The inhabitants of the UK are surrounded. There’s no escape. Brexit is everywhere you turn. News broadcasts, front pages, dinner conversations, everywhere.1 Over three years (and counting) since the result, Brexit uncertainty remains a persistent part of the UK way of life and at the forefront of investors’ minds.2

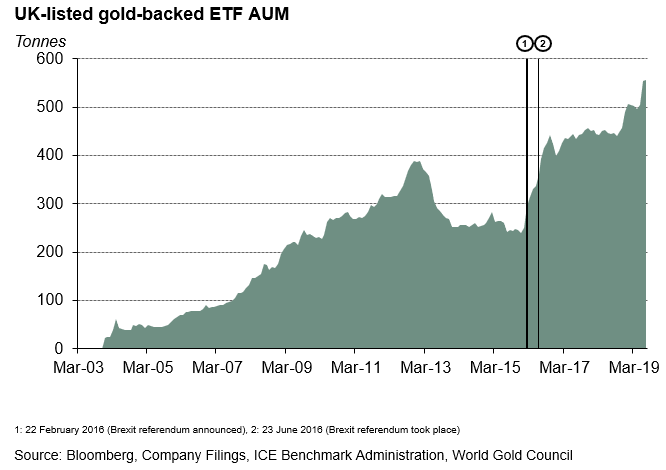

As we noted in our Market Update in April, gold – in its role as a safe haven asset – has acted as a barometer of this uncertainty. Both European and UK gold-backed ETFs have seen stellar growth in AUM since 2016, with Brexit concerns an undeniable contributor. Since end-February 2016, when the referendum was announced, AUM in these products has increased by 260t to almost 560t, a 88% increase. UK AUM now accounts for just over a fifth of global total in tonnage terms, up from 15% at the start of 2016.

The pressure on the pound following the referendum helped push the gold price in GBP higher, hovering around £1,000/oz until this year. The recent global price rally has seen GBP gold surge even higher: at the start of August, the GBP gold broke above £1,200/oz, setting a new all-time high. This performance, in a world starved of returns, has attracted a lot of attention from investors.

As fears of a ‘No Deal’ Brexit have grown, so has AUM. The uncertainty surrounding the shape Brexit will take, as well as the ongoing political ramifications, has led to investors taking cover. And investors remain pessimistic about the chances of a solution to the deadlock in negotiations before the October deadline for withdrawal. We noted in Gold Demand Trends : “UK-listed funds led the way in Q2: around 75% of all global inflows during the quarter were directed towards these products. Investors sought the safe haven of gold amid the uncertainty surrounding Brexit and the leadership battle that followed Theresa May’s resignation as Prime Minister. The sharp drop in the value of the pound also fuelled inflows during the quarter as the UK’s growth prospects were cut following repeated failures in Brexit negotiations.”

Concerns over Brexit are unlikely to disappear after 31st October. Newly appointed Prime Minister Boris Johnson has been clear that the UK is prepared to leave without having secured a deal. Should this happen, it’s likely UK investors will brace themselves for the potential fall-out. And this should mean that AUM in UK-listed gold-backed ETFs remains well supported.

Interested in exploring gold-backed ETFs further? Our comprehensive ETF dataset can be found here: https://www.gold.org/goldhub/data/gold-etfs-holdings-and-flows

1By the way, I am fully aware of the irony that this post is only adding to the problem.

2Along with uncertainty over global trade and geopolitical tensions amongst other things. There seems to be an oversupply of uncertainty at the moment.