as a strategic asset ‘Gold has consistently benefited from “flight-to-quality” inflows during periods of heightened risk. It is particularly effective during times of systemic risk, delivering positive returns and reducing overall portfolio losses.’

As German investors seem to intuitively understand gold’s risk-hedging properties, it is worth paying attention to the finding from our research that 37% of German retail investors have never bought gold before but would consider buying it in the future. Might the current relatively risky environment encourage them to do so?

This is just a small subset of the insights that our detailed German market report – scheduled for publication later in the year – will reveal about the specific drivers and behaviours related to gold investment in that market. In the meantime, please see retailinsights.gold for data generated by the global survey and for India-specific gold market insights.

Footnotes

1 This refers to the 12 months preceding survey fieldwork, which took place in Q2 and Q3 2019