Gold continues to dominate China’s jewellery market

The notable rebound in Q3 Chinese gold jewellery demand from the COVID-stricken Q2 and easing COVID restrictions paints a bright picture for the future. And our third annual gold jewellery retailer survey with China Gold News suggest that opportunities abound. To identify these, we have completed our third annual gold jewellery retailer survey with China Gold News. Our key findings include:

- Chinese consumers are paying increasing attention to gold jewellery as a financial asset

- Gold products are at the forefront of key buying occasions and dominate China’s jewellery market

- “Self-wear” is the most important jewellery buying occasion and women drive jewellery consumption

- Overall, survey results paint an optimistic picture China’s gold jewellery demand during the next 1-2 years.

Chinese gold jewellery demand: overview and outlook

China’s gold jewellery demand in the first three quarters of 2022 faced a roller-coaster ride. After a robust Q1 driven by upbeat sales ahead of the Chinese New Year’s holiday, full-scale lockdowns in key cities slowed Q2 demand down significantly. And Q3 staged a sizable q-o-q recovery as local economic growth rebounded and COVID-related restrictions eased. Investment motives constitute another key driver of Q3’s jewellery demand strength as consumers seek value preservation in gold products amid COVID-related uncertainties and the rapidly depreciating local currency.

In coming quarters, we expect demand for gold jewellery in China to rebound as China exits its zero-COVID policy (Chart 1).1 Based on Bloomberg’s economists’ median forecasts of future gold prices and the CNY exchange rates, macroeconomic assumptions from Oxford Economics, as well as marriage estimates derived from macro data assumptions under corresponding scenarios, our quantitative model predicts stable gold jewellery consumption during Q4 and a strong start to 2023.

Other factors are also at play:

- First, year-end gifting demand and the traditional sales boosts around the Chinese New Year’s Holiday should provide seasonal strength

- Second, China’s policy to boost consumption may provide additional support for local gold jewellery purchases2

- Third, Chinese households’ tendency to save may remain elevated in the near term after three years of strict COVID controls, continuing to benefit gold jewellery consumption (see below for more)

- Lastly, the continuous return of the “per-gram” based pricing model could instigate further efforts from retailers to promote heavier products for higher margins.

Chart 1: We see a stable Q4 and robust growth in Q1 2023 for China’s gold jewellery consumption*

We see a stable Q4 and robust growth in Q1 2023 for China’s gold jewellery consumption*

We see a stable Q4 and robust growth in Q1 2023 for China’s gold jewellery consumption*

*Our simplified quarterly gold jewellery model includes three main drivers: GDP growth during the previous quarter, the gold price change in the current quarter, and the change in the number of registered marriages during the previous quarter.

Source: Metals Focus, Bloomberg, Oxford Economics, World Gold Council

Sources:

Bloomberg,

Metals Focus,

Oxford Economics,

World Gold Council; Disclaimer

*Our simplified quarterly gold jewellery model includes three main drivers: GDP growth during the previous quarter, the gold price change in the current quarter, and the change in the number of registered marriages during the previous quarter.

Possible downside risks shouldn’t be overlooked. Possibilities of higher local gold price and the resurface of COVID-related disruptions may hinder local gold demand.

Identifying consumption trends is a key component in a comprehensive outlook. In addition to our quantitative model, we repeated our annual Chinese gold jewellery retailer survey with China Gold News for the third year, shining a particular spotlight on consumer key buying occasions; the results follow.

Gold jewellery is being valued for its financial worth

In our 2021 survey, we learnt that gold products dominated the inventories of Chinese jewellery retailers and those retailers were increasingly adopting the per-gram pricing model. In addition, the percentage of younger consumers was rising and retailers were heightening their digital marketing efforts.

To build on these findings, this year’s survey focused on the contribution of different jewellery categories to retailers' sales and how these categories performed at different buying occasions. To ensure our survey’s comprehensiveness, we surveyed 496 retailers from 18 provinces and 59 cities across different tiers (Appendix 1, Chart 12).

Chart 2: As consumer income growth decelerated the tendency to save rose sharply*

As consumer income growth decelerated the tendency to save rose sharply*

As consumer income growth decelerated the tendency to save rose sharply*

*Tendency to save is based on the People’s Bank of China’s quarterly household survey results. All data are quarterly updated and as of June 2022.

Source: National Bureau of Statistics, World Gold Council

Sources:

National Bureau of Statistics,

World Gold Council; Disclaimer

As previously mentioned, the increasing need to store value has become a vital driver of gold jewellery consumption. This is primarily driven by a growing tendency for local households to save more than they did in previous years, prompted by slowing economic growth and various uncertainties that are clouding the outlook (Chart 2).

Our survey results support this conclusion. Retailers told us that gold jewellery and investment products were increasingly popular among consumers compared with other jewellery products. And gold products have contributed the most to their sales so far in 2022.

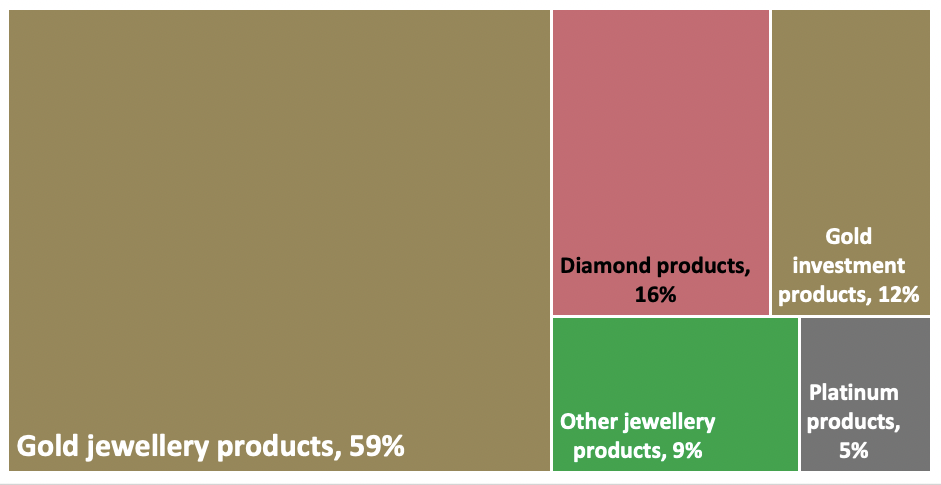

Chart 3: Gold products are the major contributor to jewellery retailer sales this year

Q: What is each jewellery category’s contribution to your retail revenue so far in 2022*

Chart 4: What else concerns consumers when they mention “gold jewellery” on the internet?

Word cloud associated with the key search term “gold jewellery” on social platforms

Our recent social listening research project with GS Data tells us that when consumers mention “gold jewellery” on various social platforms they also pay close attention to keywords such as “gold price”, “value storing” and “safe” (Chart 4). The dual nature of gold jewellery – the accessory with dazzling styles and a means of storing wealth – fulfils not only the rising trend to save more but also allows consumers to satisfy their pursuit of beauty.

As such, we believe emphasising the financial worth of gold jewellery products could help gain further attention from consumers who seek quality assets as a store of wealth.

Self-wear, the most important jewellery buying occasion

Insight into consumers’ different buying occasions helps jewellers customise their promotional strategies. Survey results show that “self-wear” has become the most important jewellery shopping occasion, making up nearly 40% of retail revenue among our survey respondents (Chart 5). And wedding related purchases – often thought to be the largest jewellery sales contributor – only accounted for 20% of the total.

Chart 5: Self-wear has become the most important jewellery shopping occasion

Self-wear has become the most important jewellery shopping occasion

A breakdown of retailer revenue by consumer purchase motives*

Self-wear has become the most important jewellery shopping occasion

A breakdown of retailer revenue by consumer purchase motives*

* Data collected at the end of July 2022. Revenues include sales from gold, diamond, platinum and other jewellery products.

Source: China Gold News, World Gold Council

Sources:

China Gold News,

World Gold Council; Disclaimer

* Data collected at the end of July 2022. Revenues include sales from gold, diamond, platinum and other jewellery products.

Gold dominates all shopping occasions

Gold jewellery products dominate key jewellery shopping occasions in China (Chart 6). We believe that tradition and an increasing awareness of gold jewellery as a value-preserving asset are the main drivers of gold jewellery’s popularity across all buying occasions.

Chart 6: Gold jewellery dominates key shopping occasions*

Gold jewellery dominates key shopping occasions*

Q: What is the sales contribution from each category on key occasions?

Gold jewellery dominates key shopping occasions*

Q: What is the sales contribution from each category on key occasions?

*Gold products include 24K and plain 18K and 22K items. Other products include pearl, gem and jade products.

Source: China Gold News, World Gold Council

Sources:

China Gold News,

World Gold Council; Disclaimer

*Gold products include 24K and plain 18K and 22K items. Other products include pearl, gem and jade products.

Chart 7: Gold’s popularity has risen notably across all shopping occasions comparing to previous years*

Gold’s popularity has risen notably across all shopping occasions comparing to previous years*

Q: Which category has seen significant growth on these buying occasions compared to previous years?

Gold’s popularity has risen notably across all shopping occasions comparing to previous years*

Q: Which category has seen significant growth on these buying occasions compared to previous years?

*Gold products include 24K and plain 18K and 22K items. Other products include pearl, gem and jade products.

Source: China Gold News, World Gold Council

Sources:

China Gold News,

World Gold Council; Disclaimer

*Gold products include 24K and plain 18K and 22K items. Other products include pearl, gem and jade products.

Manufacturers’ efforts in product innovation might also have played a key role in boosting gold jewellery’s universal acceptance. The emergence of 24K hard gold products, Heritage gold jewellery and the upgrading designs of mass-appeal items are making gold jewellery the first-choice gift for consumers themselves, their families and partners.

And gold’s popularity across various buying occasions has been rising notably over recent years while similar growth in other product categories is absent (Chart 7).

To maintain this momentum, we believe that gold jewellers may need to further extend their product ranges to accommodate consumers’ varying demand.

Self-indulgent consumption and “Sheconomy” on the rise

The rise of self-wear is perhaps not so surprising given the trend to ‘self-fulfil’ consumer desire that has been springing up in recent years. And this is an inevitable result of the improving living standard for Chinese consumers.3 The emergence of Gen-Z consumers who pursue a high-quality lifestyle constitutes another important driver of the seemingly unstoppable wave of self-indulgent consumption.4

Chart 8: Females motivate jewellery sales across all shopping occasions

Females motivate jewellery sales across all shopping occasions

Q: Who is your main client on each buying occasion?

Females motivate jewellery sales across all shopping occasions

Q: Who is your main client on each buying occasion?

Source: China Gold News, World Gold Council

Sources:

China Gold News,

World Gold Council; Disclaimer

We find that women are the key initiator or motivator of jewellery sales across all buying occasions (Chart 8). This echoes the rising trend of “Sheconomy” – a term for the rapid acceleration in women’s consumption power and ability.5 In a 2019 report, McKinsey pointed out that women contributed 41% of China’s GDP and had the potential to reach 54% by 2025.6 According to CBNData, 97% of Chinese family purchasing decisions were made by women and local female consumption reached RMB10tn in 2020.7

Jewellery sales could benefit from leveraging self-indulgent consumption and “Sheconomy” by the introduction of appropriate products and innovation of the purchase journey.

Different life stages call for different occasions

When looking at above gender analysis and consumer age groups under buying occasions, we observed interesting results. Some are as expected: for example, in the “couple gifting” occasion, young men between 18 and 35 make up the majority of jewellery consumers, motivated by their partners (Chart 9). But when it comes to selecting gifts for elder family members and children, middle-aged women appear to usually take on this task (Chart 9).

Chart 9: Different life stages drive different occasions

Different life stages drive different occasions

Q: What is the age composition of your customers under each shopping occasion?

Different life stages drive different occasions

Q: What is the age composition of your customers under each shopping occasion?

Source: China Gold News, World Gold Council

Sources:

China Gold News,

World Gold Council; Disclaimer

Some results are unexpected but reasonable. In the past, wedding jewellery items were mainly bought by parents. Today, young couples make the decision. This could have a profound impact on jewellers’ marketing strategies, especially for the gold jewellery industry as gold products account for the lion’s share.

Women between 18 and 55 dominate self-wear purchases. Compared to their younger peers, females between 36 and 55 contribute more, accounting for 65% of the total. This might be due to the fact that they are more mature and tend to be more established in their careers, thus more capable of recognising gold jewellery’s financial worth and able to afford it. Women between 18 and 35 account for 33% of jewellery sales under this buying occasion.

Consumers in different age groups drive different jewellery demand. Thus, promoting the right product to the right consumer under the right buying occasion is likely to reap greater reward for the retailer.

The future can be bright

Even though China’s current economic pressure casts a shadow over local gold consumption, our survey respondents are optimistic about the future: 40% believe their gold jewellery sales will see significant growth over the next one to two years, while nearly 80% agree that there will be at least some growth. This markedly outpaces expectations for other jewellery categories – almost no retailers predicted significant growth in their other product ranges (Chart 10).

Chart 10: Jewellers are optimistic about gold jewellery*

Jewellers are optimistic about gold jewellery*

Q: Which category will see significant/moderate growth over the next one to two years?

Jewellers are optimistic about gold jewellery*

Q: Which category will see significant/moderate growth over the next one to two years?

*Gold products include 24K and plain 18K and 22K items. Other products include pearl, gem and jade products.

Source: China Gold News, World Gold Council

Sources:

China Gold News,

World Gold Council; Disclaimer

*Gold products include 24K and plain 18K and 22K items. Other products include pearl, gem and jade products.

This highlights the fundamental difference between gold jewellery and other jewellery products, as mentioned above. Benefiting from an increasing consumer awareness around gold’s unique dual nature, gold jewellery sales tend to be resilient, boosted by faster income growth in times of economic expansion, and the need for value preservation when growth slows.

And the importance of self-indulgent consumption is recognised by most gold jewellers. 65% of our survey respondents believe the highest growth will come from gold jewellery sales in the “self-wear” category over the next one to two years (Chart 11).

Chart 11: Self-wear is seen as the most vital occasion for gold jewellery purchase in the future

Self-wear is seen as the most vital occasion for gold jewellery purchase in the future

Q: Which occasion’s contribution to gold jewellery sales will see significant/moderate growth in the next 1~2 years?

Self-wear is seen as the most vital occasion for gold jewellery purchase in the future

Q: Which occasion’s contribution to gold jewellery sales will see significant/moderate growth in the next 1~2 years?

Source: China Gold News, World Gold Council

Sources:

China Gold News,

World Gold Council; Disclaimer

Conclusion

To help identify potential opportunities in today’s gold jewellery market we conducted our third annual Chinese gold jewellery retailer survey. As the need for consumers to preserve value increases, we believe that highlighting the financial worth of gold jewellery products in the current economic environment could be beneficial to retail sales.

Our investigation of key jewellery shopping occasions found that:

- “self-wear” drives jewellery sales

- female clients contribute the most to retail sales across all buying occasions

- gold dominates all jewellery shopping occasions

- clients at different life stages have different needs.

Looking ahead, our survey respondents expressed their optimism about sales of gold products. And most retailers believe that “self-wear” and “wedding purchases” will continue to play key roles in driving gold jewellery demand.

Appendix I: Survey methodology

To identify key trends in China’s gold jewellery market we carried out a third annual survey of Chinese jewellery retailers in conjunction with China Gold News. This year’s survey was designed to:

- analyse different product sales’ performance in the first half of 2022• identify different jewellery buying occasions

- collect retailers’ views on future gold jewellery demand under various shopping occasions and canvass their opinion on the outlook for other jewellery categories.

To understand the full range of Chinese gold jewellery market trends, we collected 496 validated responses from 63 different tiered cities in 18 provinces. Fieldwork took place between July and August 2022 via both online questionnaires and face-to-face interviews (Chart 12).

Chart 12: We surveyed nearly 500 retailers from 59 cities

We surveyed nearly 500 retailers from 59 cities

We surveyed nearly 500 retailers from 59 cities

Source: China Gold News, World Gold Council

Sources:

China Gold News,

World Gold Council; Disclaimer

The survey captured opinions from store managers, sales people and senior management in national chains such as Chow Taifook, China Gold Jewellery, LFX Gold Jewellery, and Yuyuan Jewellery, as well as regional brands including Baoqing Gold Jewellery, Changzhou Gold Jewellery and Xinjin Gold Jewellery.

To mitigate possible biases arising from store types, we divided our sample equally into two groups: jewellery stores in malls and those on streets.