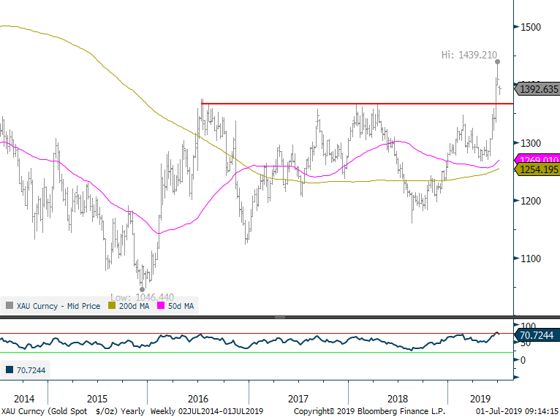

- Gold continued its strong June, closing the week higher (LBMA 0.8%, XAU 0.7%) for the sixth straight week. It was as high as $1,440 on Tuesday, but gave up some of its gains late in the week as Fed Chairman Powell made comments that a 50bps cut in July was ‘too much’. Gold had its best month in two years, rallying nearly 9%; it is up 10% this year.

- Gold made all-time highs in a few currencies last week, most notably the Australian dollar, but gave back some of its USD early-week gains as it became the most overbought (RSI) on a weekly basis since 2016. Given the sharp move over the month of June, a pullback would not be unexpected. $1,365 should act as strong support.