Weekly Markets Monitor: The tail is wagging

16 February, 2026

Get updates in your inbox

Get email updates

Get updates in your inbox

Get email updates

Highlights

- Global data last week delivered a mixed set of signals. Stronger headline job gains and sticky inflation in the US dampened prospects for near-term Fed easing, even as weak retail sales and sizeable downward payroll revisions signaled softer underlying momentum. Europe’s growth diverged with the UK stagnating and the Eurozone steady, while in Asia Japan’s real wages remained under pressure, China’s weak demand and property slump persisted, and India’s inflation climbed.

- Global stock markets finished the week mixed, as Treasury yields retreated, the US dollar softened, and oil prices edged lower.

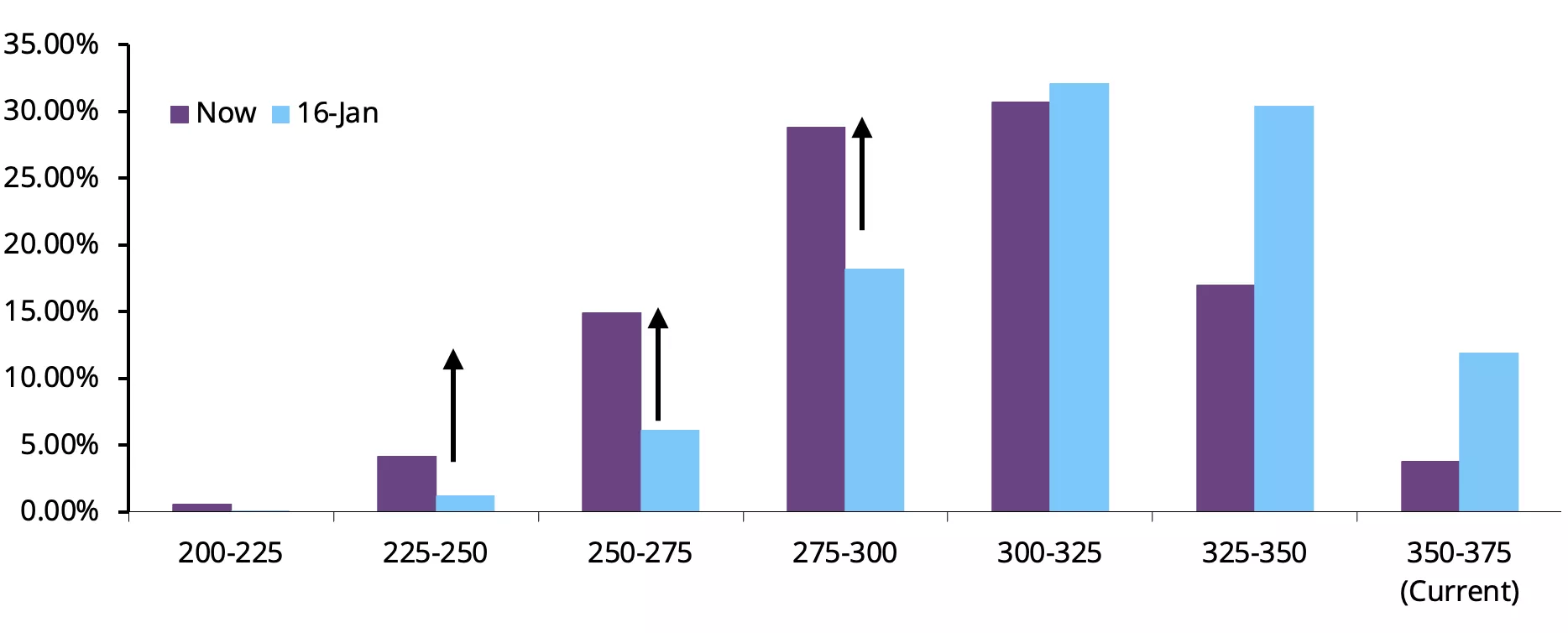

- The strong headline Non-farm payrolls (NFP) number for January (+130k) arrived with fanfare but heavy baggage. The 2025 change in NFP jobs was revised down by 403k. Last January’s +143k, subject to strong seasonal factors was revised to -48k, boding ill for the latest figure. Yet, the unemployment rate remains low and despite weak retail sales and a lower CPI, the Fed members have barely blinked. The market still sees two cuts in 2026 as most likely, but the tails are starting to budge with a subtle rise in three and four-cuts expectations (C.O.T.W).

Chart of the week: The tail is wagging

Market expectations for Fed Funds rate by December 2026*

*Data as of 16 February 2026. Fed funds interest rate expectations, based on 30-day Fed Funds Futures prices.

Source: CME, World Gold Council

Disclaimer

Important information and disclaimers

© 2026 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.