Gold performance/technicals:

- Gold moved higher last week (XAU 0.5%, LBMA 0.6%) as the US dollar gave back some of the previous week gains and market weakness drove rates lower.

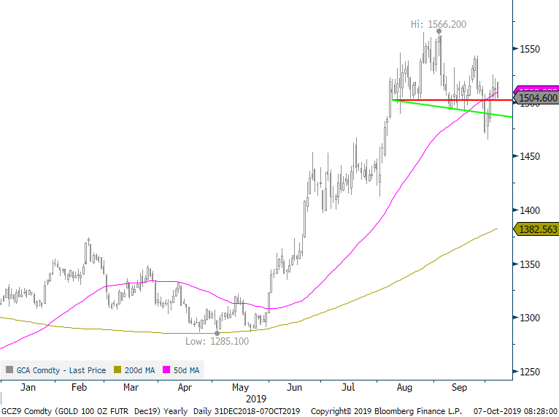

- Gold moved back above the $1,500 and 50-day moving average levels, suggesting the bearish head-and-shoulders breakdown the previous week was a false move. These levels will remain very important as to sense the next price direction of gold.

Gold Price

Source: CFTC, Bloomberg

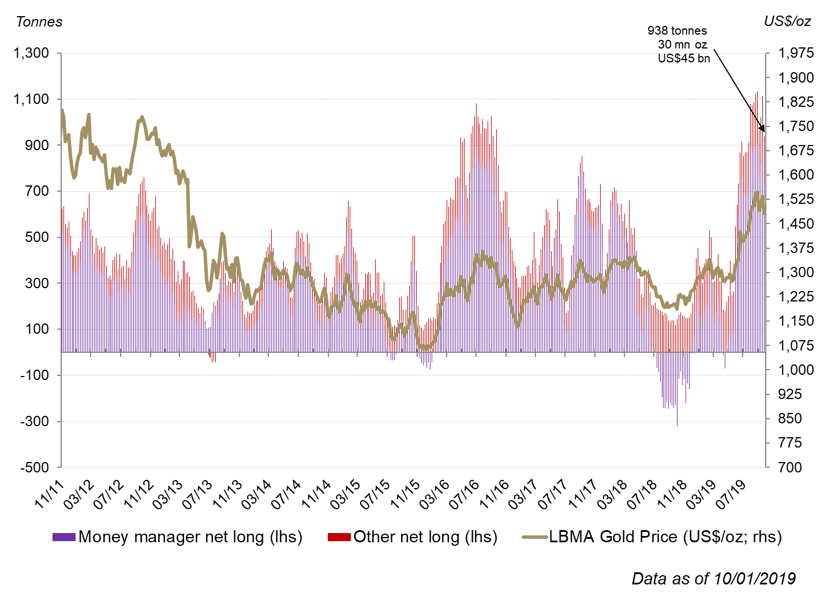

Gold-backed ETF flows by time periods:

- $800mn worth of inflows globally last week split between the US (+$380mn) and Europe (+$408mn). Other regions had minimal flows.

- Flows are higher by $638mn in October; September ETF flows will be released tomorrow at 8am EST

Options and volatility:

- Implied volatility rose to near 1-yr highs with the recent >1% moves in the price of gold. Options skew remains bullish in sentiment with premiums paid for calls versus puts.

- $1,500 and $1,550 house significant futures open interest and should act as a trading range in the near term.