Central bank statistics for February 2019 are now published. Here’s a summary of the key findings:

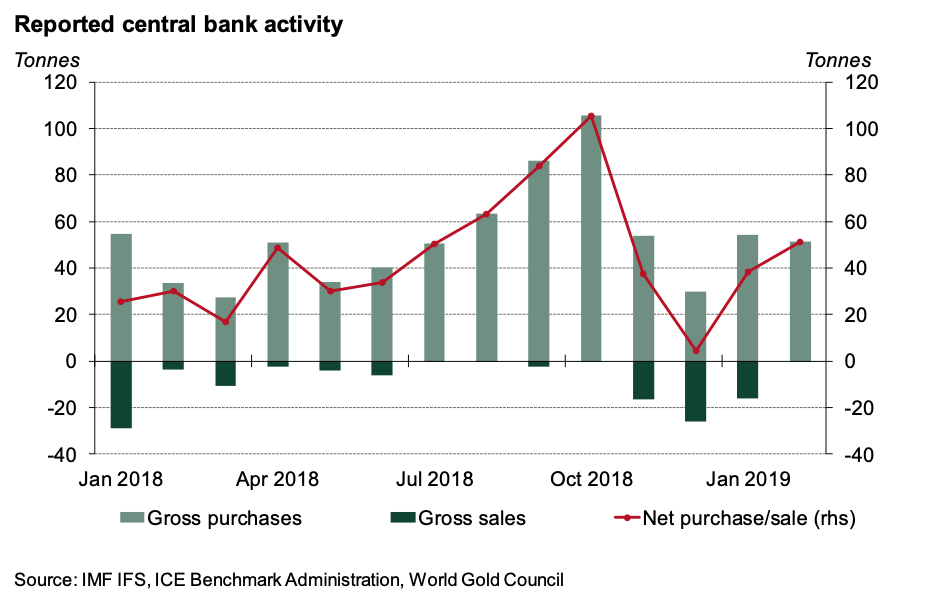

- Central banks bought a net 51t in February - in February, global central bank gold reserves increased by a net 51 tonnes (t) – the biggest monthly increase since October 2018, when central banks reported an increase in global gold reserves of 105t. Gross monthly sales were virtually non-existent: globally, central banks sold just 0.2t during the month.

- 2019 net buying has reached almost 90t so far - Central banks’ gold holdings have grown by 90t in the first two months of the year, compared with 56t in the same period in 2018 (and the highest level of growth since 20081) This shows that collectively, central banks – mostly from the emerging markets – continue to accumulate gold at a healthy pace.

- Diversification continues to drive buying - Diversification remains the key motivation for central banks to buy gold, as ongoing geopolitical and economic uncertainty continue to cast a shadow over the future. As we noted in Gold Demand Trends Full year and Q4 2018:

“Heightened geopolitical and economic uncertainty throughout the year increasingly drove central banks to diversify their reserves and re-focus their attention on the principal objective of investing in safe and liquid assets.

Despite a decade passing since the global financial crisis, times seem no less certain. Central banks reacted to rising macroeconomic and geopolitical pressures by bolstering their gold reserves. These actions are consistent with a recent survey commissioned by the World Gold Council: 76% of central banks view gold’s role as a safe haven asset as highly relevant, while 59% cited its effectiveness as a portfolio diversifier. And almost one fifth of central banks signalled their intention to increase gold purchases over the next 12 months.”

1Saudi Arabian Monetary Authority (SAMA) announced in June 2008 that gold data from Q1 2008 has been modified, due to an adjustment of their gold accounts.

Find our latest central bank statistics.

Read our latest Gold Demand Trends report.

For more detail on our central bank survey findings.