Today we released our analysis on gold-backed ETF flows for the first quarter of 2020, as well as the month of March.

Q1 2020 highlights

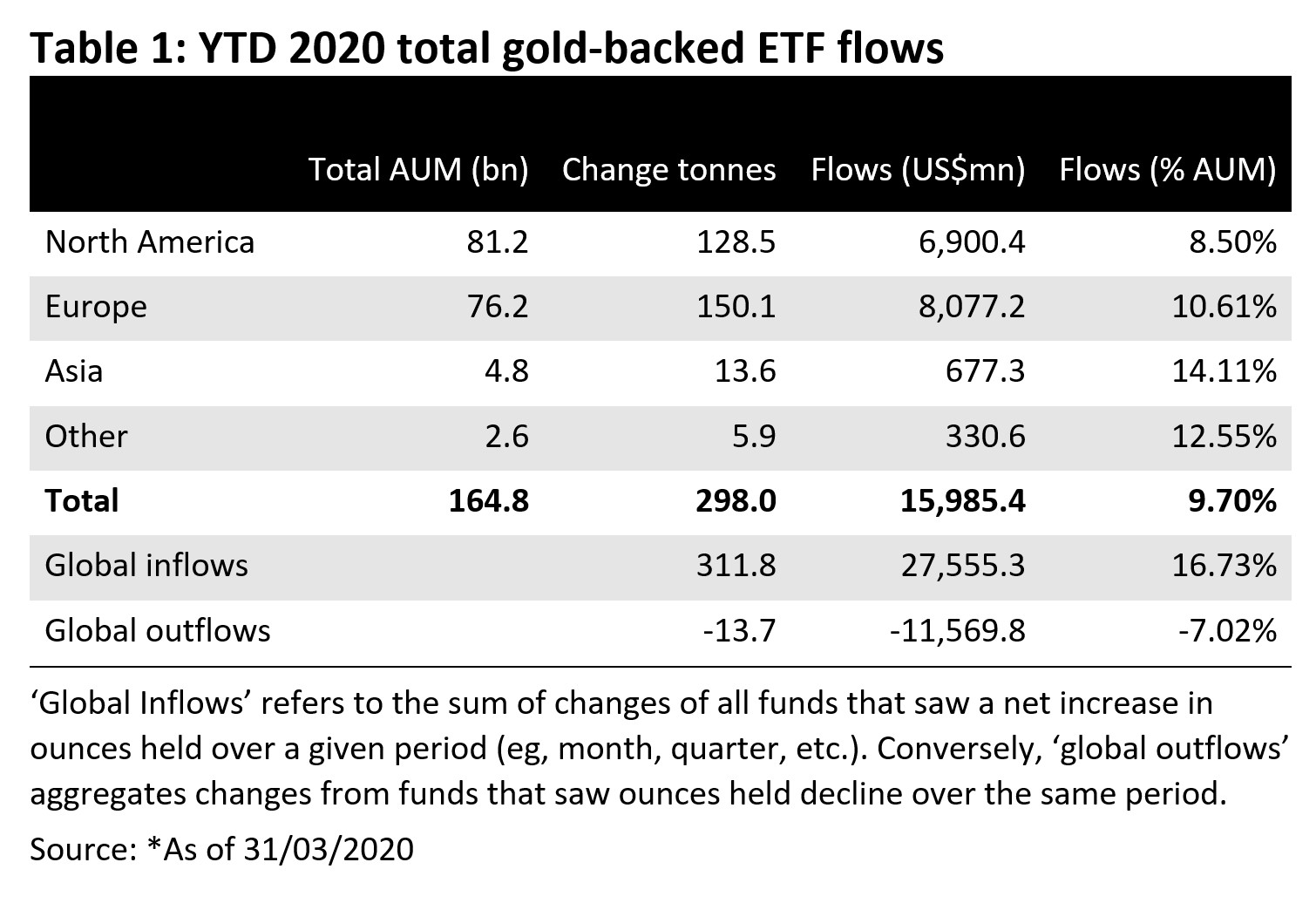

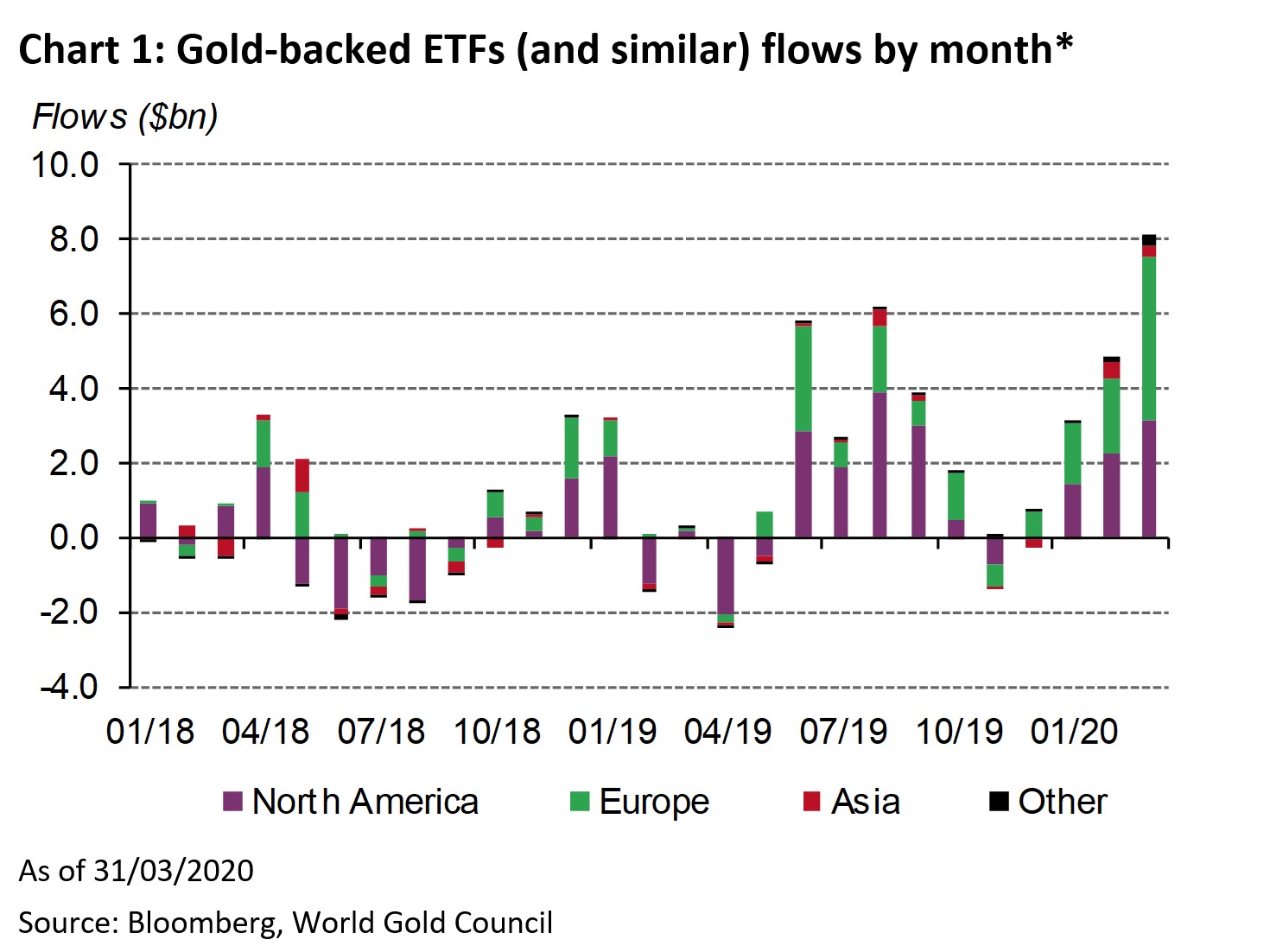

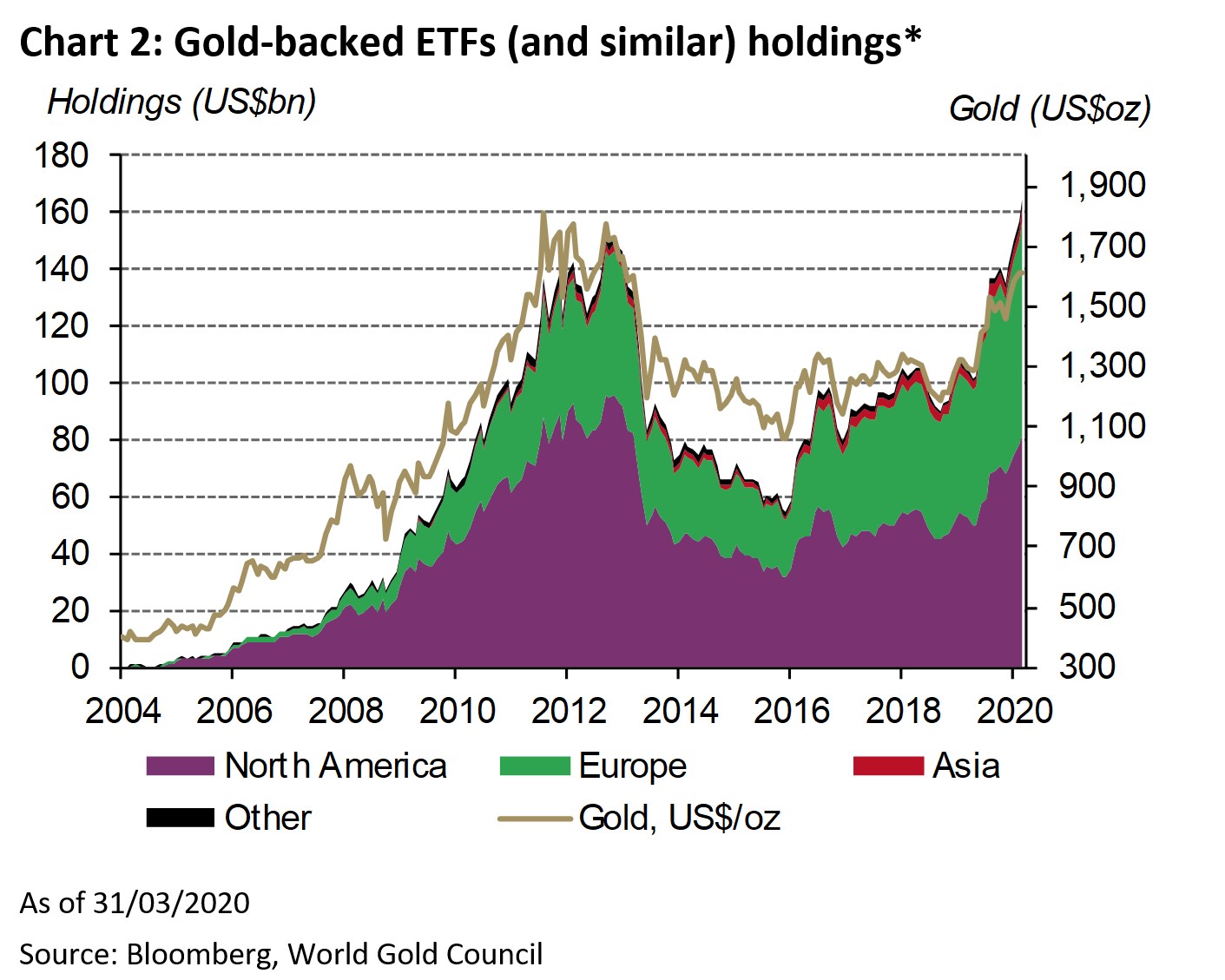

- Global gold-backed ETFs (gold ETFs) and similar products added 298 tonnes(t), or net asset growth of US$23bn, across all regions in the first quarter of 2020 – the highest quarterly amount ever in absolute US dollar terms and the largest tonnage additions since 2016.

- During the past year, gold ETFs added 659t, the highest on a rolling annual basis since the financial crisis, with assets under management (AUM) growing 57% over the same period.