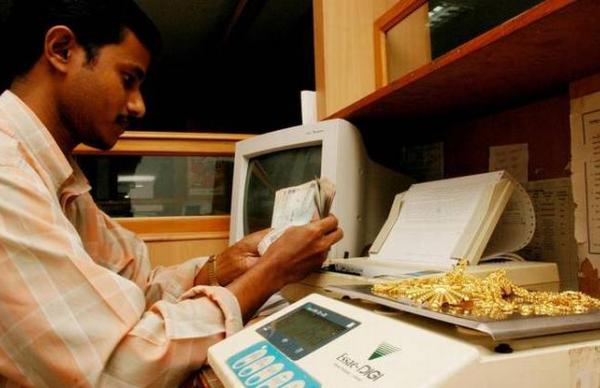

Demand for gold loans, both through banks and non-banking financial companies (NBFCs) has grown in response to the economic impact of the COVID-19 pandemic. As a result, outstanding organised gold loan is expected to grow to INR 4,051bn (US$55.2bn) in FY 2021 from INR 3,448bn (US$47bn) in FY 2020. Technology has been a key enabler in the growth of gold loan NBFCs in recent years.

In this report, we explore:

- the growth of organised gold loan market

- gold loan market in the COVID era

- the regulatory landscape for gold loan market in India

While gold demand in India has softened in 2020, it has not fallen out of favour. Gold has been increasingly used as a collateral to meet the financing needs of individuals and small businesses. It provides capital preservation, liquidity, and source of funding during tough economic times – supporting the relevance of gold as a strategic asset in India