Investors should consider doubling their gold allocations amid negative interest rates

We have entered a new and unprecedented phase in monetary policy. Central banks in Europe and Japan have now implemented Negative Interest Rate Policies (NIRP) to counteract deflationary pressures and, in some cases, currency appreciation. Amid higher market uncertainty, the price of gold is up by 16% year-to-date – in part due to NIRP.*

Investors, including central bank managers, should assess the implications of holding bonds with negative return expectations on portfolio composition and risk management. Our analysis shows that:

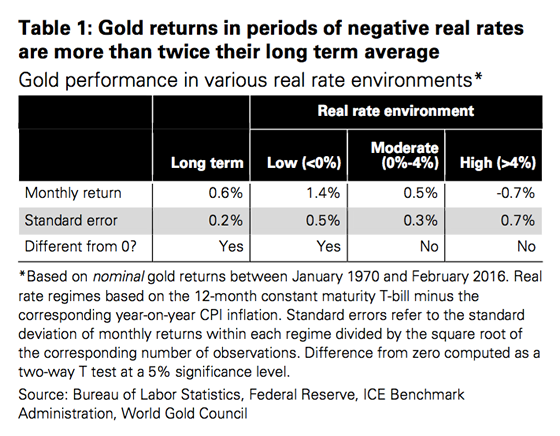

- Gold returns in periods of low rates are historically twice as high as their long-run average

- Investors may benefit from increasing their gold holdings up to 2.5 times, depending on the asset mix, even under conservative assumptions for gold.

In addition, we expect that demand for gold as a portfolio asset may structurally increase, as NIRP:

- Reduces the opportunity cost of holding gold

- Limits the pool of assets some investors/managers would invest in

- Erodes confidence in fiat currencies

- Further increases uncertainty and market volatility.

*As of 30 March 2016. Other factors influencing the gold price include concerns about economic growth and financial stability in emerging markets; a weaker US dollar based on fewer expected rate hikes by the Federal Reserve; latent demand for gold; and price momentum.