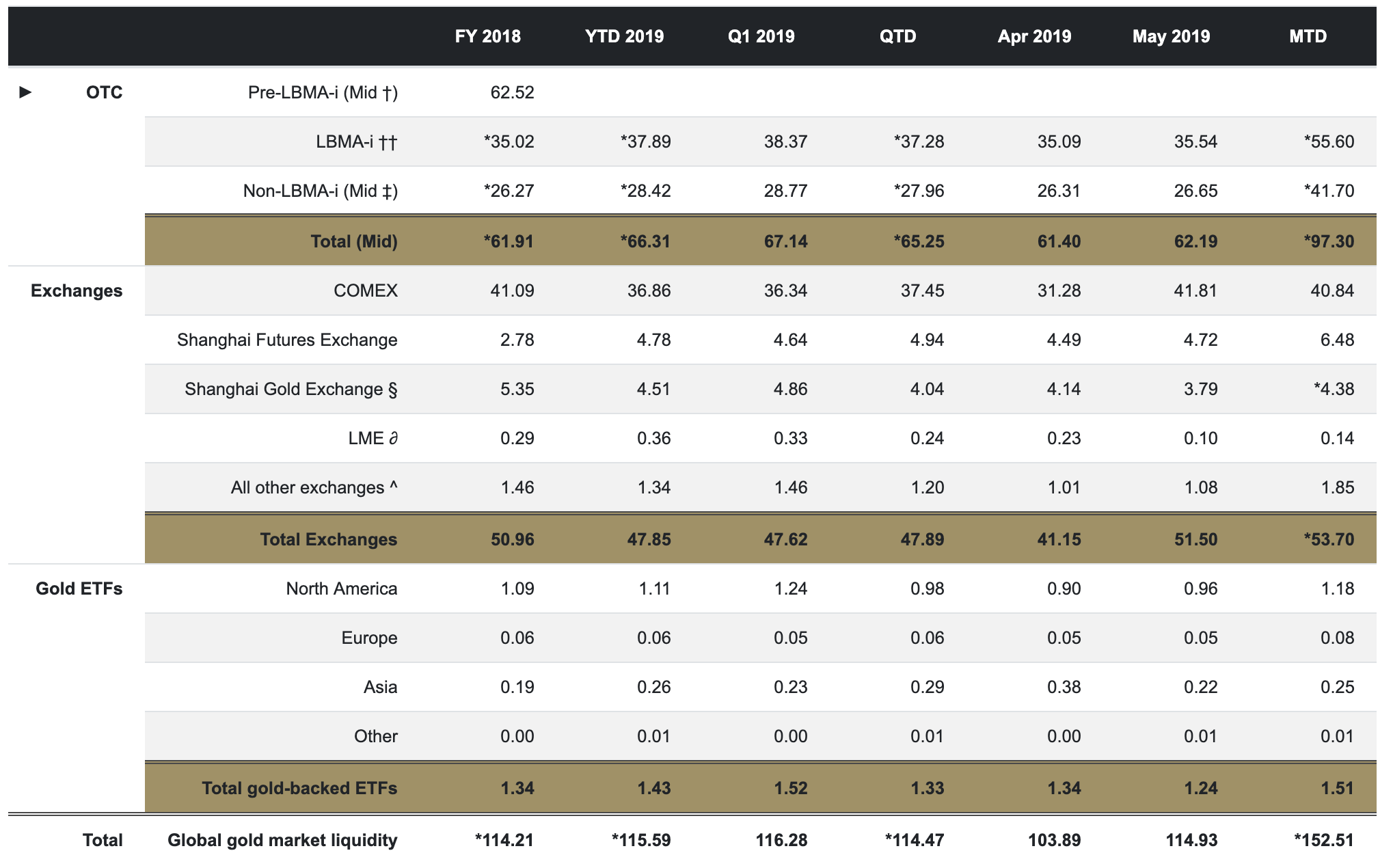

- With the recent rally, Gold trading volumes have increased significantly in June ($151bn vs ytd average of $115bn), particularly in the LMBA OTC market, which has seen averages increase 50% this month.

Gold OTC trading volume is 50% higher this month

17 June, 2019

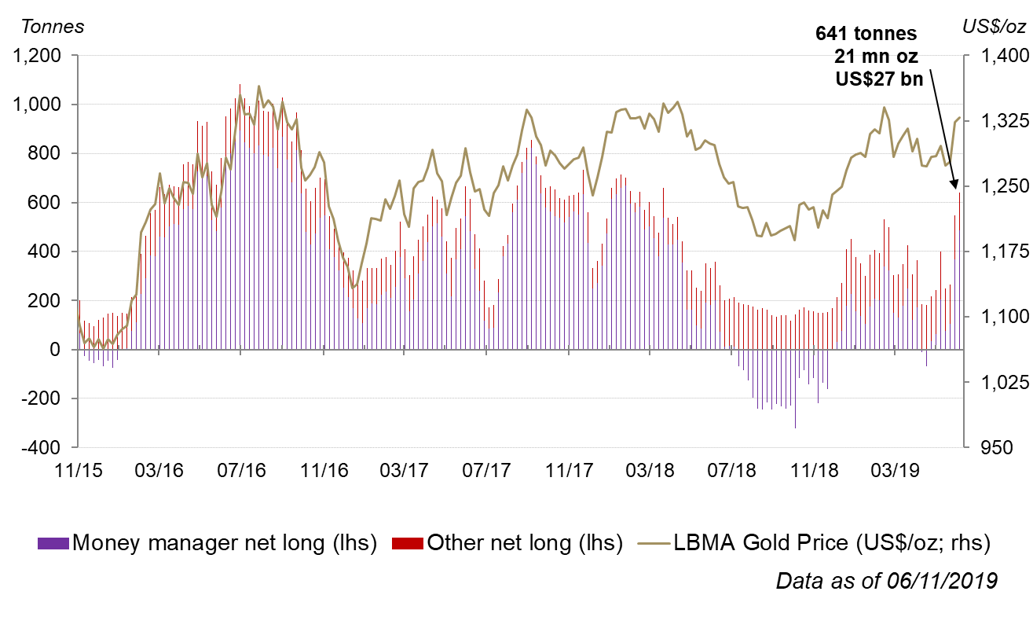

- COMEX net longs continued to increase meaningfully to 641t, a level not seen in over a year, highlighting the bullish shift in sentiment.

- Options and volatility – Bullish sentiment is very much reflected in the pricing of gold options, particularly as it related to options skew. Put skew, or the premium an investor wants to pay for bearish exposure is nearing 5-year lows (people are effectively not paying a premium for downside protection). Call skew remains rich as investors pay for upside exposure. Implied volatility has risen to ytd highs with the move higher in the price of gold, as well as bullish sentiment, however, realized volatility does remain somewhat low.

3-month gold put skew

Source: Bloomberg

- Gold-backed ETF flows - US funds continue to have inflows, increasing assets last week by $490mn. Month-to-date, global gold-backed ETFs have added nearly 3% to assets or $3bn, driven by the US and Europe. YTD, flows in North America are close to turning positive again with outflows of only $300mn. Inflows globally are $2.5bn, driven entirely by European funds.

- Technicals – Gold tried to break above the important level of $1,365 on Friday, but ultimately settled closer to around the $1,350 level. A pause in the price would likely be positive for a continued push higher as the price is somewhat overbought from a relative strength index perspective.