Annual gold demand dips to 4,355.7t

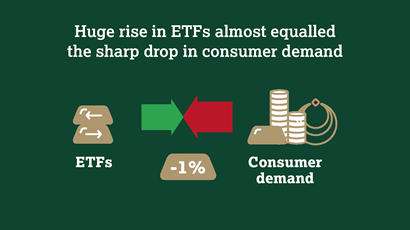

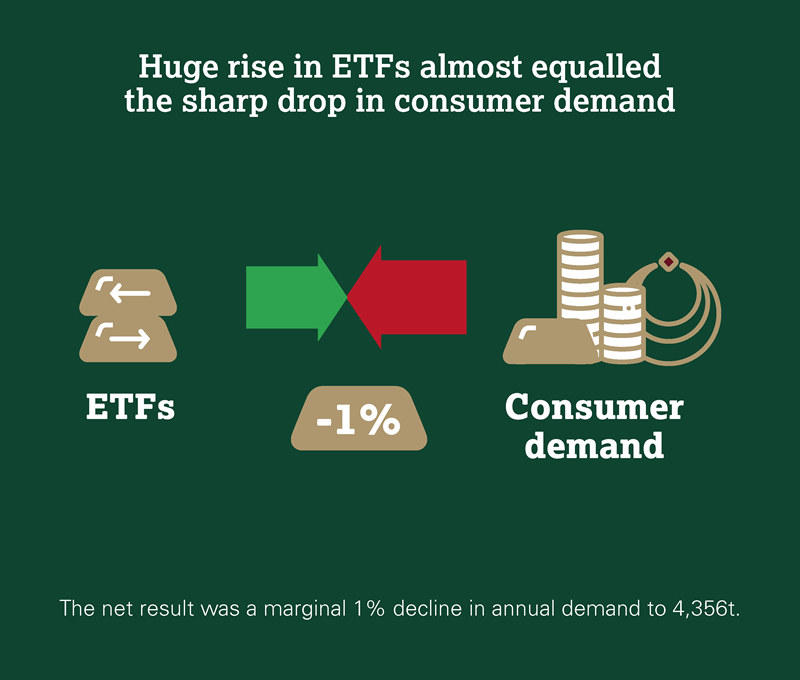

Gold demand fell 1% in 2019 as a huge rise in investment flows into ETFs and similar products was matched by the price-driven slump in consumer demand.

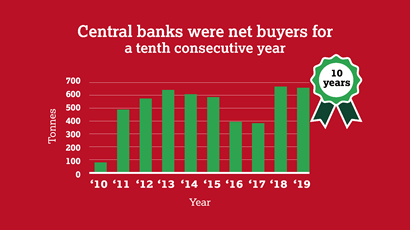

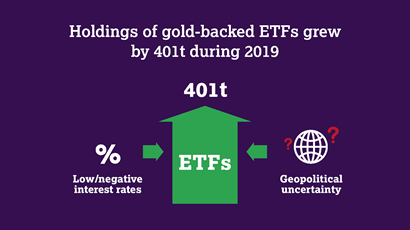

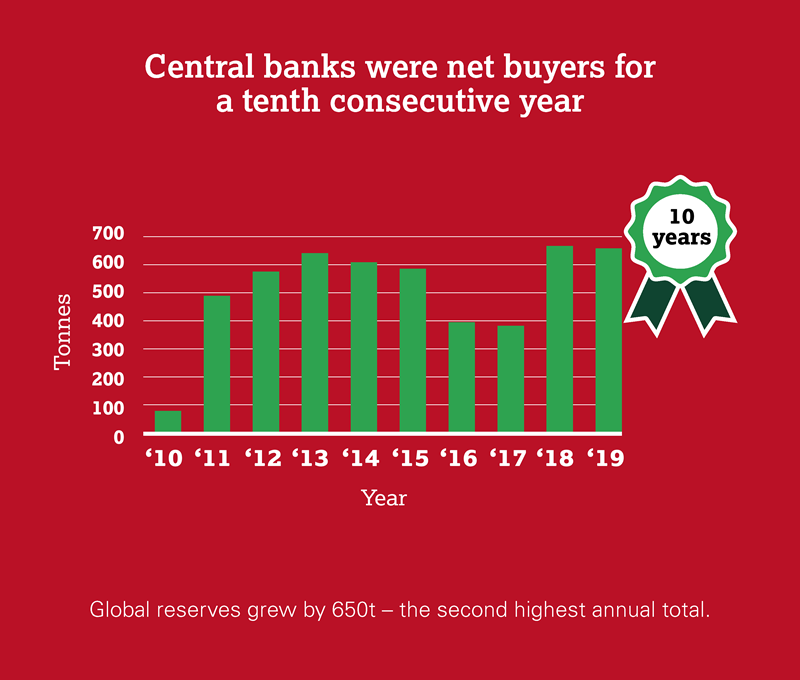

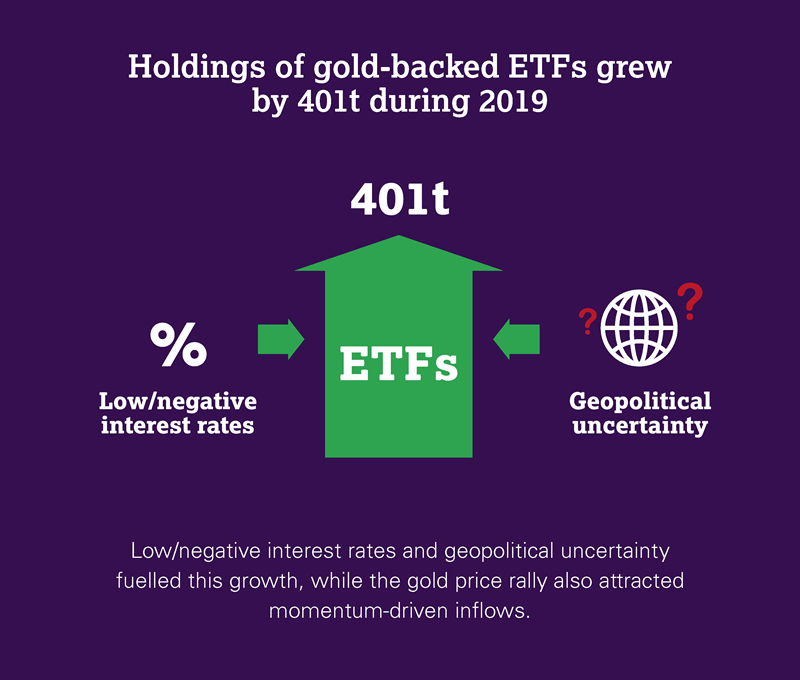

2019 was broadly a year of two distinct halves: resilience/growth across most sectors in the first half of the year contrasted with widespread y-o-y declines in the second. Global demand in H2 was down 10% on the same period of 2018 as y-o-y losses in Q4 compounded those from Q3, notably in jewellery demand and retail bar and coin investment. Central bank demand also slowed in the second half – down 38% in contrast with H1’s 65% increase. But this was partly due to the sheer scale of buying in the preceding few quarters and annual purchases nevertheless reached a remarkable 650.3t – the second highest level for 50 years. ETF investment inflows bucked the general trend. Investment in these products held up strongly throughout the first nine months of the year, reaching a crescendo of 256.3t in Q3. Momentum then subsided in Q4, with inflows slowing to 26.8t (-76% y-o-y). Technology saw modest declines throughout the year, although electronics demand staged a minor recovery in Q4. The annual supply of gold increased 2% to 4,776.1t. This growth came purely from recycling and hedging, as mine production slipped 1% to 3,436.7t.