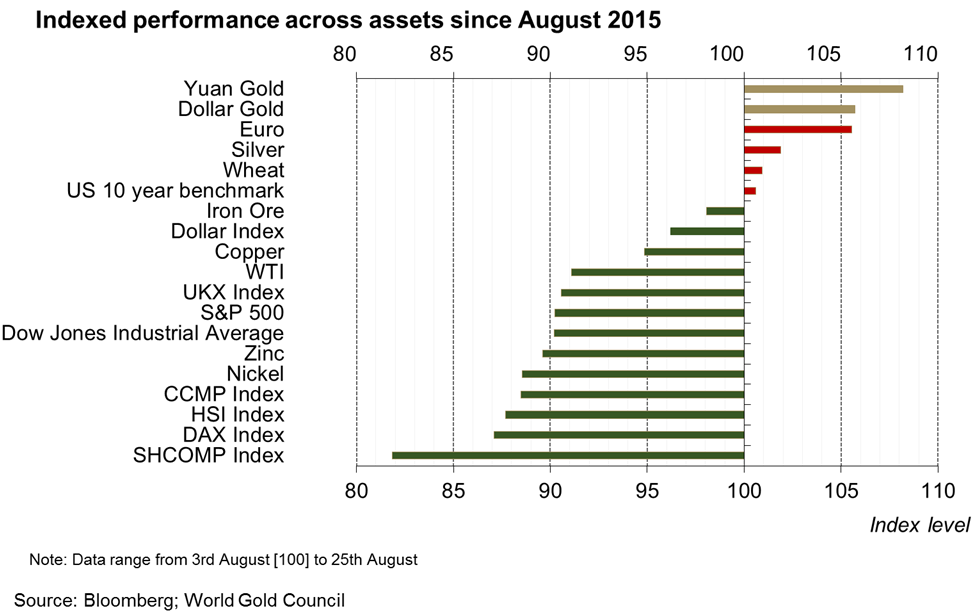

Gold, however, is up: 5% in US dollars, 9% in yuan, and 10% in rupees. Gold has been a wealth preservation tool for centuries as it is an effective hedge against various risks including financial risk, currency weakness, and inflation and tail risks for investors the world over. This was illustrated following the financial crisis of 2007-9 and in Western markets during Black Monday in 1987.

By the beginning of Q3 2015, gold demand had seen a recovery in main markets including India and China. In the China market, sales have recovered in July judging by the feedback from large retailers including banks and producers. This may partly due to a fall in stock markets worldwide at the beginning of July 2015, where investors were losing money and becoming aware of the risks involved. This is also why investors are beginning to consider gold as a tool to diversify their investment portfolios and thereby returning to gold market. After the gold price fell, the number of individual investors purchasing high value gold products began to increase, evidence that investors are returning to the market.

Retail investors and institutional investors alike benefit from holding gold in their portfolio over the long-term. Our research shows that by holding between 2% and 10% of their portfolio strategically in gold overall portfolio performance can be enhanced.

The World Gold Council suggests that investors should consider the options available in their market, the form of investment that is appropriate to their circumstances and should always seek professional advice . Investors can buy products backed by physical gold (gold bars and coins), Exchange-traded funds (ETFs), establish gold account, and other gold-linked products. For more investment recommendation, please refer to WGC’s website https://www.gold.org/gold-standards/retail-gold-investment-principles or https://www.gold.org

Gold plays an important role in asset portfolio because of its unique attribute of hedging. World Gold Council’s analysis demonstrates that gold can be used in portfolios to protect global purchasing power, reduce portfolio volatility and minimise losses during periods of market shock. National central banks, stewards of the world’s largest long-term investment portfolios, use gold to mitigate portfolio risk in this way. For more insights into gold’s role in a portfolio, please refer to World Gold Council’s website:https://www.gold.org/goldhub/research/relevance-of-gold-as-a-strategic-asset-2022 or www.gold.org