China gold market update: Wholesale demand fell in August

16 September, 2025

Highlights

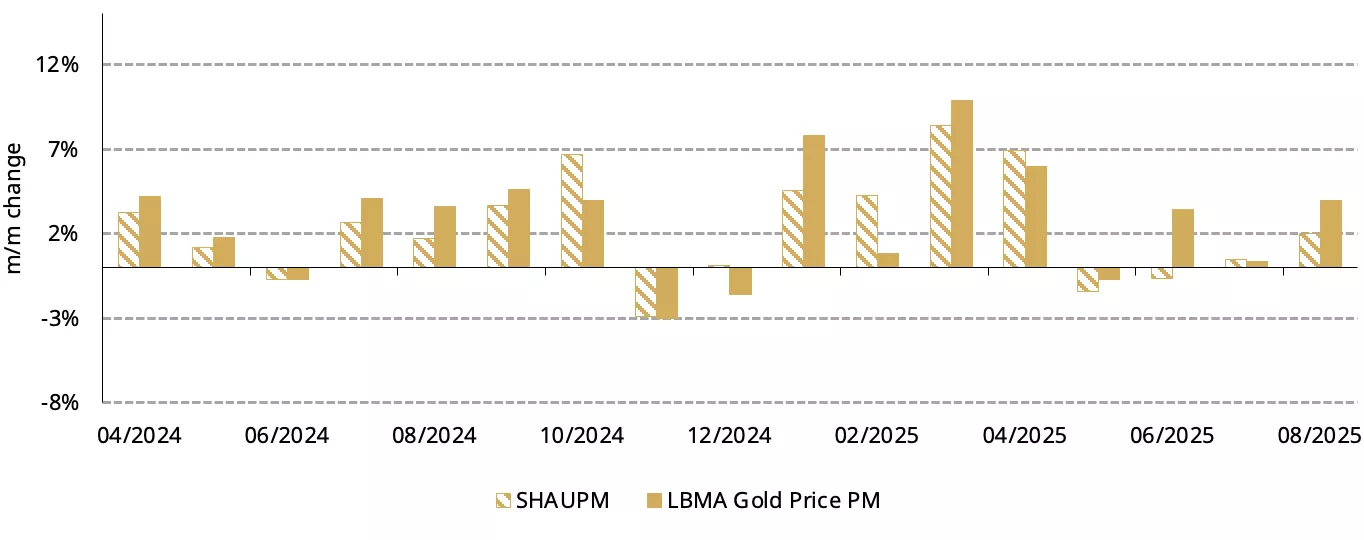

- Gold climbed higher in August. The LBMA Gold Price PM in USD rose 3.9% while the SHAUPM in RMB climbed 2% – the narrower increase was mainly due to an appreciating RMB against the dollar.

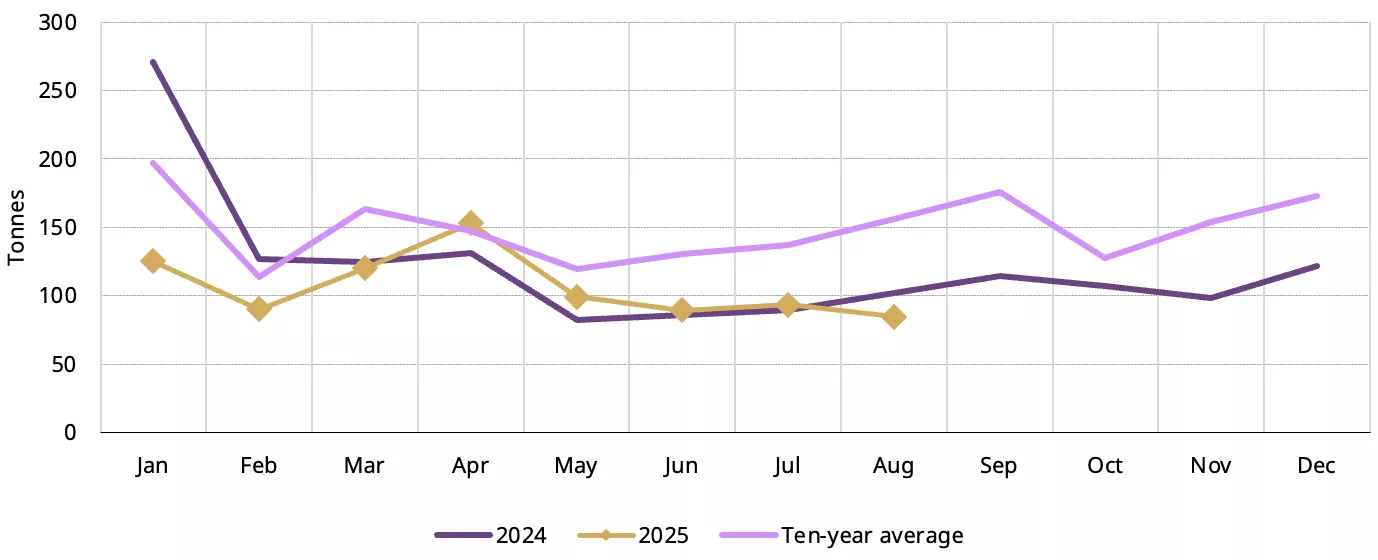

- Gold withdrawals from the Shanghai Gold Exchange (SGE) saw another m/m decline in August: investment weakness masked a rebound in jewellery demand.

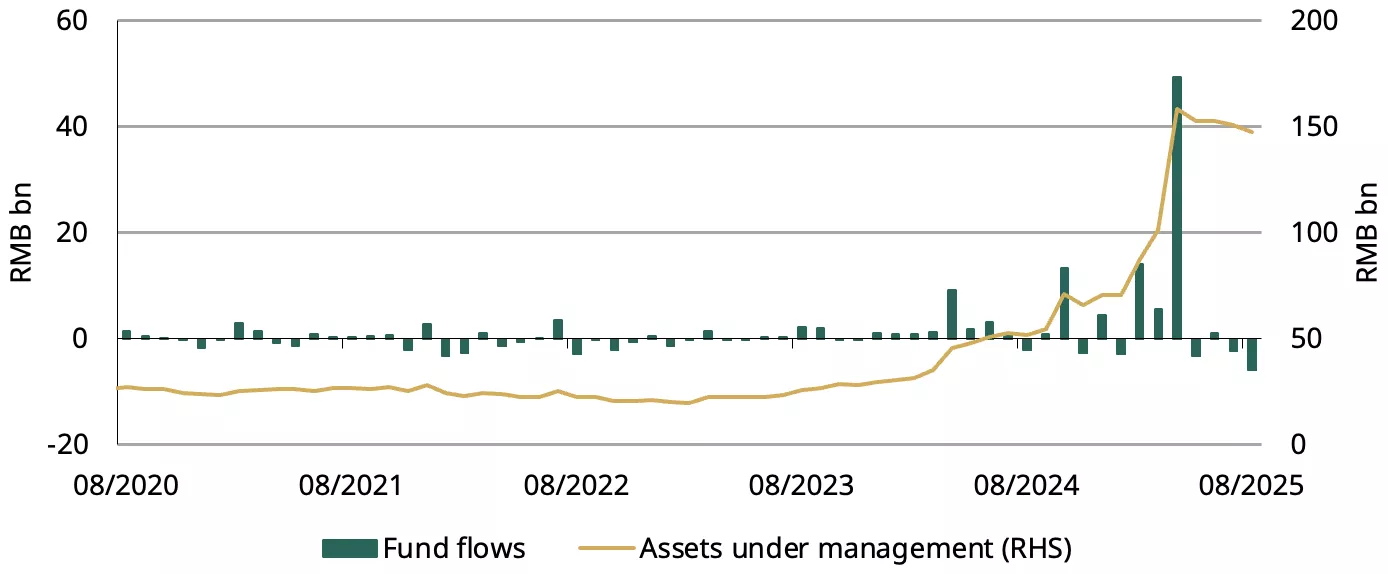

- Amidst local investors’ improving risk appetite, Chinese gold ETFs witnessed further outflows (RMB6bn, US$834mn) in August and gold futures trading volumes on the Shanghai Futures Exchange (SHFE) also fell.

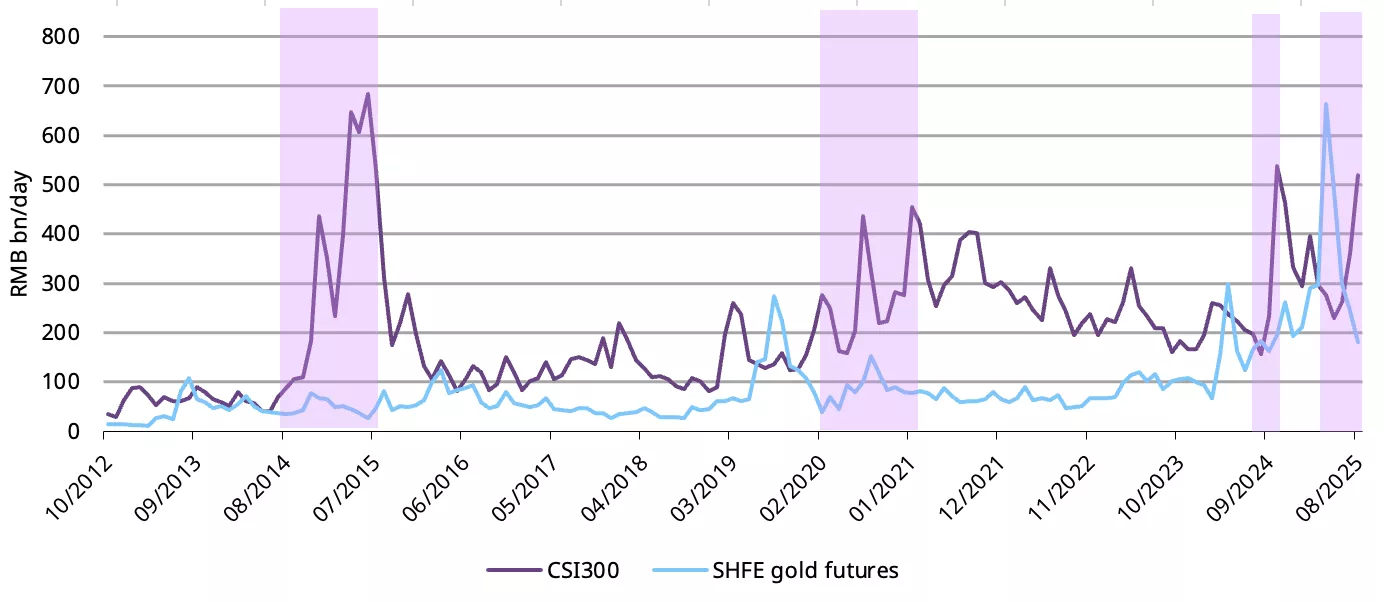

- Gold futures trading volumes on the Shanghai Futures Exchange (SHFE) also fell on investors’ rising risk appetite and low gold price volatility during most of August.

- In August, the People’s Bank of China (PBoC) reported a 1.9t gold reserve increase, the tenth consecutive monthly gold purchase.

- China’s gold imports rebounded in July, rising 50t m/m to 89t.

Looking ahead

- Despite a recent slowdown, we expect investment demand for gold to rebound amid the renewed gold price strength

- Jewellery retailers may step up their efforts in replenishment for the National Day Holiday in early October; various jewellery fairs in September also tend to support wholesale demand.

Gold registered further gains

Gold recorded another positive month in August (Chart 1). This is mainly supported by higher inflation expectations, intensifying expectations of a Fed cut and continued dollar weakness. Meanwhile, sustained geopolitical and trade risks also contributed to gold’s gains in the month.

Chart 1: Gold rose in August

Monthly returns of the SHAUPM in RMB and the LBMA Gold Price PM in USD*

*Data as of 29 August 2025.

Source: Bloomberg, World Gold Council

Wholesale demand weakened

China’s wholesale gold demand fell 9t m/m to 85t last month. This represents a 17t y/y decline, the weakest August since 2010 – the unseen gold price level has kept tonnage demand low so far in 2025 compared to previous years.

The m/m decline was against seasonality - where demand often gradually picks up towards the end of Q3. Conversations with industry participants indicated that the August wholesale gold demand weakness mainly came from subdued bar and coins sales, as investors directed their attention to rallying equities.1 Meanwhile, the lack of a clear trend in the gold price in most of August also led to investors waiting on the sidelines.

The cooling investment momentum overshadowed improving jewellers’ replenishment activities amid the Chinese Valentine’s Day and the price stability during most of August.2

Chart 2: Wholesale gold demand fell in August*

*The 10-year average is based on data between 2015 and 2024.

Source: Shanghai Gold Exchange, World Gold Council

Chinese investors continued to sell gold ETFs

Chinese gold ETFs witnessed another month of outflows, shedding RMB6bn (US$834mn) in August (Chart 3). The rising gold price was insufficient to offset the outflow, leading to a 2% m/m decline in Chinese gold ETFs’ total assets under management (AUM), which now stands at RMB148bn (US$21bn). Meanwhile, holdings fell 7.7t to 189t.

Similar to factors denting bullion sales as noted above, the strong equity performance - the CSI300 Stock Index jumped 10% in August, the strongest month since September 2024 – and the range-bound gold price movements during most of August also weighed on gold ETF demand.

Chart 3: Chinese gold ETFs saw further outflows in August

Total AUM and monthly flows of Chinese gold ETFs*

*As of 29 August 2025.

Source: Company filings, World Gold Council

Trading volumes of gold futures at the SHFE fell in August, declining 26% m/m to 231t/day – though remaining above the five-year average of 216t. Surging equity market volumes (Chart 4) and a low gold price volatility also dimmed future traders’ interest.

Chart 4: Investor attention was diverted to the strong equity market

Daily average trading volumes of SHFE gold futures and CSI300 Stock Index*

*As of 29 August 2025. The shaded areas refer to equity bull runs, alongside surging equity trading volumes, which coincide with falling gold futures volumes.

Source: Shanghai Futures Exchange, World Gold Council

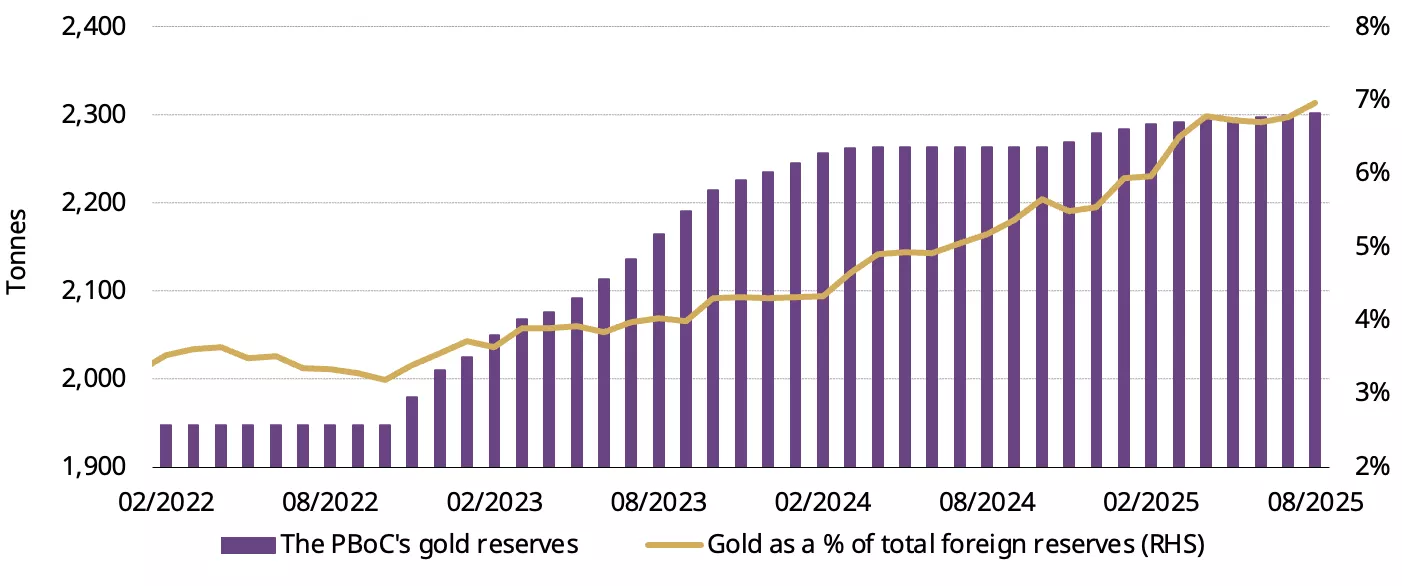

Ten months of non-stop PBoC gold accumulation

The PBoC reported its tenth consecutive monthly gold purchase, adding 1.9t to its total reserves in August. Now gold accounts for 7% of China’s total foreign exchange reserves, standing at 2,302t (Chart 5). Y-t-d, China has announced official gold purchases of 22.7t.

Chart 5: China’s official gold holdings rose further

Reported official gold holdings and gold as a percentage of total foreign exchange reserves*

*As of August 2025.

Source: State Administration of Foreign Exchange, World Gold Council

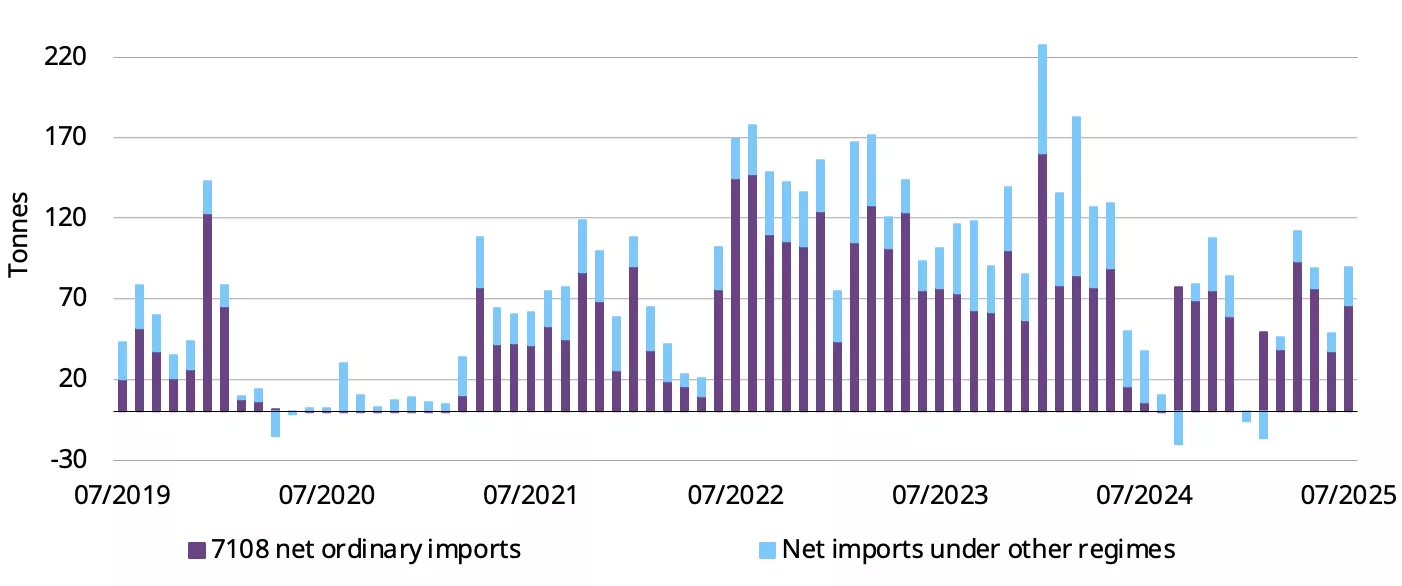

Imports rebounded in July

China’s gold imports reached 89t in July, based on the latest data from China Customs, a 50t rise m/m and 53t higher y/y. We believe importers’ anticipation of rising wholesale gold demand towards the end of Q3 and positive local gold price premiums in the month encouraged imports.

Chart 6: July gold imports bounced higher

Net 7108 gold imports under various regimes*

*Based on the latest data available. Data to June 2025.

Source: China Customs, World Gold Council

Footnotes

1See: China retail investors are using savings to fuel stock market bull run, 25 August 2025.

2Chinese Valentine’s Day in 2025 occurred on 29 August.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.