We often get asked about cryptocurrencies and whether they represent a potential replacement for gold, as well as what role, if any, bitcoin should play in a portfolio. We have written on this topic in these papers: Cryptocurrencies are no substitute for gold, and Cryptocurrencies are not a safe-haven.

Although cryptocurrencies and blockchain technology look promising as a whole, they clearly do not represent a substitute for gold either in theory or in practice.

The reasons gold is very different from cryptocurrencies:

Gold:

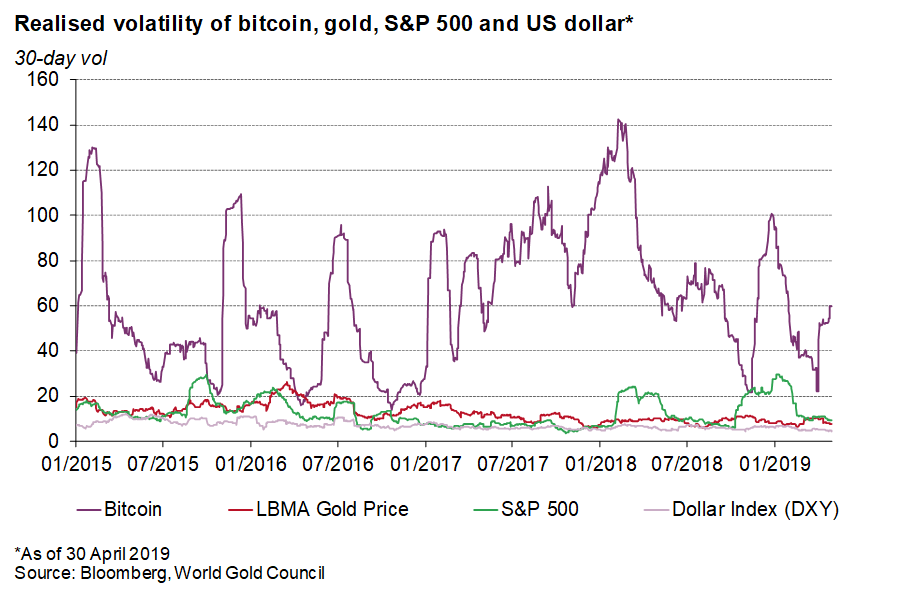

- is less volatile

- has a more liquid market

- trades in an established regulatory framework

- has a well understood role in an investment portfolio

- has little overlap with cryptocurrencies on many sources of demand and supply

- is a safe-haven investment.

Volatility:

- Cryptocurrencies extreme daily and intraday volatility disrupts its use as a medium of exchange and discourages strategic investments

- Gold’s volatility is slightly above the stock market as a whole, in line with most fiat currencies over time.

Regulation

- We have seen how lack of regulation has led to multiple crypto exchange defaults and fraudulent activity, resulting in losses amounting to billions

- The government could begin to regulate cryptocurrencies by directly or indirectly discouraging investors’ ability to transact with them

- Ultimately, gold trades in a widely authorised and regulated market with transparency.

Demand:

- Gold demand is diverse, coming from jewellery, investment, technology and central banks

- Cryptocurrency demand is highly speculative or investment related, as there is little proof of its use as a medium of exchange

- Gold has a track record dating back to 600 BC, whereas bitcoin has only a 10-year track record.

Supply:

- The stock of both bitcoin and gold tends to grow in the low single digits; both have finite amounts of supply

- However, there is nothing to prevent an enhanced cryptocurrency from being launched, devaluing those already in existence.

Investment

- Gold is a well understood investment tool in portfolios as it:

- has been a source of returns rivaling the stock market over the long-term

- protects against inflation

- is a portfolio diversifier, useful during downturns in the market

- trades in a liquid market.

- Cryptocurrency performance has been remarkable over the long-term but has seen massive haircuts during some periods and has failed during periods when it should have thrived. Cryptocurrency has:

- failed as a hedge in late 2018, behaving like a risk asset, down on par with technology stocks, falling 55% in the fourth quarter. Gold was up 9% over the same period

- developed into a highly volatile investment as timing is vital

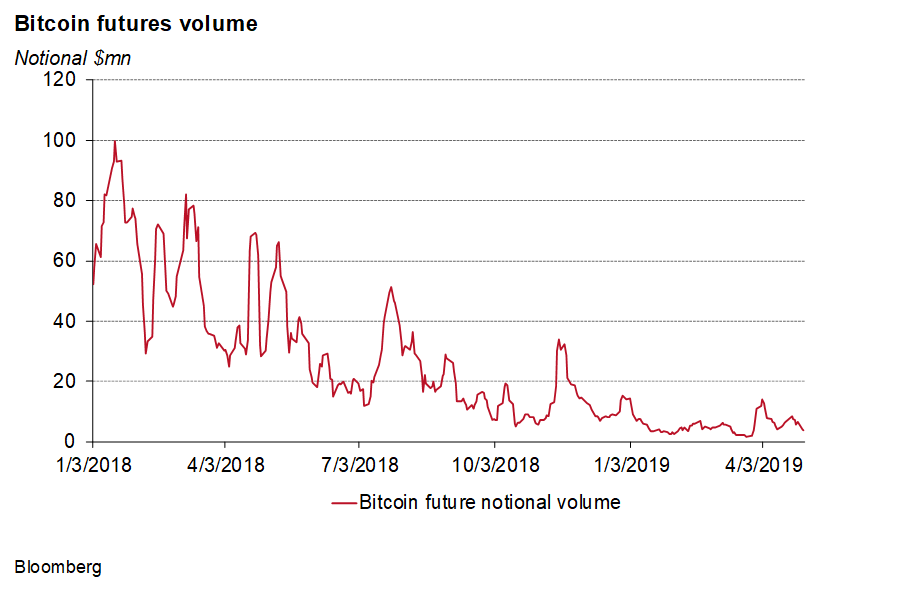

- scarce liquidity and non-transparent pricing.

We continue to acknowledge the innovation taking place in the cryptocurrency and blockchain spaces and believe there will be a role for this technology in the future. However, it is clear that cryptocurrencies are not a replacement for gold and gold should remain a component in all investment portfolios.

Disclaimer: This information does not purport to make any recommendations or provide any investment or other advice with respect to the purchase, sale or other disposition of gold, any gold related products or any other products, securities or investments, including without limitation, any advice to the effect that any gold related transaction is appropriate for any investment objective or financial situation of a prospective investor.