Innovative jewellery products are getting popular

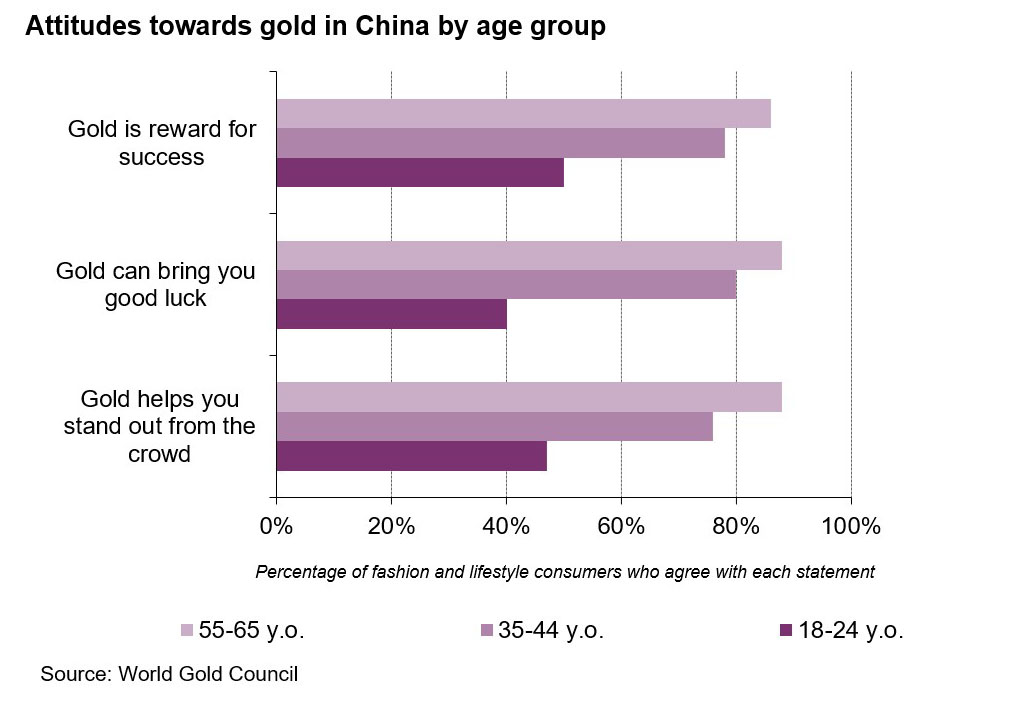

Young consumers tend to view gold differently. Our 2019 global consumer research results suggest that young Chinese consumers are less likely to believe that gold is a reward for success, or gold can bring you luck when compared with elder ones. Fashion barriers exist too: only 47% of fashion and lifestyle consumers between the ages of 18 and 24 believe gold can help them stand out from crowds, far below their elder peers. Hence, attracting young consumers – a major consuming force in the future – is challenging for Chinese jewellers.

And China’s jewellery market has been adapting. Even though the traditional plain, mass-appeal 24K jewellery still holds the lion’s share of the market, innovative products such as 3D hard gold, “5G” gold and heritage gold – which are all innovations under the 24K gold jewellery category – have sprung up in recent years. These innovative pieces with fashionable designs, intricate craftsmanship and relatively lighter per-piece weight have been stealing the limelight from traditional products and gaining popularity especially among young consumers.

These Innovations only became possible after the emergence of technology overcoming one of pure gold’s main challenges – its softness. The discovery of the process to harden pure gold has formed the foundation for all innovative pure gold products and become an important feature favoured by consumers and jewellers.

From a consumer’s perspective, the appeal lies in the combination of purity and aesthetic designs. It is no secret that Chinese people love pure gold in general – even though demand has weakened somewhat in recent years, traditional mass-appeal 24K gold products still account for the lion’s share of the market. It also became an increasingly visible trend that the younger generation favours jewellery with fashionable designs. A product offering both would naturally be expected to grab many eyes … and it has.

There are also benefits for jewellers in promoting these innovative products. Firstly, these products are generally sold by piece (rather than by weight), providing higher margins for retailers. From our visits to jewellery stores in different cities across China, we have seen increasing displays of products sold at a ‘by-piece’ price as jewellers are pursuing profits when the broader jewellery demand is sliding. And most of these hard-pure gold products are lighter than traditional mass-appeal items, easing retailers’ inventory pressure.

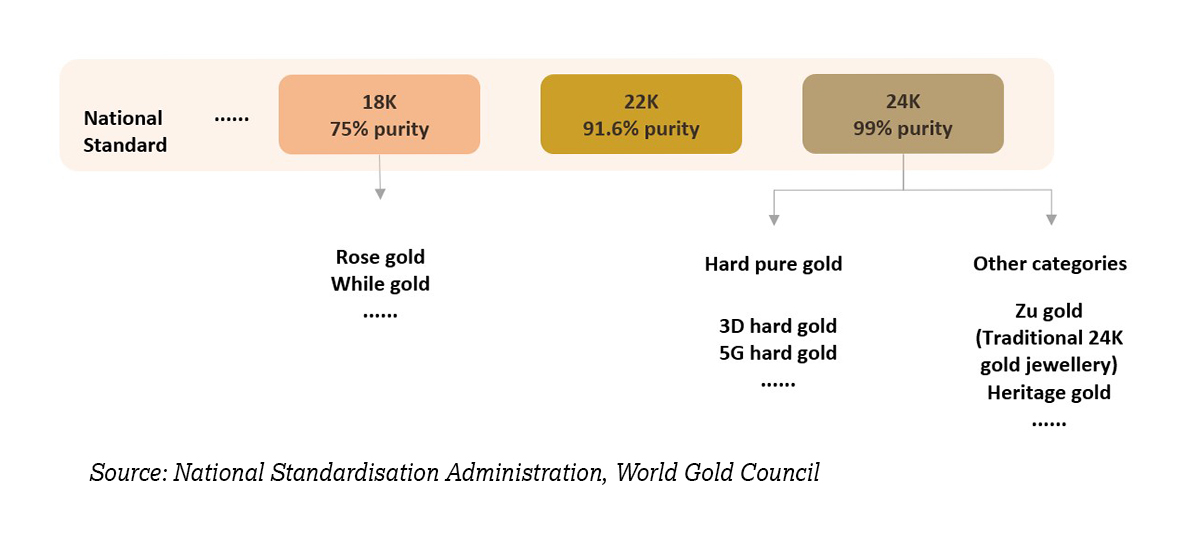

But the rapid pace of innovation can be confusing to interested observers of China’s jewellery market. To gain a clearer view, here is a basic classification sketch for traditional and innovative gold jewelleries in China. Currently, the main mandatory standard for gold jewellery in China is National Standardisation Administration’s “Jewellery – Fineness of precious metal alloys and designation 2015”. This standard categorises all gold jewellery sold in China into purity grades, that is, the minimum gold content required for each category. And it also provides fundamental information for jewellers to adhere to e.g. the required format of hallmarks on precious metals jewellery.

Guidance and standards needed

The hard-pure gold jewellery market is booming but lacks an industry standard defining these products and providing industry guidance e.g. the ideal range of hardness and the proper handling of unique alloys, etc.1 Consumers buying these innovative pieces should be guaranteed of their purity, hardness, and safety to both humans and the environment. Lack of such guidance could hinder the development of a promising sector.

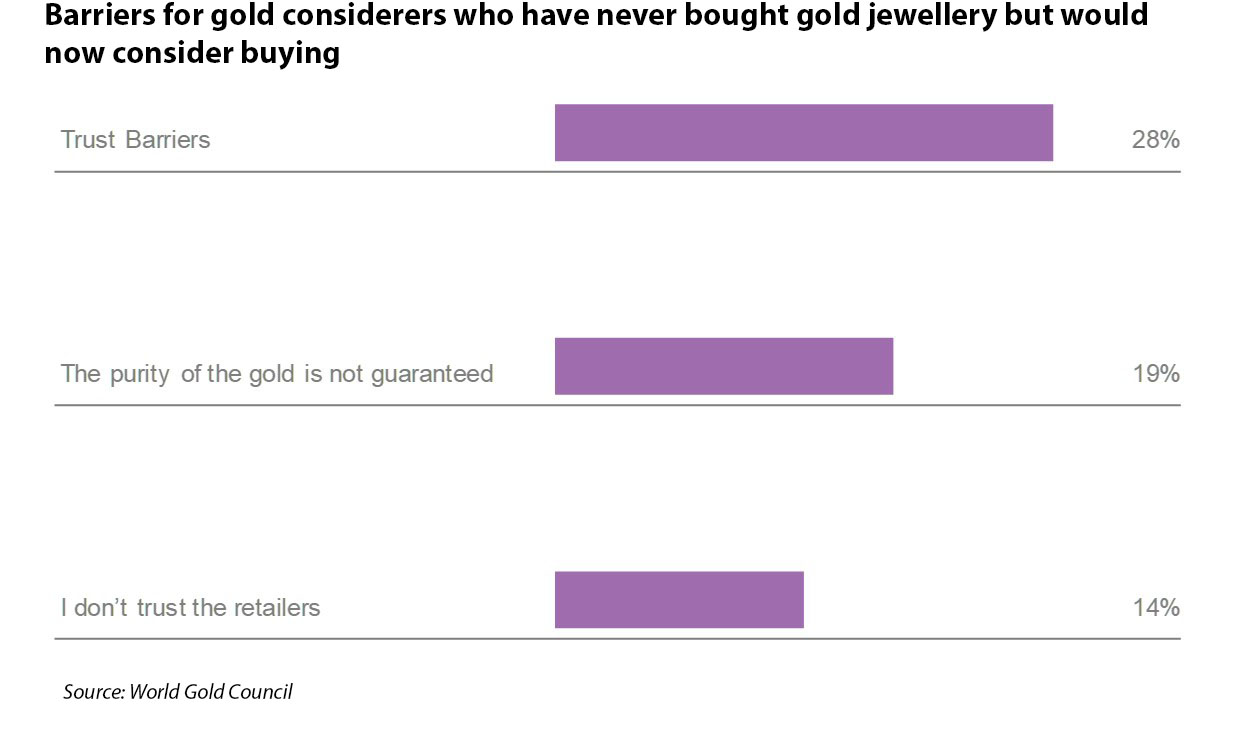

Our consumer research results also highlighted the necessity of proper jewellery market standards. While fine gold jewellery has strong global penetration, the top barrier for potential jewellery consumers – that is, people who have never bought gold jewellery before but would consider doing so in the future - is trust: 19% of potential jewellery purchasers think the purity of the gold is not guaranteed and 14% don’t trust the retailer.2

The World Gold Council China team has been working with the National Jewellery Standardisation Committee, industry associations and leading Chinese jewellers, to draft proper standards for hard-pure gold jewelleries. By providing guidance for the hardness, requirements for eco-friendly manufacturing and other important aspects of hard-pure gold jewellery, we believe this supplement to China’s existing jewellery industry standard will help to remove the trust barrier blocking potential consumers and lead to a better future for China’s jewellery market.

Footnotes

1 These hard-pure gold products contain alloys less than 0.1% to achieve the desired hardness.

2 Potential jewellery consumers are those who have never bought gold jewellery in the past but who say that they would consider buying it in the future.