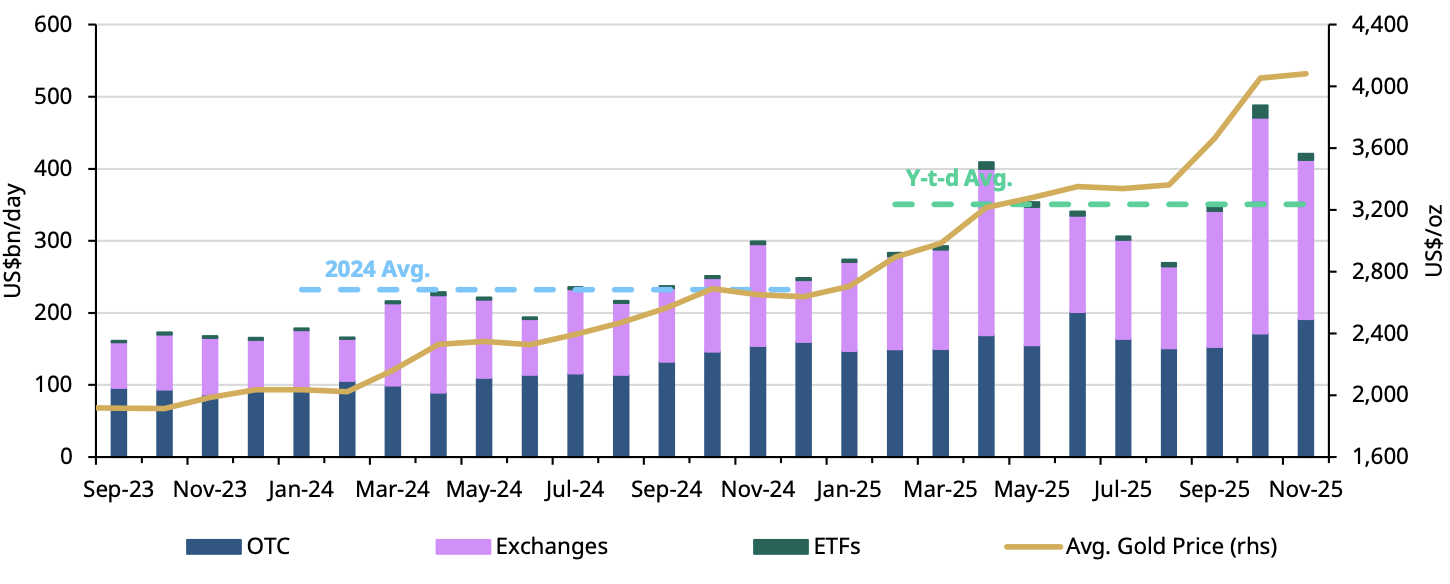

Volumes stayed elevated

Gold market trading volumes pulled back, averaging US$417bn in November, down 26% compared to the record level set in October.5 Nonetheless, global gold volumes remain well above their 2024 average of US$232bn/day. With gold price volatility decreasing in the month, all sectors saw slower activity.

OTC trading was lower by 24% m/m to US$188bn/day, primarily on reduced LBMA volumes (US$169bn/day, -25%). And exchange-traded volumes fell 26% to US$221bn/day, likely impacted by reduced gold price volatility in the month. Meanwhile, global gold ETF trading activity plunged 50% m/m, reaching US$8.4bn/day – yet still well above the 2024 average of US$2.9bn/day.

In tonnage terms, global gold market liquidity averaged 3,167t/day in November (-26% m/m) – 6% higher than the 2024 average. All segments of the gold market experienced cooler trading activity in the month: LBMA OTC (-25%, 1,287t/day) and COMEX (-24%, 1,129t/day) drove declines in OTC markets and exchanges. Global gold ETF trading also cooled notably, down 50% to 63t.

COMEX money manager net longs continued to experience data release delays, showing declines as of 14 October – the latest available. Their open interest trended up and down, concluding November at US$179bn, almost unchanged from the end-October level.6

Chart 2: Gold volumes declined m/m yet stayed elevated

Average daily trading volumes by segment*

*Data as of 30 November 2025. Gold price based on the monthly average LBMA gold price PM USD.

For more information on trading volumes please visit our Trading Volumes page on Goldhub: Gold Trading Volume | Gold Daily Volume | World Gold Council.

Source: Bloomberg, Nasdaq, COMEX, ICE Benchmark Administration, Shanghai Gold Exchange, Shanghai Futures Exchange, ETF providers, Multi Commodity Exchange of India, Dubai Gold & Commodities Exchange, Japan Exchange Group, Thailand Futures Exchange, Borsa Istanbul, Bursa Malaysia, Korea Exchange, World Gold Council