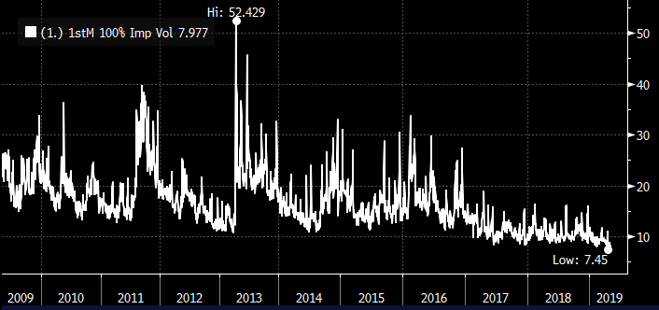

- Implied volatility in gold across tenors continues to fall and is at an all-time low for the data we have going back 10-years, largely a result of the flat performance this year, as well as low expected future volatility in the gold price

Gold implied volatility at all-time lows

7 May, 2019

- Globally, gold-backed ETFs experienced outflows of US$536mn last week, driven by North America and are continuing the weak trend from April. April ETF flows will be released at 8am EST (Tues) and show a decline of 2% of holdings last month

- Gold bounced off the 200-day moving average of $1,267 but remains below the important $1,290 level which could act as resistance

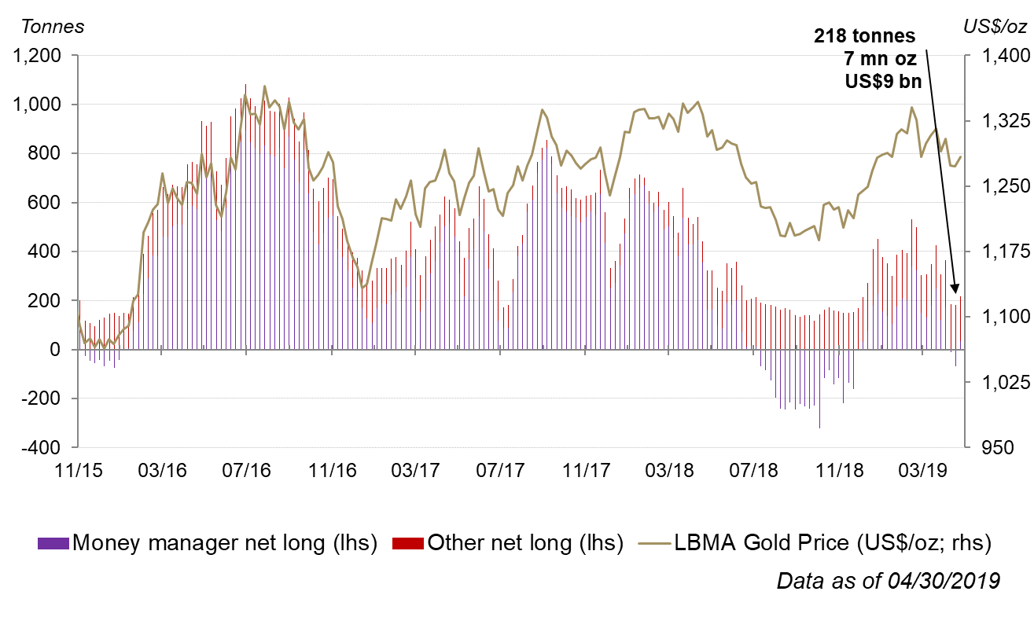

- Comex net longs increased last week from 112t to 218t, despite the weakness in the gold price

- Broad Markets: The Fed’s commentary following the US economic data last week that dislocations were seen as transitory was perceived as more hawkish by market participants. As such, the implied probability of a rate cut in 2019 based on bond prices fell from 70% to 50% and the 2/10 yield curve in the US flattened to 19bps. This drove the US stock market lower on Wednesday and Thursday. However, shorts were squeezed on Friday on incredibly low volume and strength in technology stocks, reverting the pullback. By the end of the week, the US stock market finished flat. Other global stock markets also finished less than 50bps higher. Oil was down 2%, driving the overall commodities index down 1%. The US dollar finished down slightly to -0.5%. Today (May 6) the US stock market was meaningfully lower and the Chinese stock market was down over 6% last night as negotiations have stalled and news came out that the US will increase tariff rates and US$ value amounts further on Chinese goods starting this coming Friday. Commentary related to future negotiations is likely to drive global markets this week. In addition, keep an eye out on the VIX futures as they are at incredibly short levels; further stock market pullbacks could cause a spike in the VIX, with futures positioning fueling further stock market deterioration.