Gold has long been recognised as a safe haven, an asset that investors seek out for protection and security during uncertain times. As our Director of Market Intelligence, Alistair Hewitt, put it in a recent interview "Gold historically benefits from flight-to-quality inflows during periods of heightened risk and, by providing positive returns and reducing portfolio losses, gold has been especially effective during times of systemic crisis when investors tend to withdraw from stocks."

That certainly seems to have been borne out over the last week, with the US$ gold price reaching a seven-year high.

Accordingly, the recent escalation of tensions on the global stage has reportedly sparked a fresh wave of gold investment in the UK. A statement by the Royal Mint attributed a 572% increase in sales revenue and a 416% increase in average order value at its Bullion division last weekend to the outbreak of violence and increasing hostility between the US and Iran.

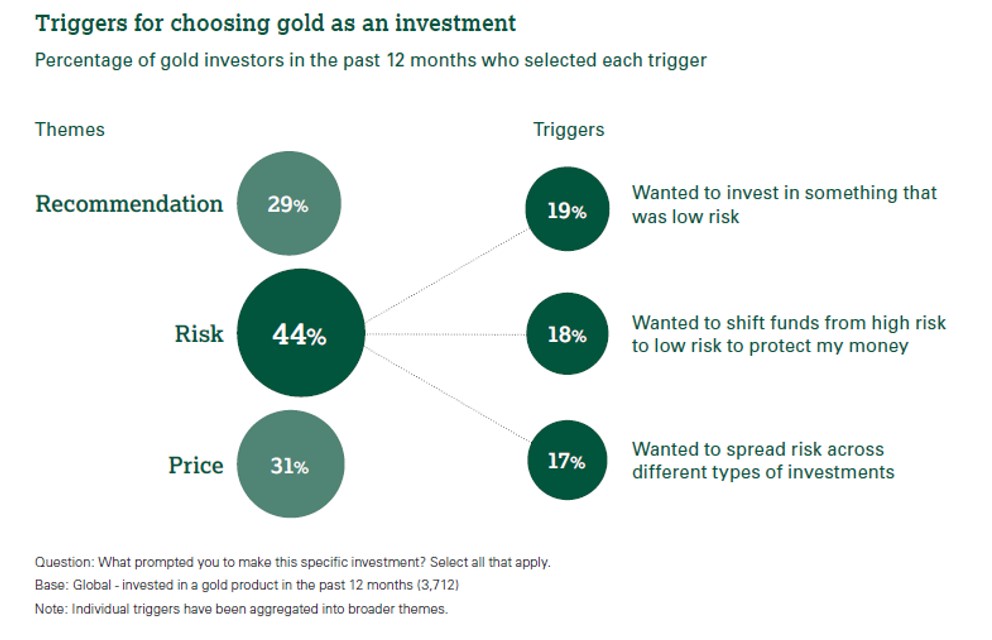

Consumer research confirms that this is far from being just a UK phenomenon. Our global survey of 12,000 retail gold investors from North America to China, via Germany, India and Russia, showed that 44% of investors who had bought gold in the last 12 months did so in response to risk factors. And gold was their top choice of investment product with which to manage risk, ahead of even government bonds.