We’ve just released our updated central banks statistics which now include initial data for May. As we’ve seen since the start of the year, central bank demand for gold is maintaining its positive momentum.

Reported net purchases (so far) of a tonne or more totalled 35.8t in May, 27% lower than the previous month.1 This brings reported net purchases year-to-date to 247.3t, 73% higher than the same period last year. Gross purchases – the total of those countries whose reserves increased over the month – accounted for almost the entirety of this figure as gross sales were only 6.2t. This emphasises the continued positive mindset the central banking community has towards gold.

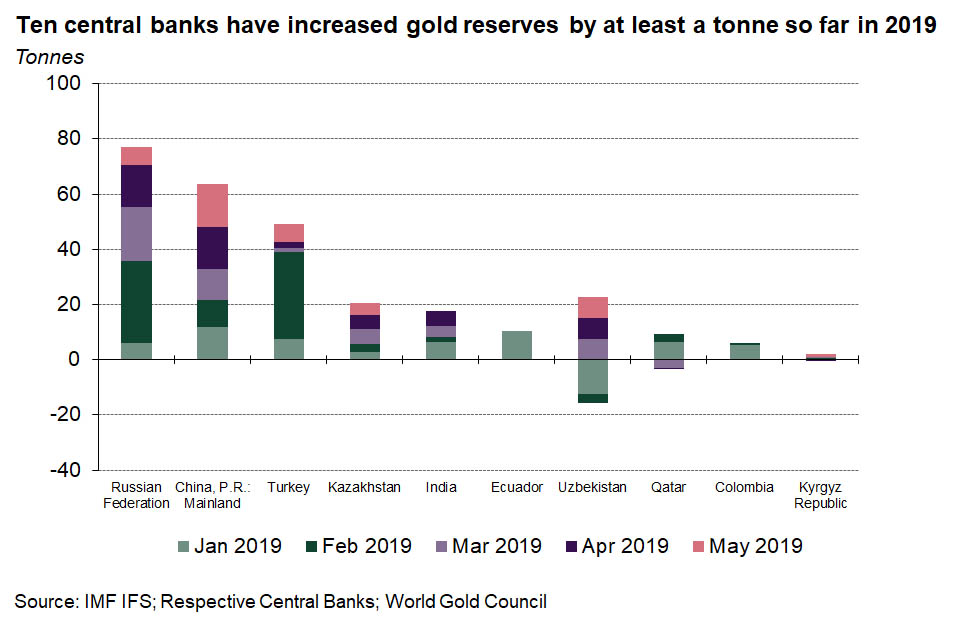

Several emerging market banks continue to dominate. To regular readers of Gold Demand Trends, this is not news. Several emerging market central banks – including Russia, China, Turkey and Kazakhstan – have dominated buying for a few years now. This is still the case in 2019, with those banks the four biggest buyers so far.

But they are not alone. A total of ten central banks have increased their gold reserves by at least a tonne in the last five months – with reserves rising by a combined 260t. By contrast, only three – Mongolia, Tajikistan and Germany – have decreased reserves by a tonne or more over the same period (for a total of 6.5t).