Summary

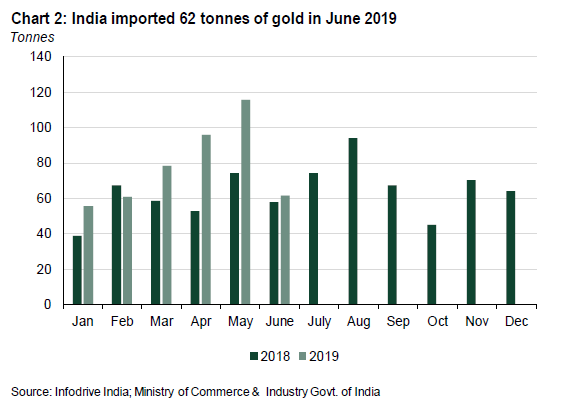

- Indian gold imports were 62t in June 2019 – up slightly on the same month last year

- The domestic gold price was 6.1% higher in June as compared to end of May

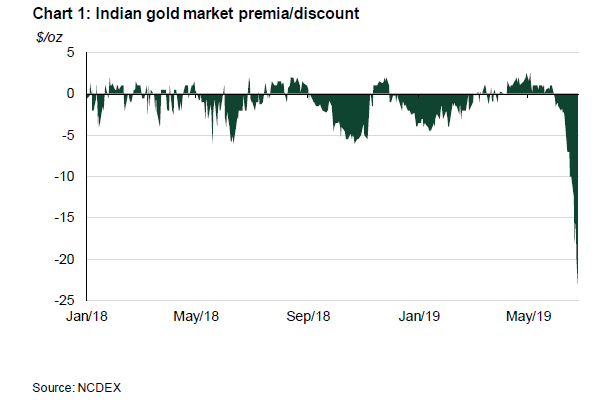

- With higher domestic gold prices, the local discount in the gold market reached $23/oz (1.6% to the international price) by end of June

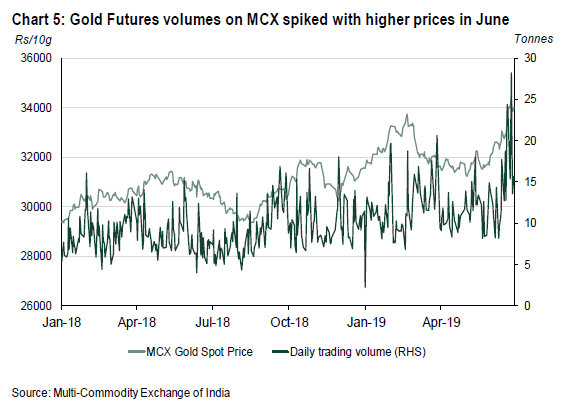

- Higher and relatively volatile prices encouraged gold futures trading on MCX: volumes touched a high of 28.2t in June

Consumer demand tailed off

Indian gold demand tapered off after the monsoon1 started on the 1st June and weakened further after the local gold price spiked with the sharp rally in the US dollar price. Once the domestic gold price breached Rs 33,500/10gm level on 20 June, retail demand fizzled out. The domestic economic environment also had a dampening effect, with indicators such as IIP and domestic car/motorcycle sales pointing towards a slowing economy. Consumers also held up purchases in June in the erroneous hope that a cut in customs duty would be announced in the Budget on 5 July. The retail demand however received some support from the ongoing wedding season till end of June.

After healthy imports in April and May, the drop off in retail demand in June meant the wholesale market was relatively muted. As the gold price spiked towards the end of the month, the domestic market reached a discount of $23/oz by end of June – the biggest discount since August 2016 (Chart 1).

Import duty rose on gold

On the 5th July during the annual budget, India’s Finance Minister, Ms. Nirmala Sitharaman, increased the custom duty on both gold bar and gold doré by an additional 2.5%. This was implemented on the 6th July. The custom duties on gold bar and gold doré now stand at 12.5% and 11.85% respectively.1 With an additional 3% GST, consumers will be now paying 15.5% tax for refined gold.

We believe it will have a negligible long-term effect on gold demand. It may be a temporary measure: when the government’s books are in better shape we may see some of these tax increases rolled back. The market will be supported by other government initiatives, including the structural reforms such as the India Gold Spot Exchange and plans to boost rural incomes. We discussed this in our recent blogpost India’s gold import duties rise.

Imports fell m-o-m

Indian gold imports were 62t in June 2019- 6.4% higher y-o-y but 46.8% lower m-o-m (Chart 2). Healthy imports of 211.8t in April and May, uncertainty around custom duty on gold to be announced in Union Budget together with onset of monsoon from June 1 were the primary reasons for lower imports in June.

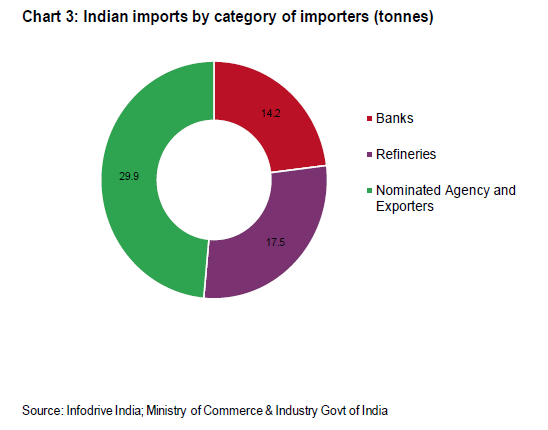

When analysing gold imports data in June, gold doré (fine gold content) imports were 28% of total imports; 17 refineries imported 17.5t of gold doré in June. Similarly, 14 banks imported 14.2t bullion in June (Chart 3). After considering Jewellery exports and round-tripping volumes, net gold imports in June was 47.6t- marginally higher than 44t y-o-y.3

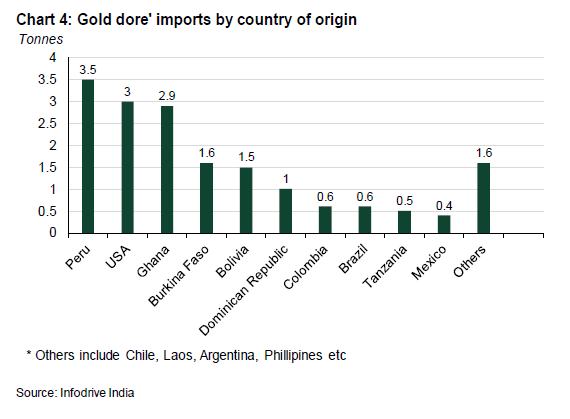

Most of the bullion- 60% came from Switzerland and 12% was imported from UAE. Gold doré imports in June was however more distributed with imports from Africa, Latin America and USA. The prominent gold doré exporting countries to India were Peru, the US and Ghana - accounting for a combined 54% of gold doré imports in June (Chart 4).

Driven by volatile and higher domestic gold price in June (up 6.1% m-o-m), trading volumes on MCX reached a high of 28.2t on 25 June (more than twice the average volume of 12.2t in May) when domestic gold price closed at an all-time high of Rs34329/10gm.This was the highest trading volume level since 24 August 2012.

Outlook for July 2019

With increase of custom duty by additional 2.5%, domestic gold price (995 fineness) has breached Rs34,500/10gm level almost 7.6% higher than end of May gold price. With such higher domestic price along with the seasonally quiet period of monsoon, import is expected to be muted in July 2019.

1Rural community gets engaged in Kharif sowing with onset of monsoon

2

https://www.indiabudget.gov.in/

3Round-tripping is the act of exporting gold, be it jewellery, bars or coins, with the sole purpose of melting it down before re-importing it back to the original exporting country.