This morning we released the Global gold-backed ETF flows report for April which highlighted gold-backed ETFs (gold ETFs) had inflows for a sixth straight month.

Highlights of the report include:

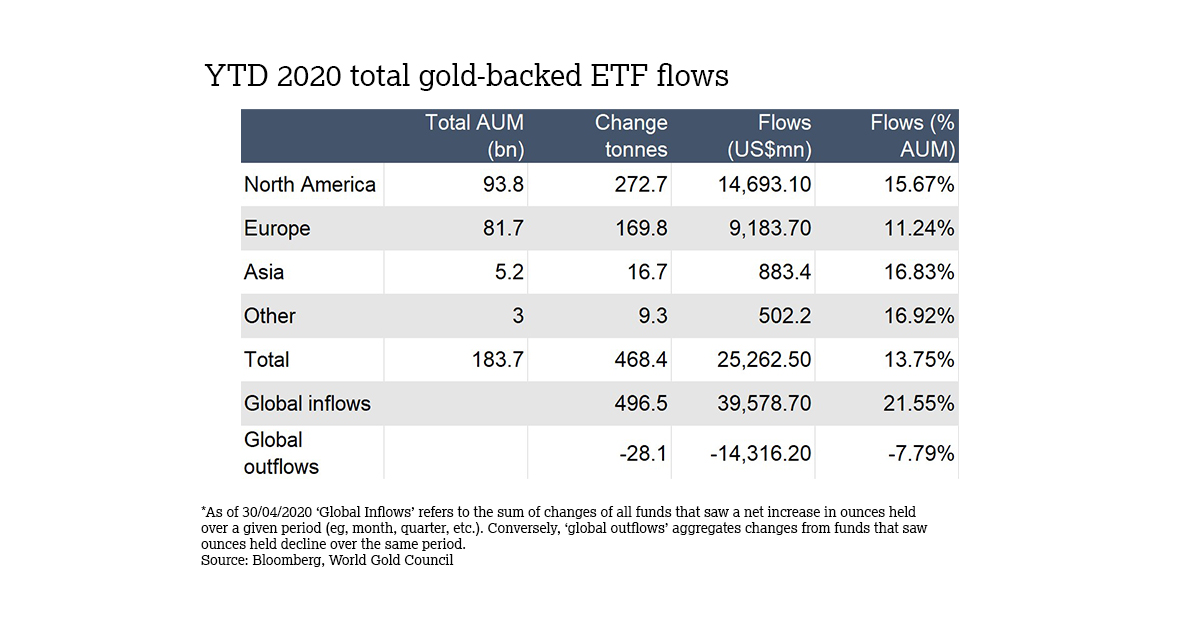

- Gold ETF inflows of 170 tonnes(t) or US$9.3bn (+5.1%) during the month

- New all-time holdings of 3,355t and assets under management of US$184bn

- North America drove the bulk of global gold ETF inflows in April

- SPDR® Gold Shares and iShares Gold Trust represented 71% of all global inflows in April

- Gold ETF assets have grown 80% in the past year

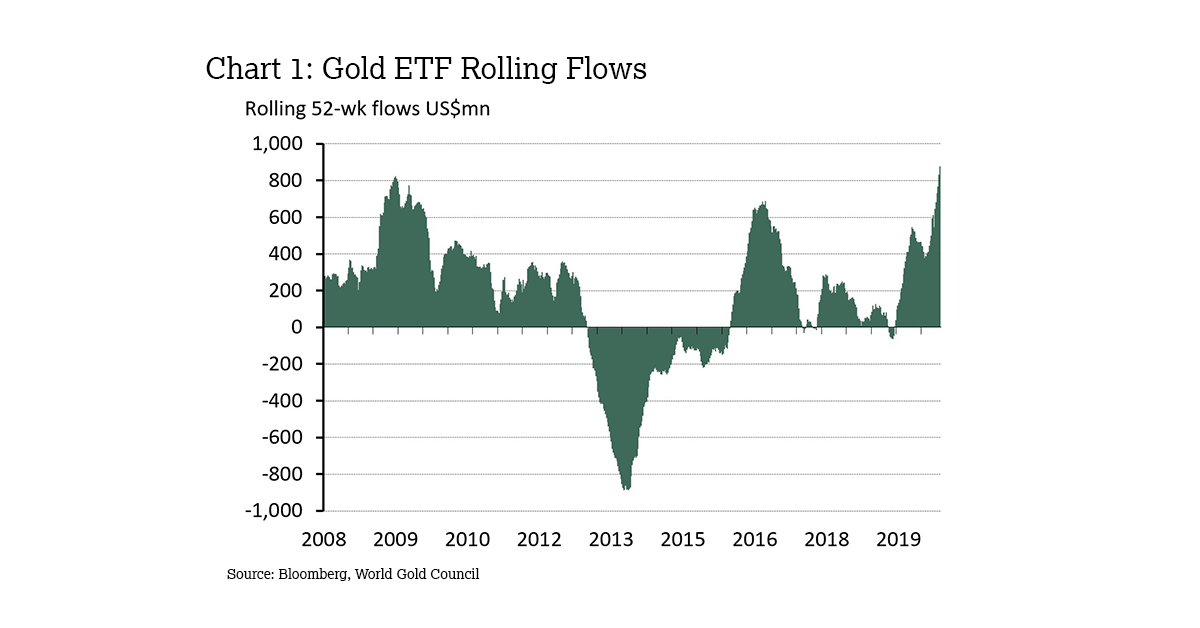

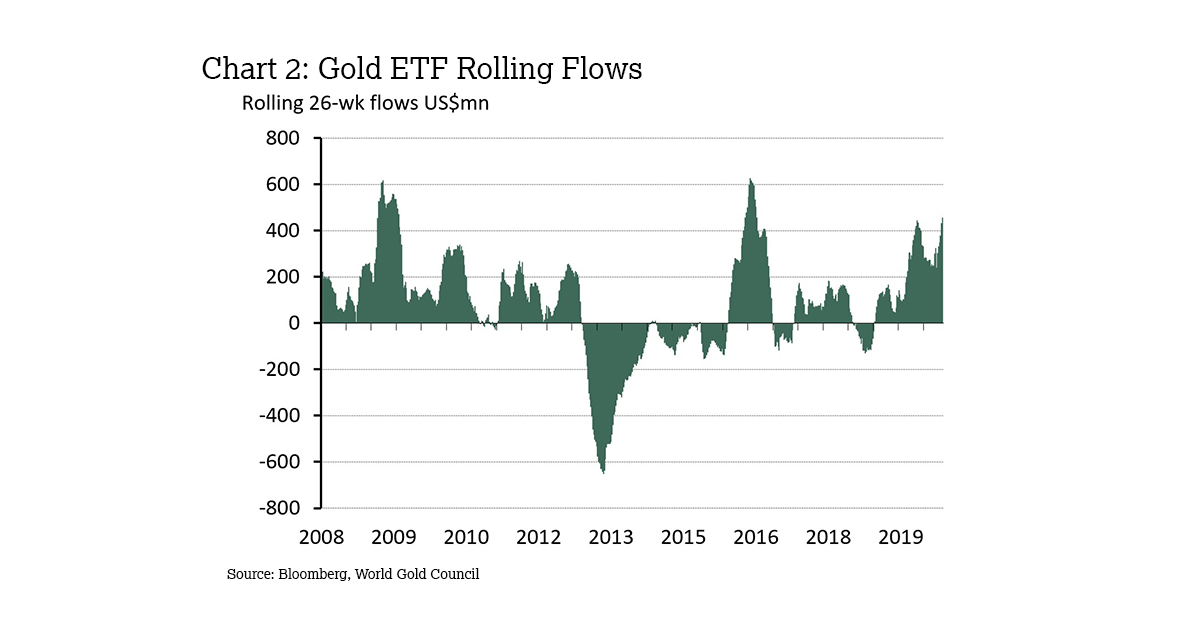

Inflows have been strong and consistent in recent months, but not unprecedented:

- Rolling twelve-month inflows of 879t just surpassed those of 2009 and 2016, but…..

Looking ahead:

- So far, recent gold strength has mirrored that of the Global Financial Crisis and the impacts of the first QE

- Central banks remain committed to supporting the economy as COVID-19 cases diminish and medical advances may help create a path toward ‘normalisation’

- Recent GDP releases by the US and UK suggest an extremely negative impact on growth

While gold jewellery and technology demand has been negatively impacted history suggest, investment demand strength, like ETF inflows, may offset this weakness.