Over the past 18 months, central banks have had a voracious appetite for gold. Alongside the impressive AUM growth in gold-backed ETFs, this has been one of the most prominent stories in the gold market. As we noted in the most recent edition of Gold Demand Trends, in H1 2019 central bank demand hit the highest level since becoming net buyers in 2010.

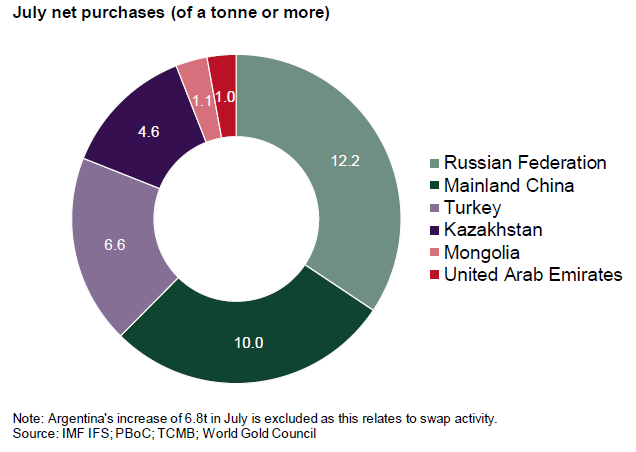

Examining the latest data, we can see that net purchases (of a tonne or more) in July amounted to a relatively modest 13.1 tonnes. This is 90% less than June and the lowest level of monthly net purchases since August 2017.23 Of this, gross purchases of a tonne or more totalled 35.5 tonnes, while gross sales of 22.4t were entirely due to the reduction in Uzbekistan’s gold reserves. And on a year-to-date basis reported central bank net purchases are now above the 400t level. This is the fastest pace of accumulation since they became net purchasers – on an annual basis – since 2010.

Stop me if you’ve heard this one. Looking at the list of the countries which increased their gold reserves in July, few will be surprised by who we see. Are most net purchases from a small cadre of banks? Check. Are they from emerging markets? Check. Have they been significant purchasers recently? Check.