Those familiar with our work will already know that we are unashamedly fans of gold. And for a very good reason we’d argue. While it is without doubt our focus, it would be wrong to say that we analyse it in a vacuum. In our recently published report Gold: the most effective commodity investment, we looked at how gold is under-represented in the commodity indices investors often use to gain exposure. This can have unintended consequences on portfolio performance, especially when other commodities – such as oil – can have significantly different characteristics than gold.

The drone attack in Saudi Arabia on 14th September highlighted this. The event resulted in approximately 5% of global oil supply being taken offline. In response, global oil prices initially spiked by 20% before partially falling back. A major reason for this reaction is that the global supply of oil is concentrated. Looking at data from the US Energy Information Administration, the top 10 oil producing nations accounted for 70% of global oil production in 2018. (Saudi Arabia – the world’s second largest producer – accounted for 12%.) What’s more, half of the list are situated in the Middle East region.

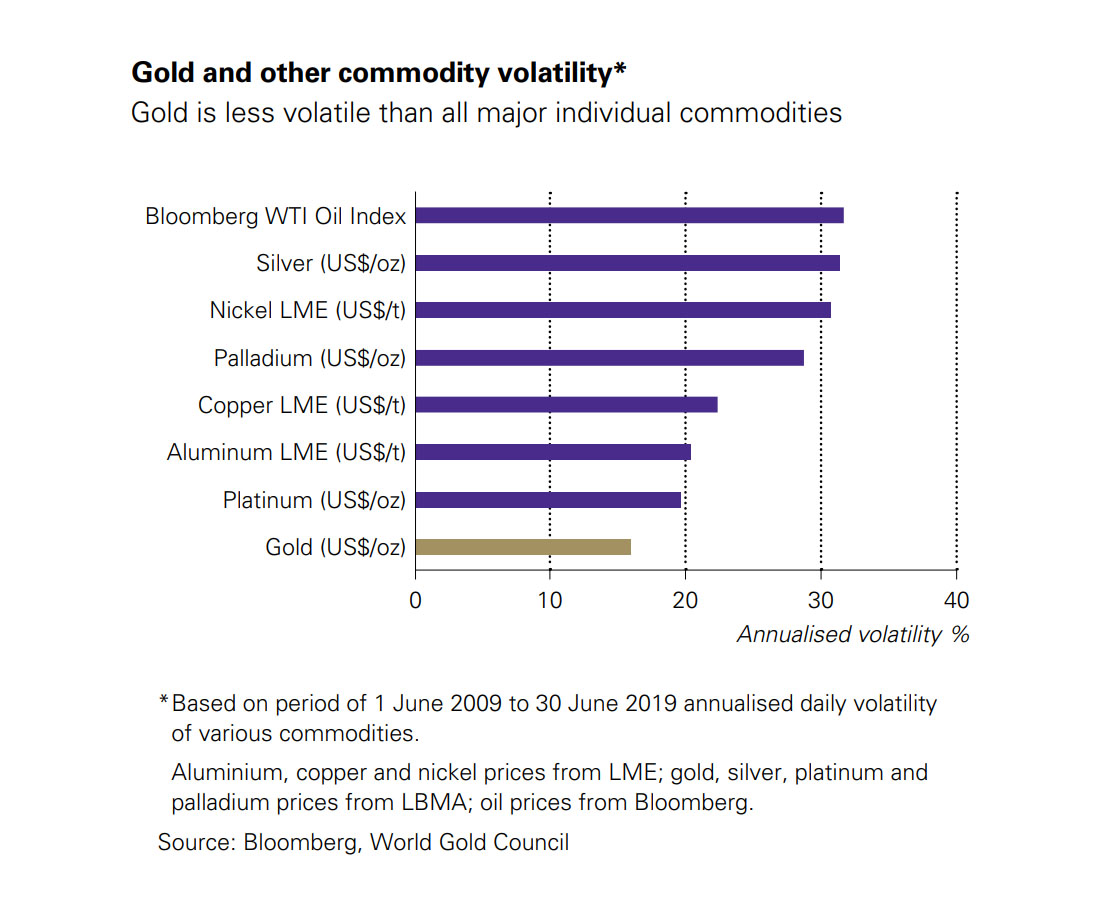

Global gold production, on the other hand, is more geographically diverse. The top 10 producing nations only account for 60% of the global total, with no single producer accounting for more than 12%. And the concentration risk is far lower as gold is mined on every continent except Antarctica. This diversity in mine production helps to create a more stable supply chain, less susceptible to supply shocks. This, in turn, helps to reduce price volatility. Gold has a significantly lower annualised volatility (16%) than oil (32%), and many other key commodities. It’s also worth noting the lack of a consistent relationship between gold and oil prices.1