Summary

- On 6th July, India’s gold import duty increased from 10% to 12.5% as part of a revenue-raising budget

- We believe it will have a negligible long-term effect on gold demand

- We think it may be a temporary measure: when the government’s books are in better shape we may see some of these tax increases rolled back

- The market will be supported by other government initiatives, including the structural reforms such as the India Gold Spot Exchange and plans to boost rural incomes

What happened?

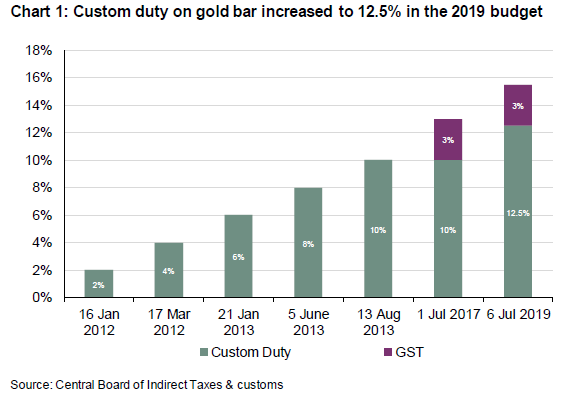

On the 5th July during the annual budget, India’s Finance Minister, Ms. Nirmala Sitharaman, increased the custom duty on both gold bar and gold doré by an additional 2.5%. This was implemented on the 6th July. The custom duties on gold bar and gold doré now stand at 12.5% and 11.85% respectively.1 With an additional 3% GST, consumers will be now paying 15.5% tax for refined gold (Chart 1).2

This came as quite a surprise to the industry. In the past year the gold trade has been working collaboratively with government officials to improve the degree of transparency in the industry.

The context behind this development is key to understanding the potential implications. This was not an isolated move targeting gold. It was part of a broader revenue-raising budget: taxes on many imported items, including electronics, increased along with personal income taxes, which saw the higher rate jump from 35% to 42.7%.

So, rather than being designed to curb gold demand, it is part of a wider tax raising initiative with the objective of improving the government’s fiscal position. In the financial year (FY) 2018-19 the tax to GDP ratio fell to 10.9%; that is 0.3% lower than the previous year. The shortfall in revenue is primarily attributed to lower-than-expected GST collections which fell short by about Rs750bn in FY 2018-19 – that is equivalent to around US$11bn. With US$3.3bn collected through custom duties on gold in FY 2018-19, an additional 2.5% custom duty is expected to add approximately US$800mn to the government’s coffers.3

What does this mean for the market?

- Consumer demand: Conventional wisdom with suggest a higher tax would be a headwind for gold demand. And to some extent that is true. Econometric analysis we published in our report India’s gold market: Innovation and evolution, indicated that a 1% increase in gold’s import duty may decrease consumer demand by 3 tonnnes (t) per year in the long-term. There will also just be a short-term effect. Our analysis also indicated that a 1% increase in gold’s import duty may reduce that year’s consumer demand by 1.9%, although this effect fades over time as people adjust to the higher tax – that equates to a 14t decline within six to twelve months.

The important message to take away is that the effect is negligible. The long-term impact of this price rise is just demand is just 7.5t. That’s insignificant. Even the short-term impact is small compared to the 700-800t annual demand. The logic underpinning this is that the 2.5% duty hike is relatively small in the context of the overall transaction. For example, gold price rose 8% in June 2019 alone.4 Moreover, the hike has come into effect during the monsoon season, a traditional quiet period for gold. This gives the industry and consumers time to adjust the expectations ahead of the all-important gold-buying period during Diwali In October.

- Trade flows: Import costs will go up and this may impact official inflows in Q3 2019. We already expect official imports to slow down due to healthy imports level in Q2 2019. And the relatively high levels of inventories across the supply chain – which we estimate to be between 200-210t - may lead to speedy de-stocking and a spate of discounts triggering sales during Diwali.

A higher custom duty, however, provides further incentives for gold smuggling which would normally encourage increased grey market activity. This would hinder the government’s efforts to encourage cashless transactions and to drive greater transparency in the gold market. But the Modi government has made great strides in clamping down on black money and illicit activities through the introduction of GST, income tax reforms, and tighter border control, so it is no longer axiomatic that smuggling will rise. This is an area we will be watching closely.

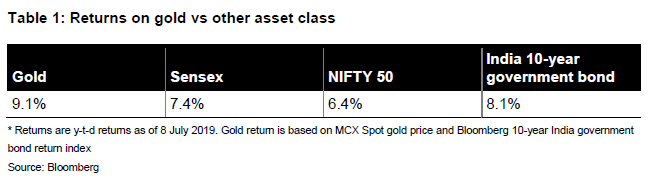

This tax increase should not be looked at in isolation. Higher earners in India are hugely relieved that a much talked about inheritance tax has been shelved. The budget also contained unprecedented levels of support for rural India, including double farmers’ income by 2022. And lacklustre stock and debt market performance has already made gold one of the best performing asset on 2019 (Table 1). The factors bode well for future gold demand.

And if we chart successive measures of reforms on tax compliance since demonetisation, the government is clearly intent on reforming the gold market. Structural developments like the Gold Spot Exchange under an over-arching policy following the recommendations of the Watal Committee in the Report on Transforming India’s Gold Market by the Government think-tank, NITI Aayog, will accelerate the development of the organised part of India’s gold market. It is important that this remains the focus for the government and gold industry alike. Reform measures including an organised trading platform, bullion banking and the development of standards such as hallmarking, good delivery and responsible sourcing are key to the long-term success of India’s gold industry.

Footnotes

1https://www.indiabudget.gov.in/budget2019-20/doc/Budget_Speech.pdf

2https://www.gold.org/goldhub/research/market-update/gst-impact-on-indias-gold-market

3Department of Commerce India

4Domestic price on 5 July closed at 8.1% higher as compared to end of May price