- Broad Markets – There continues to be a divergence of the equity and bond markets as equities continued their move higher with yields falling (bonds increasing) last week. Bond holders appear to believe the Fed’s recent language suggests an economic downturn in the US, while equity owners seem to believe in a new ‘Powell Put’ as stocks had their best quarter in 10 years. Stock markets in the US and Europe were 1-2% higher with Asia slightly lower. The 3m/10yr curve in the US remains negative with shorter-term rates falling. The 10-yr closed at levels last seen in 2017 when the effective Fed Funds rates were 1.3% lower. Last week, economic advisor Larry Kudlow went as far as to say the Fed needs to cut rates 50bps immediately despite the stock market again trading near all-time highs. Fed futures are pricing in a 2/3 probability of a 25bps cut and 23% chance of a 50bps cut this year. The GS Commodity index was flat, despite oil gaining 2% as precious metals fell. The US dollar gained globally, in particular, against the pound as the UK had another failed Brexit vote. There is a 4th Brexit vote scheduled today in the UK. Investors are bracing for earnings reports which come into full swing next week.

- Technicals – Gold has now formed the right shoulder of a bearish head and shoulders formation. A close below $1,290 could precipitate a sharp move lower to a projected price of $1,230 or a percentage move of 5%.

There continues to be a divergence of the equity and bond markets

1 April, 2019

- Option Exposure and Volatility – With the sharp moves last week, 30-day realized volatility in gold increased to 12, which is the 99th percentile over the past year. Interestingly, implied volatility in gold remains low, both for short- and longer-dated options suggesting, investors have not yet bought into the idea it will remain volatile. There is over $1tn of options open interest in futures at the critical $1,300 level which could create resistance.

- ETF flows by time periods – Weekly flows were higher last week by $256mn. This was mostly from North American Funds. Global funds had small inflows in March driven by North America, having reversed the early-month outflows. YTD flows are higher by $1.9bn (1.8% of AUM) with inflows coming from the US and Europe. We will be releasing our monthly ETF flows report this Thursday 4/4.

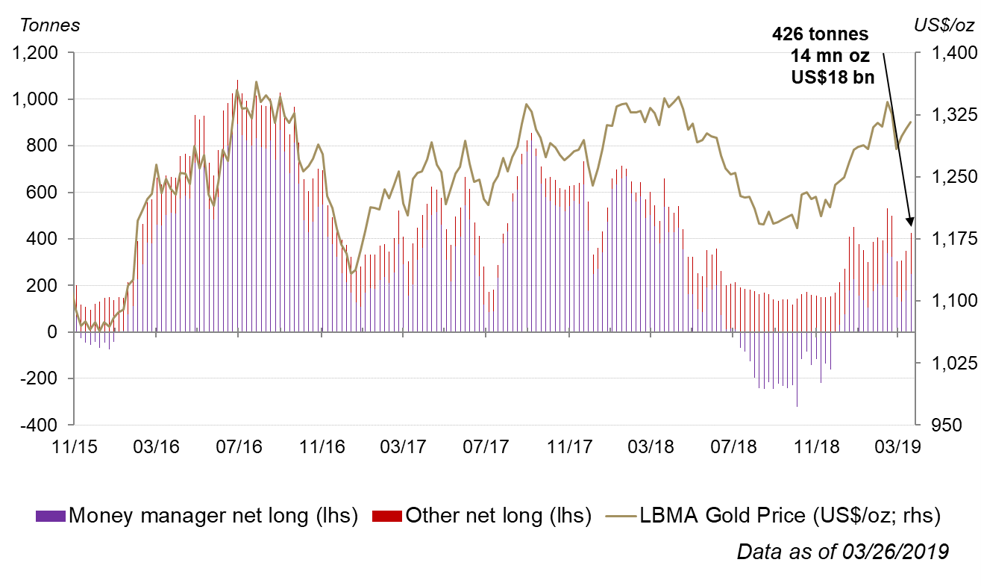

- Liquidity – Volumes in the OTC and COMEX markets increased meaningfully in March to $125bn a day a gain of 15% m-o-m. Open interest in gold futures is at $80bn, slightly above the ytd average. COMEX net longs increased from 349t not 426t net long, the highest level since February.