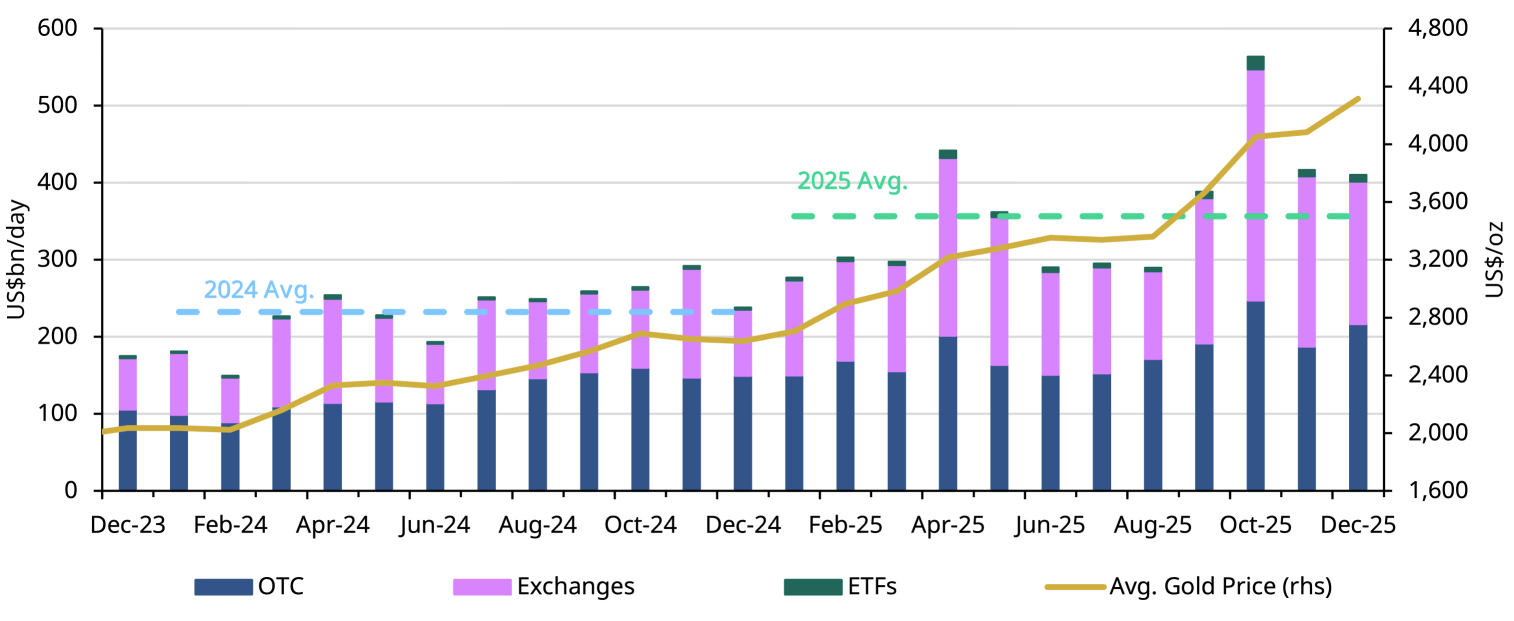

A record year for volumes

Global gold market trading volumes averaged US$410bn/day in December, a mild m/m decline of 2% yet above the y-t-d average of US$357bn/day.5 OTC volumes rose (US$216bn, +16% m/m) on stronger LBMA trading, while a lower gold price volatility weighed on derivatives activity at key exchanges (US$185bn/day, -16%). Global gold ETF trading saw a slight increase m/m (US$9bn/day, 4%) and remained well above the 2024 average of US$2.9bn/day. While volumes in tonnage terms during the month painted a similar picture.

Global gold market liquidity in 2025 hit a record high, averaging US$361bn/day, a 56% surge compared to 2024. All segments saw notable growth:

- OTC activities rose 41% to US$180bn/day, on average driven by robust LBMA trading (US$161bn, +42%)

- Exchange-traded volumes soared 71% to US$174bn/day, led by COMEX (US$114bn/day, +57%) and Shanghai Futures Exchange (US$51bn/day, +116%) posting another year of strong growth

- Global gold ETF liquidity more than doubled to US$7bn/day, led by North America (US$5bn, +138%).

In tonnage terms, global gold trading volumes averaged 3,247t/day in 2025, up 8% y/y and marking a record year. Despite a minimal 1% decline in OTC activity, other markets experienced robust growth.

Total COMEX net longs rose 15% during the month, closing out the year at 683t.6 Money manager net longs rose 18% to 395t, and Other net longs increased by 11% to 288t. This was largely driven by the strong surge in precious metal prices in December. Along with the usual drivers that dominated 2025 such as ongoing geopolitical risks7 and US dollar weakness.

Despite a significant rise in the gold price, money manager net longs were 30% lower than their end-2024 level, potentially highlighting room for further growth.

Chart 2: Gold volumes remained elevated into year-end

Average daily trading volumes by segment*

*Data as of 31 December 2025. Gold price based on the monthly average LBMA gold price PM USD.

For more information on trading volumes please visit our Trading Volumes page on Goldhub: Gold Trading Volume | Gold Daily Volume | World Gold Council.

Source: Bloomberg, Nasdaq, COMEX, ICE Benchmark Administration, Shanghai Gold Exchange, Shanghai Futures Exchange, ETF providers, Multi Commodity Exchange of India, Dubai Gold & Commodities Exchange, Japan Exchange Group, Thailand Futures Exchange, Borsa Istanbul, Bursa Malaysia, Korea Exchange, World Gold Council