China’s first exchange-traded gold future’s option was listed on 20th December 2019 on the Shanghai Futures Exchange (SHFE). While gold options already existed in China, these were traded over-the-counter (OTC) on the OTC market platform at the Shanghai Gold Exchange (SGE) and linked to physical gold products.1 The newly listed SHFE gold option’s underlying assets are gold futures, filling a gap in the exchange-traded gold option market in China.

Current state of China’s option market

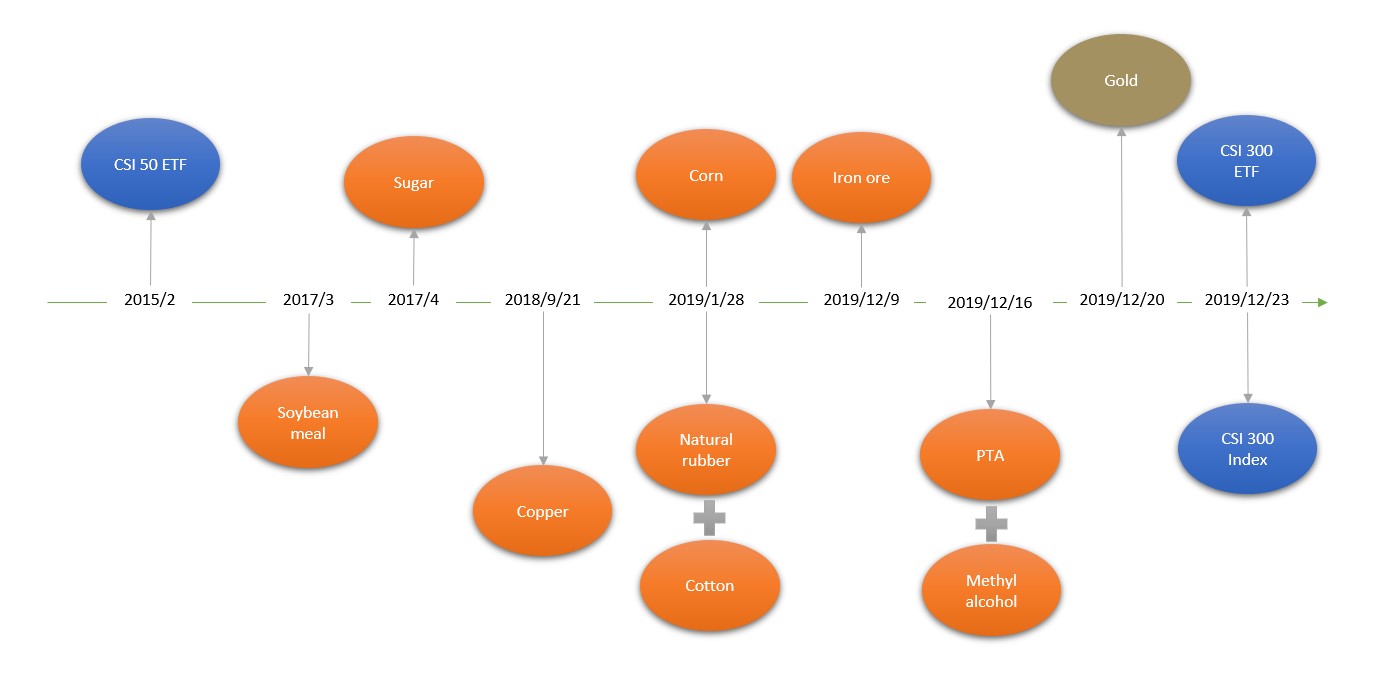

China’s option market is young. It started with the birth of the OTC options market in 2013. This is regulated by China Securities Regulatory Commission and its main participants are security brokerage firms and futures companies, as well as commercial banks. Two years later, China’s exchange-traded options market came into existence. Having developed over the last four years, there are now three stock index options and ten different commodities futures options listed at exchanges.

Listed exchange-traded options in China

Note: PTA stands for Purified Terephthalic Acid

China’s exchange-traded options market has grown significantly since its launch. For instance, CSI 50 ETF option’s daily trading volume averaged around one billion yuan, or US$200 million, in 2019 – eight times greater than its 2015 daily average. The market size of commodities options has also expanded since 2017, when the first commodity option was listed, as market participants’ awareness of options trading started to grow.

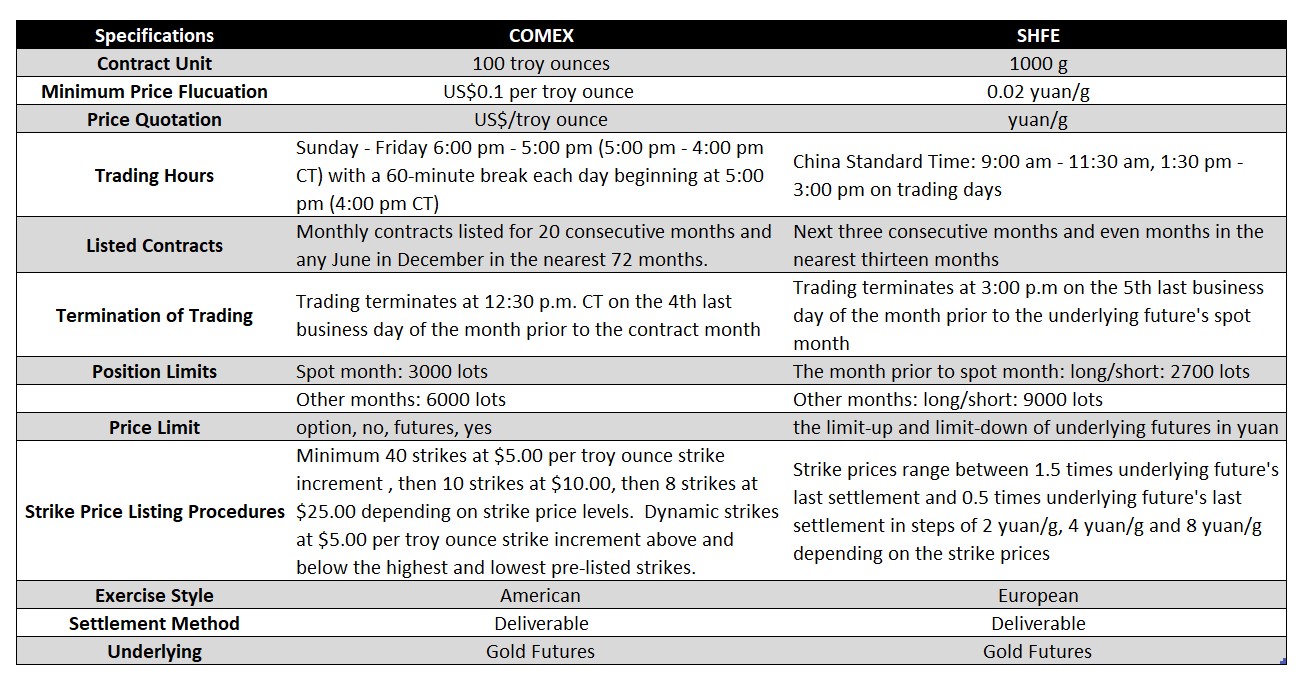

Gold futures options at the SHFE and COMEX

The two gold options based on the most liquid gold futures contracts globally at COMEX and the SHFE are different, yet to some extent, similar. The SHFE’s gold option is European style, whereas gold options at the COMEX are American style.2 This means that SHFE’s gold option can only be exercised at maturity while COMEX’s can be exercised any time before maturity. The SHFE also set stricter gold option access restrictions for retail and institutional investors, such as tracking records of derivatives trading history. In addition, differences also exist in price limits, contract ranges, etc.

As for similarities: both options’ underlying assets are gold futures, and both are deliverable, meaning investors will get corresponding gold futures positions upon exercise. And there are position limits – although not the same in sizes – in both gold options for risk control.

Market-making mechanism of the SHFE’s gold option

To ensure market liquidity, the SHFE has chosen 14 qualified institutions as market makers to answer price inquires at a certain frequency.3 Recruiting market makers is a necessary step in fostering China’s emergent option market. Other exchange-traded options in China all adopted such liquidity-providing mechanism.

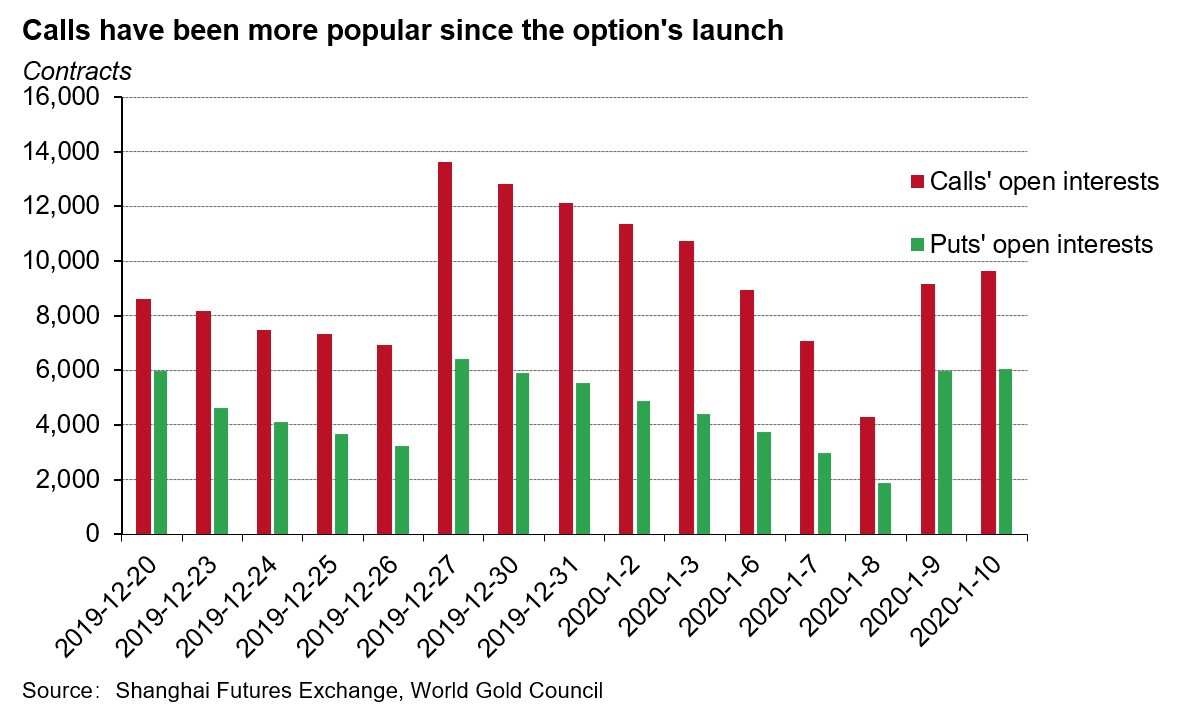

China’s gold option trading activity suggests bullish sentiment among investors

Based on trading volumes since inception, investors are more interested in calls than puts. As of 10th January 2020, the option’s daily trading volume averaged 79 million yuan or US$11 million. And open interest for calls has reached 9,201 contracts daily versus 4,619 put contracts, primarily driven by elevated safe-haven demand due to uncertainties surrounding US & Iran.

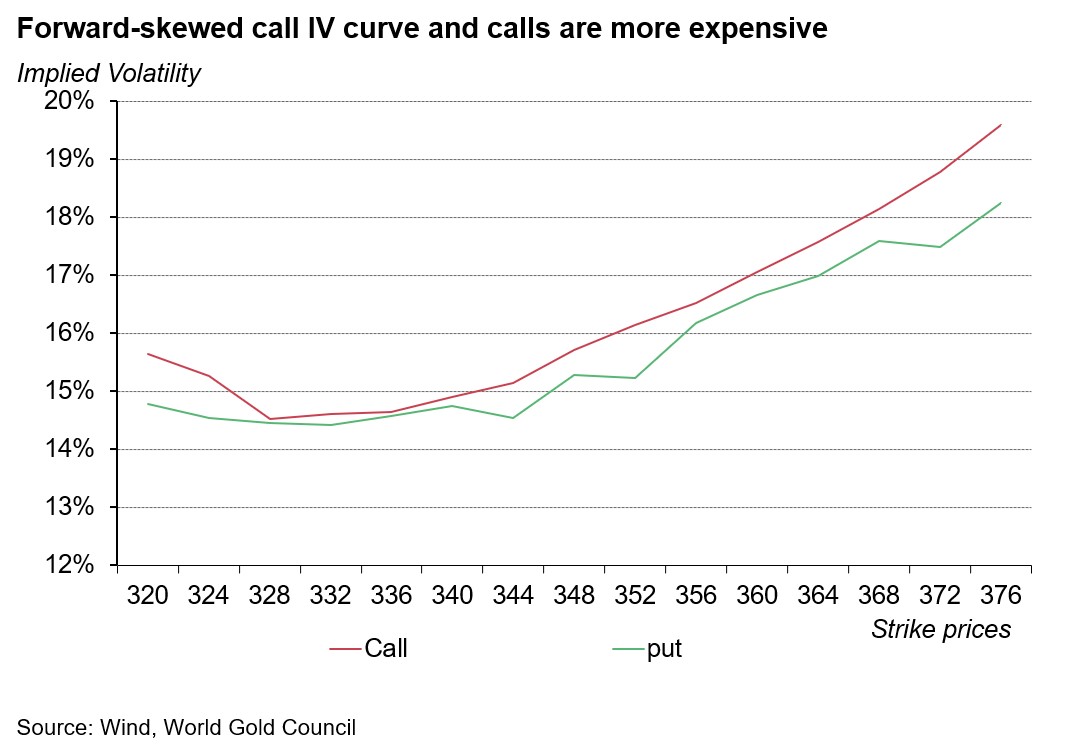

Investors’ bullish expectation for gold also can be observed in the SHFE’s gold option’s implied volatility (IV) curve. After trading for three weeks, its call options’ IV curve is skewed to the right and higher than puts at all strike prices. This suggests that not only are investors bullish on the gold price (IVs are higher at higher strike prices), they are also willing to pay more to gain the exposure of future upside potentials than protection against downside risks.4

Note: we selected the most active options expiring June 2020 and their IVs on 10th January 2020.

Conclusion

There are clear benefits to expanding China’s gold access channels. As a supplement to existing gold derivatives in China, companies in the gold industry now have an additional tool to manage their risks more efficiently. And speculators are also able to trade gold’s volatility and its time value. Expanding the gold derivatives market, will help China build a more efficient, transparent and fair pricing mechanism for gold, further raising China’s gold market’s status.

Footnotes

1 The SGE contains matching market, OTC market, leasing market and international trading market.

2 Both COMEX’s regular gold option and weekly gold option are American style: www.cmegroup.com/trading/metals/precious/gold_contractSpecs_options.html?optionProductId=192#optionProductId=7488

3 Gold future’s options’ market makers include fund management companies, security brokerage companies risk management companies and gold companies with creditable reputation and sufficient capital.

4 Holding everything else constant, higher implied volatility means higher option premium.