The gems and jewellery industry is a key contributor to India’s total exports

Given the high dependence on bullion and doré imports and the subsequent effect this has had on the country’s current account deficit (CAD), gems and jewellery (G&J) exports play an important role in cushioning at least some of this impact. For instance, G&J exports have accounted for 11% of India’s total exports; worth approximately US$25-40bn per year during the financial years 2012 to 2022 (Chart 3). 12

Chart 3: Gems and jewellery exports have bounced back after COVID-19

India Jewellery Demand: Chart 3

Sources:

S&P Global Market Intelligence,

World Gold Council; Disclaimer

These exports include several product segments, such as cut and polished diamonds, gold jewellery and medallions, rough diamonds, gemstones, pearls, synthetic stones and fashion jewellery. Of these, cut and polished diamonds accounted for over half of the total, while gold jewellery (plain and studded) accounted for 23% in 2021 (Chart 4).

US overtakes UAE to become top jewellery export destination

Until the pandemic, the UAE had been the top export market for Indian jewellery, accepting nearly half of outbound jewellery shipments from India and peaking at 67%.13 But in 2021 the US, which had been the second biggest importer of Indian jewellery, saw its market share surpass the UAE (Chart 5). It is important to note that Indian exports to the US suffered when in 2007 the US withdrew the Generalised System of Preferences (GSP) status that applied to some key jewellery categories, notably gold rope necklaces and neck chains, and gold mixed link necklaces and neck chains. 14 As a result, Indian exports attracted the most favoured nation (MFN) 15 import duty of around 5-6% compared to the pre-2007 duty-free status. 16 This caused a substantial fall in Indian exports to the US: from $2.3bn in 2006 to $1.3bn in 2017. 17

Chart 4: Gold accounted for 23% of gem and jewellery exports in 2021

India Jewellery Demand: Chart 4

Sources:

S&P Global Market Intelligence,

World Gold Council; Disclaimer

*Others include pearls, synthetic stones, fashion jewellery and sales to foreign tourists

Chart 5: US surpassed UAE as the top destination for Indian jewellery exports in 2021

India Jewellery Demand: Chart 5

Since 2019 trade tensions between the US and China have escalated and the imposition of tariffs on Chinese exports has benefitted Indian exports to the US. For instance, before the trade war, goods from both Hong Kong and China had long been subject to duties at the US MFN rate of 7%. 18 However, a “Section 301” list published in August 2019 subjected many Chinese consumer goods, including diamonds and jewellery, to an additional 10% US tariff. 19 This tariff has been changed a few times but today stands at 14.5%. Metals Focus’ discussions with exporters in India suggest that the duty advantage they have enjoyed over the last three years has enabled more Indian fabricators to better compete with China when it comes to US exports.

But while trade with the US increased, that with the UAE suffered due to the implementation of a 5% import duty in 2017 and 5% VAT from the beginning of 2018. This additional cost for Indian jewellery arriving in the UAE resulted in lower margins for Indian exporters and in turn contributed to the overall decline of gold jewellery exports to the UAE. To put this in context, from a peak of US$8.2bn in 2019, Indian exports to the UAE dropped to US$3.2bn in 2021. 20

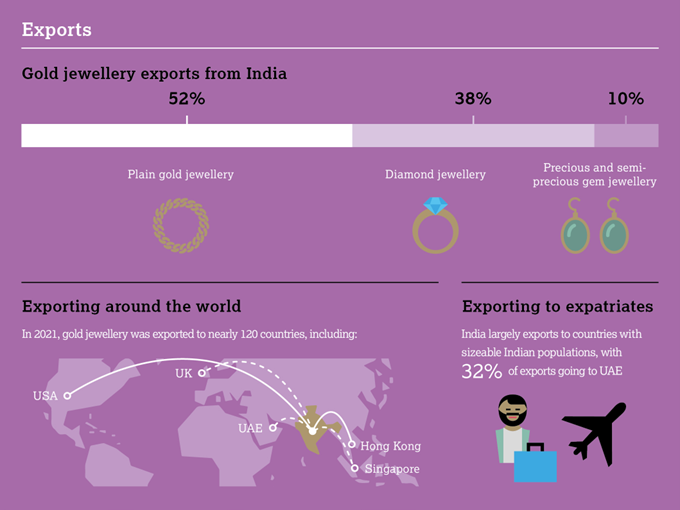

Share of plain gold jewellery has declined in the export mix

Reflecting this market share shift among export destinations, the product mix of gold shipments has also changed. During the UAE’s earlier export market dominance, plain gold jewellery accounted for a larger share than studded gold jewellery (which is mostly studded with diamonds). However, over the last two years the greater influence exerted by the US has caused a marked reversal of this trend. To put this into perspective, in 2019 exports of plain gold jewellery – at US$8.7bn – were more than double that of studded gold jewellery, (US$3.4bn). 21 But by 2021 the growth in exports of studded gold jewellery (US$4.4bn) had outstripped plain gold jewellery (US$4.1bn). Importantly, the share of studded jewellery in India’s export mix increased from less than 30% in 2018 to 48% in 2021 (Chart 6). 22

Chart 6: Plain gold jewellery exports accounted for 38% of gold jewellery exports from India in 2021

India Jewellery Demand: Chart 5

Removal of proposed tariffs by the US will further help Indian jewellery exports

Although exports to the US have grown, there has been ongoing uncertainty with regard to new tariffs levied by the US on Indian exports. To provide some context, in April 2021 the US Trade Representative (USTR) proposed retaliatory duties of 25% on six nations, including India, that had introduced e-commerce taxes on US companies, such as Amazon. 23 This included 17 jewellery categories worth approximately US$50 million annually in exports, according to India’s Gem & Jewellery Export Promotion Council (GJEPC).24 In June 2021, after the conclusion of the one-year Section 301 investigations, the USTR suspended these tariffs for a period of up to 180 days to give additional time to complete the ongoing multilateral negotiations on international taxation, which were to take place at the OECD and the G20.

These tariffs were finally scrapped in November 2021 and, looking ahead, the removal of this uncertainty will help Indian exports to continue their aggressive push into the US market. 25 Recent India-US trade discussions have included a proposal to restore India’s beneficiary status under the US GSP system. 26

The India-UAE CEPA will help lift the UAE as a jewellery import destination

In February 2022 India and the UAE signed a landmark Comprehensive Economic Partnership Agreement (CEPA), which was implemented on 1 May 2022. The CEPA will cover in excess of 11,000 goods and services, affording more than 90% of Indian goods duty-free access to the UAE. This effectively makes jewellery exports to the UAE once again competitive by eliminating the 5% import duty. As mentioned earlier, the UAE had been the largest importer of Indian jewellery for decades until the US displaced it as the most important buyer of Indian jewellery in 2021. This has further implications, as the Emirates act as a global gateway for Indian jewellery exports; products exported there are not just consumed by the Indian diaspora but are also re-exported to the Gulf Cooperation Council (GCC) and parts of Africa.

While these are still early days for CEPA, there has already been a visible boost for Indian exports to the UAE. For instance, in the first four months of 2022 – before CEPA was in force – shipments averaged US$2.6bn per month; in the following three months (May to July) jewellery exports rose 30% to a monthly average of US$3.62bn. 27

There is a need to develop new markets to boost exports

Over the last decade nearly 90% of India’s jewellery exports have flowed to just five major markets: namely, the UAE, the US, Hong Kong, Singapore and the UK. India exports jewellery to a total of 146 countries but most of these are extremely small customers. And although Indian jewellery is re-exported to many other destinations across Africa, the Middle East and Europe – through hubs such as Dubai and Singapore – the trade needs to develop newer direct export markets to help secure healthier margins. At present, the likes of Australia and Canada account for a small share of the total (2% and 1% respectively in 2021), but a more focused approach in these jurisdictions should help increase Indian exports as these locations also have a large Indian or Asian diaspora. The same is true for many countries in the Middle East, such as Kuwait, Qatar and Bahrain, where direct exports are currently very small and jewellery is shipped via Dubai.

Trade bodies also need to help focus a spotlight on Indian craftsmanship, as a large part of Indian jewellery is hand-made – a skill that is appreciated globally.

There are various government schemes for jewellery exporters

The government has launched many enterprise schemes that support exporters in areas such as banking, finance, skill development, technology and marketing. For instance, the Credit Guarantee Scheme provides small enterprises with straightforward access to financing, 28 offering a credit guarantee for loans of up to Rs.20m (US$0.24m) without the need for collateral or a third-party guarantee. The Market Development Assistance (MDA) Scheme is a government endowment available to all exporters that have delivered up to Rs.150m (US$1.8m) of exports in the preceding year. 29 This provides funding for export promotion activities, such as participation in trade fairs and exhibitions.

Given the high customs duty in India, it is imperative to provide duty-free access to gold for export purposes. In this regard, India has introduced the Advance Authorisation Scheme (AA). Put simply, a gold jewellery exporter can import gold without paying customs duty as long as they export jewellery within 120 days from the date of import of each consignment. 30 This includes an "actual user" condition, which means that the gold cannot be transferred and must only be used in the premises of the license holder. Furthermore, a minimum value addition (the difference in value between the finished jewellery and the input raw material used to manufacture it) of 3.5% must be achieved for the export of plain jewellery and 6-7% for studded gold jewellery. 31 Apart from that, a maximum manufacturing loss (wastage) of 2.5% is permitted for plain gold jewellery compared with 5% for studded gold items. 32 To prevent misuse of the scheme, licenses carry an obligation whereby exports recorded against the gold must be fulfilled – both in terms of quantity and value – within 90 days from accounting for value addition and manufacturing loss.

Another scheme that provides exporters with duty-free gold is the Duty Drawback Scheme (DBK). Unlike the AA scheme, where duty is exempt at the time of import, the import duty under DBK has to be paid at the point of import and subsequently claimed back after providing the applicable paperwork, such as a Bill of Export.

In 2019 the government also allowed Indian exporters to replenish gold equivalent to any they had sold at exhibitions abroad without paying duty, although this was stopped after the implementation of the GST in 2017 and the benefit for exporters who sold jewellery in this way was removed.

That aside, jewellery exporters are able to take advantage of gold metal loans if they can provide a bank guarantee or cash margin of ~110% of the notional gold value.

Despite these various government schemes, all of which are broadly supportive of gold jewellery exporters, jewellery exports in tonnage terms have faced headwinds in recent years. Key policy measures are needed to facilitate exports and alleviate the challenges exporters currently face (Focus 3).

Indian gold jewellery imports remain very small

In contrast to exports, gold jewellery imports into India remain small (Chart 7). Primarily, imported jewellery is machine-made and is either high-end or from international brands that do not manufacture locally. The bulk of India’s jewellery imports are from the UAE, the US and Italy. Given India’s expertise in hand-crafted jewellery, handmade pieces rarely feature in India’s jewellery imports.

Chart 7: Indian gold jewellery exports dwarf gold jewellery imports

India Jewellery Demand: Chart 7

Round tripping continues despite government measures to reduce fictitious exports

While the vast majority of Indian exports are genuine, there remains an element that is not. The practice of round tripping (RT) involves exporting gold (jewellery, bars or coins) with the sole purpose of the product being melted down and re-imported into the original exporting country. This circular flow of gold inflates trade statistics and in India is used by firms to artificially boost their trading volumes and, in turn, secure less expensive finance on the basis of a higher turnover. Due to various government programmes to promote overseas trade, export credit is usually less expensive, and inflating exports through round tripping allows exporters access to more credit at lower rates than other companies would pay.

The government has introduced measures that, to some extent, curtail this practice by restricting exports of 24-carat jewellery. In its notification of 14 August 2017, the government permitted only the export of gold jewellery containing gold between 8 and a maximum of 22 carats. 33 There have also been changes to value addition norms to help prevent RT.34 In setting value addition norms the government must perform a delicate balancing act because if they are too high they may negatively impact genuine jewellery exporters. In 2017 the government banned the export of 24-carat medallions and coins but subsequently allowed 22-carat versions to be exported with a value addition of 1.5%. 35

Despite the measures taken by the government, RT continues, particularly in the jewellery trade with the UAE, Hong Kong and Singapore (Chart 8).

Focus 3: Potential policy measures to facilitate exports

Despite the foreign trade policy having been broadly supportive of exporters of gold jewellery, jewellery export figures are declining in volume terms, even as they rise in value terms. This disparity is largely due to the rise in gold prices we have seen in recent years.

To examine the reasons for the decline in volume and explore the remedial measures to reverse the downtrend, the issue needs to be tackled on two fronts, i.e. issues related with the policy and its implementation, and those related to ‘Marketing India’.

- Policy related/operational issues

- Tackling the scarcity of duty free gold

In India, nominated agencies import duty free gold for exporters. At a few ports, this gold is cleared the same day the shipment is landed (e.g., Delhi or Chennai). However, at some ports (e.g., Kolkata) custom officers delay the clearance of imported cargo for several days, often on some frivolous pretext. The resultant delay results in a cost escalation due to demurrage and interest costs. For instance, due to these reasons banks are unwilling to import duty free gold at Kolkata port. Instead, they prefer to use Chennai or Delhi where the clearing process is smooth and expeditious; banks later transfer the gold to Kolkata. This escalates costs for the exporter in Kolkata as the cost of stock transfer is also realised by the banks in the form of increased premiums compared to the London settlement. Moreover, inter-state stock transfers attract Integrated Goods and Services Tax (IGST), which the exporter pays up front. This requires more investment and interest costs, which reduces the competitive edge of the exporter.

- Procedural problems in clearing gold supplied in advance by foreign buyers

Customs rules permit the import of gold by an exporter if the metal is being supplied by an overseas buyer as an advance against the export of jewellery of equivalent quantity in terms of fine gold. At the time of import, the importer has to furnish a bond backed by a Letter of Undertaking (LUT) or Bank Guarantee (BG) equivalent to the value of the imported gold and the import duty. The LUT/BG can be redeemed after submitting proof that the jewellery has been exported. Mumbai customs routinely clears such consignments, but the Kolkata customs refuse to do so on a subjective interpretation that the gold has been imported on a loan basis. Given the above mentioned issues, it is recommended that uniform procedures are implemented at all customs ports to support exporters.

- Foreign Trade Policy (FTP) should also allow the import of gold by an exporter if it is supplied by an overseas buyer post export of jewellery

The UAE is one of the biggest importers of Indian gold jewellery. The normal trade practice in the UAE is to settle gold jewellery payments plus value addition in cash. However, to settle the bills of Indian suppliers, the UAE dealer has to first sell his stock of gold bullion (which he receives from his buyers) and then convert the local currency into USD to wire transfer the invoice amount to India. Due to this, the UAE dealer, at times, has to sell gold at a discount and also suffers a loss due to conversion currency charges, thereby increasing his transaction costs. Dealers in the UAE therefore insist on settling the bill by export of equivalent gold in fine terms and wire transferring dollars for value addition and freight and insurance. However, India’s FTP does not permit such transactions. The FTP should allow the import of gold supplied by an overseas buyer in advance as well as post receipt of shipments from India. The GJEPC recommended this about two years ago.

- Replacing Duty Drawback with Remission of Rates and Taxes

Exporting gold jewellery made out of duty paid gold and claiming duty drawback is not commercially viable, as the drawback duty rates are always lower than the rate paid while importing. The rates of duty drawback are revised and fixed for a period of six months, which does not work well for a commodity like gold whose price is usually quite volatile. In addition, nominated agencies do not supply duty free gold to small exporters who want to service overseas orders, which prevents newer players from entering this space. Over a period of time, the GJEPC has seen a drop in the number of companies exporting gold jewellery under the Micro, Small and Medium Enterprises (MSME) category, which has impacted exports from Domestic Tariff Areas (DTAs). The loss suffered on account of an insufficient duty drawback is also very high. The present duty drawback does not recognise this peculiarity.

- Marketing related measures

It is a well-accepted fact within the Indian industry that to secure a greater share of jewellery exports the need for sustained and vigorous marketing of Indian jewellery is paramount. Though the GJEPC is mandated to promote Indian jewellery overseas, its activities are centred around holding B2B exhibitions in India or overseas markets and inviting or sending trade delegations. There is also a need to target consumers in overseas markets with better publicity through those avenues that are available today. Unfortunately, this is an extremely expensive proposition and the GJEPC alone cannot garner sufficient resources for B2C publicity.

It is therefore recommended that the government should consider supporting the industry to facilitate B2C events.

Pankaj Parekh

Regional Chairman- Eastern Region, GJEPC

This can involve crude jewellery in the form of bangles, which is close enough in form to be exported as jewellery but crude enough to carry negligible making charges. 36 After arriving at its destination, the jewellery is melted down and shipped back to India in bar form through official or unofficial channels. Prior to the measures taken in August 2017, RT focused on exporting jewellery in medallion form and without any value addition this wrongly inflated India’s jewellery export figures.

Chart 8: Round Tripping has continued despite government measures to curb these exports

India Jewellery Demand: Chart 8

Special Economic Zones (SEZs) have played a key role in boosting jewellery exports

The Special Economic Zones (SEZs) Act introduced in 2005 has played a key role in boosting India’s exports over the last two decades. To provide some background, a SEZ is an area classified as a territory outside the customs territory of India for its authorised operations. The policy was announced in April 2000 with the main objective of providing an internationally competitive and hassle-free environment for exports. SEZs feature key facilities, such as banks and in-house customs, to allow for quick and easy clearance. By the end of 2021, 268 SEZs were operational in India. 38 Of these, 15 are dedicated to gems and jewellery, and are home to over 500 manufacturing units (Table 6). 39 Studded gold jewellery accounted for the highest share (47%) of net exports from the SEZs in 2021, followed by studded silver jewellery (27%), plain gold jewellery (11%), plain silver jewellery (7%) and polished lab-grown diamonds (3%). 40

For jewellery exporters, operations in the SEZ allow duty-free imports of gold and hence save considerable working capital and paperwork compared to exporting through the Domestic Tariff Areas (DTAs) where duty refunds must be processed separately. The latter not only takes more time but often offers a lower duty drawback than the actual duty paid, due to differential applicable tariffs. That aside, DTAs also attract GST, which does not apply within export units based in the SEZs.

Table 6: List of operational or approved SEZs in India

Source: Metals Focus, World Gold Council

As a consequence, gold jewellery exports through SEZs grew from just 23% in 2015 to 57% in 2019.41 However, the pandemic negatively impacted jewellery fabrication and by 2021 the share of exports via SEZs had collapsed to 11% (Chart 9). This drop can also be attributed, in part, to the fact that some of the tax advantages enjoyed in SEZs for nearly two decades (such as income tax exemption on export income), ended in 2020. 42

Chart 9: The share of SEZs in total gold jewellery exports collapsed after the pandemic

India Jewellery Demand: Chart 9

The government is considering the introduction of a new SEZ policy in the coming years, which should further ease the export process. Indian authorities have already introduced a draft policy – the Development of Enterprise and Services Hub Bill 2022, or DESH Bill – which is intended to be WTO compliant as it seeks to explicitly prevent concessions and subsidies for exporters located in the SEZs. 43 Through this Bill, the government intends to go beyond export-oriented manufacturing and focus on broad-based parameters such as boosting additional economic activity, generating employment, and integrating various industrial hubs. Unlike in the SEZ ecosystem, the government now proposes to create development hubs where the focus is not limited to just exports but is inclusive of the domestic market. In addition, the custom duty would be paid only on the inputs used and not on the expensive final goods. Although the SEZ Act led to a notable improvement in India’s exports, interest in SEZs over the last few years has declined across many industries and as a consequence more than 100 units were de-notified between 2008 and 2020. Of the 425 currently notified SEZs, only 268 are operational. The new legislation should help address key hurdles, such as a lack of land for certain sectors and the complexity of operational models, and thus help improve the SEZs’ performance.

GST issues have stabilised after initial hiccups

The Goods and Services Tax (GST) that was introduced in 2017 initially created complications for Indian exporters as they had to pay 3% GST up front when they bought gold from nominated agencies, such as banks. This created an additional blockage of working capital for exporters as, apart from providing a bank guarantee for the customs duty, they also had to set aside additional capital for the GST, which in turn undermined their margins. However, following a period of lobbying by the industry, on 1 January 2019 the government announced that jewellery exporters would – under the scheme for “Export Against Supply by Nominated Agency” – no longer have to pay the 3% Integrated Goods and Services Tax (IGST) to nominated agencies. 44 There were conditions attached: namely that the beneficiary of the GST exemption must export their jewellery within 90 days, and the exporter must provide to the nominated agency a copy of the shipping bill or bill of export with a Goods and Services Tax Identification Number (GSTIN) within 120 days of receiving the gold.

Jewellery exports via e-commerce are a big positive for the industry

In June 2022 the government legalised jewellery exports through e-commerce platforms. The new rules allow jewellery exports through a courier service, but only after receipt of full payment and with exhaustive evidence of the product being uploaded on the customs system: namely, photos of the export jewellery, product package/outer covering, product listing on the e-commerce platform and the hallmarking certificate. Re-imports of physically damaged or defective jewellery exported via a courier are permitted, subject to criteria to prevent misuse. These criteria include conditions that the product must be returned through the same platform and using the same mode. In addition, the return e-commerce transaction for the jewellery should have been initiated by the same consignee to whom the jewellery was exported, and the total number of returns for the exporter must not exceed 5% of the total number of shipping bills in the same financial year.

Given the scope of global e-commerce, this should effectively open new markets for Indian exporters. Even small-sized firms, will now be able to increase their exports by selling via e-commerce platforms.

Outlook

During the last few years the Indian gold market has grappled with numerous changes, both in the regulatory environment and in the behaviour of consumers. And looking ahead, gold jewellery demand faces further challenges, particularly from changing demographics as younger generations of consumers are tempted by other products, be that different styles of jewellery or luxury fashion accessories. Gold jewellery demand has, however, remained resilient in India despite all these factors. And it will likely benefit from strong economic growth and further urbanisation as per capita income rises and the number of middle class consumers increase.

The Indian government has focused on strengthening manufacturing and exports, and this is likely to be enhanced in the coming years. Proposals to allow advance payments to overseas precious metal suppliers and the instigation of Mega Common Facility Centres (CFC) in the SEEPZ (in Mumbai) and Surat, could boost exports if implemented. Importantly, the CFCs would provide common manufacturing processes and a common pool of high-end capital-intensive state-of-the-art machines. This will particularly benefit small manufacturers as they will have access to the latest technology and resources to help enhance quality and in turn improve export performance.