Central Bank Gold Statistics: Central bank gold buying in July slows but remains firm

3 September, 2025

- Central banks added a modest 10t to global gold reserves in July, despite the elevated gold price1

- The National Bank of Kazakhstan added 3t to its gold reserves this month while the Central Bank of the Republic of Turkey, the People’s Bank of China and the Czech National Bank each bought 2t over the same period

- The Bank of Uganda announced a pilot project for its domestic gold buying programme will be carried out in the next two to three years, following its initial announcement back in August 2024.

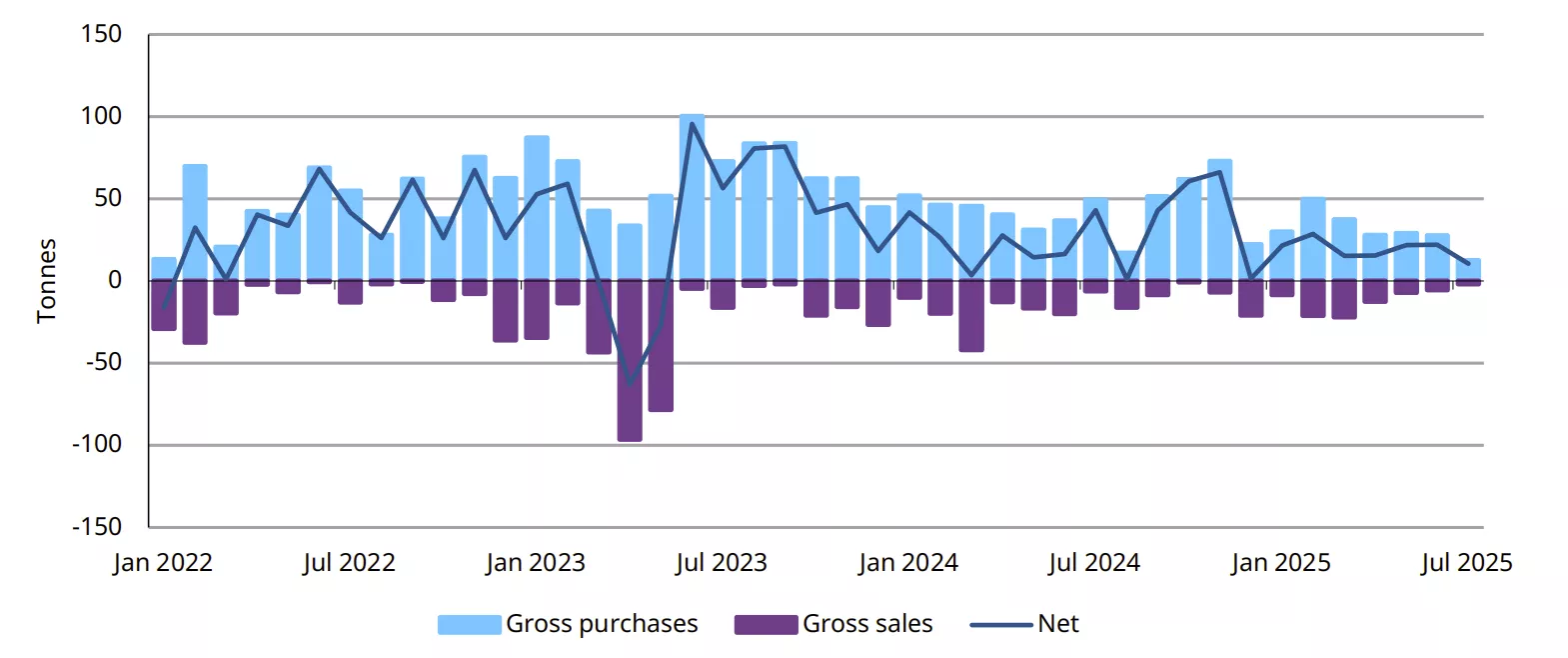

Global central banks bought net 10t in July based on reported data, a moderate net allocation compared to previous months (Chart 1). Despite this slower pace of net buying, central banks continue to be net buyers of gold even in the current price range.

Chart 1: Central bank net purchases moderated in July

*Data to 31 July 2025 where available.

Source: IMF, respective central banks, World Gold Council

Emerging market central banks continue incremental buying in July

The following emerging market central banks reported changes (of 1t or more) to their gold reserves in July:

- The National Bank of Kazakhstan added 3t, bringing its total y-t-d gold additions to 25t – the third largest central bank reported gold purchases so far, just behind Poland and Azerbaijan.

- The Central Bank of the Republic of Turkey, People’s Bank of China and Czech National Bank each added 2t of gold. The appetite for these three central banks continues, with the pace of gold accumulation incremental yet steady. Turkey has been a net purchaser for 26 consecutive months – since June 2023 – while the Czech National Bank has bought gold for 29 consecutive months – since March 2023. The People’s Bank of China continued its gold buying for the ninth consecutive month, with purchases totalling 36t over this period.

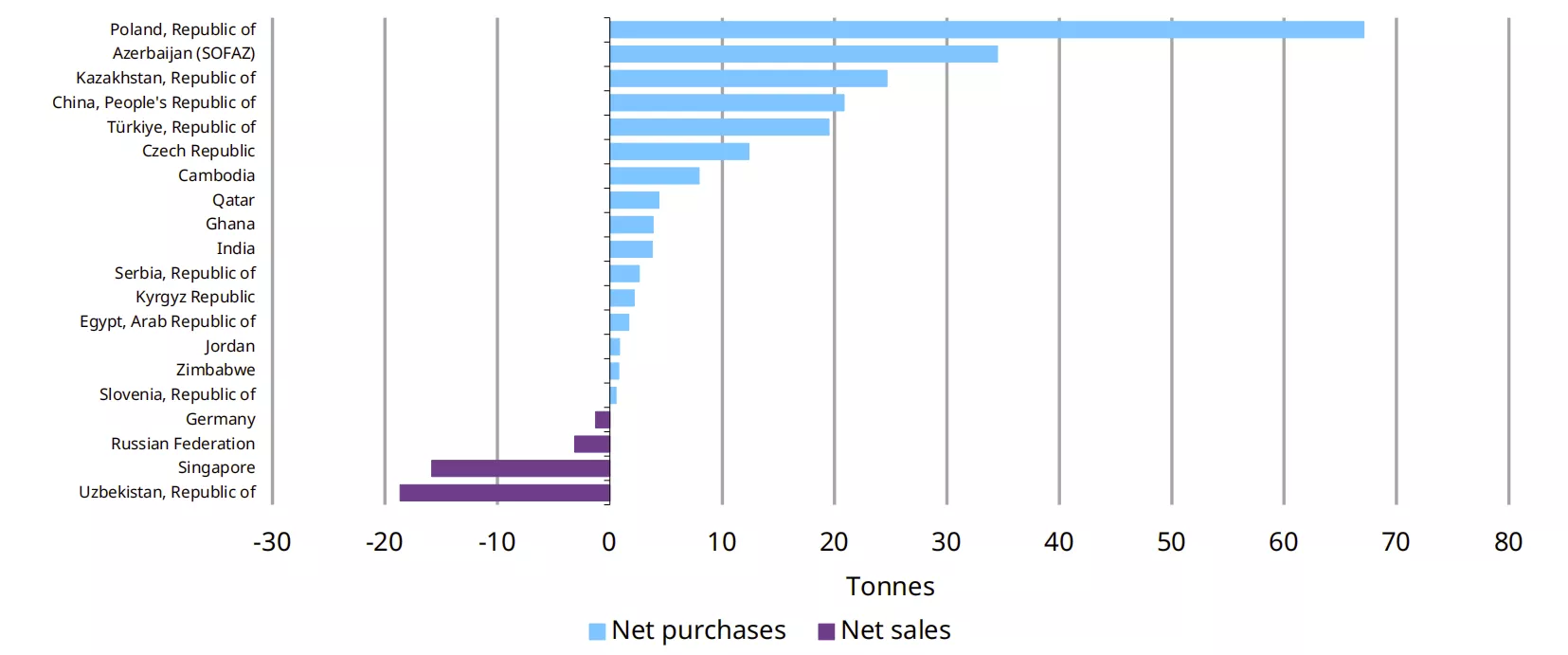

- The National Bank of Poland remains the largest net purchaser of gold in 2025 with 67t y-t-d, though its gold reserves has been virtually unchanged since May 2025 (Chart 2).

- The Bank of Uganda announced a two-to-three-year pilot programme to purchase gold domestically from artisanal miners and aimed at building official reserves and reducing reliance on traditional foreign assets. The initiative follows the central bank’s announcement in 2024 of plans to begin domestic gold buying.

Chart 2: Central banks gold accumulation in 2025

Y-t-d central bank net purchases and sales, tonnes*

*Data to 31 July 2025 where available. SOFAZ represents the gold reserves of the State Oil Fund of Azerbaijan.

Source: IMF, respective central banks, World Gold Council

Footnotes

1Owing to IMF data released after the time of writing, which shows that Bank Indonesia reduced its gold reserves by 11 tonnes in July, our initial estimate for central bank net buying in July (10t) will be revised to zero based on available information. We will also note this revision in next month's blog and statistics.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding the LBMA Gold Price

The LBMA Gold Price is administered and published by ICE Benchmark Administration Limited (IBA). The LBMA Gold Price is a trademark of Precious Metals Prices Limited and is licensed to IBA as administrator of the LBMA Gold Price. ICE and ICE Benchmark Administration are registered trademarks of IBA and/or its affiliates. The LBMA Gold Price is used by the World Gold Council with permission under license by IBA.

Published LBMA Gold Price information may not be indicative of future LBMA Gold Price information or performance. None of IBA, Intercontinental Exchange, Inc. (ICE) or any third party that provides data used to administer or determine the LBMA Gold Price (data providers), or any of its or their affiliates makes any claim, prediction, warranty or representation whatsoever as to the timeliness, accuracy or completeness of LBMA Gold Price information, the results to be obtained from any use of LBMA Gold Price information, or the appropriateness or suitability of using LBMA Gold Price information for any particular purpose. to the fullest extent permitted by applicable law, all implied terms, conditions and warranties, including, without limitation, as to quality, merchantability, fitness for purpose, title or non-infringement, in relation to LBMA Gold Price information, are hereby excluded, and none of IBA, ICE or any data provider, or any of its or their affiliates will be liable in contract or tort (including negligence), for breach of statutory duty or nuisance, or under antitrust laws, for misrepresentation or otherwise, in respect of any inaccuracies, errors, omissions, delays, failures, cessations or changes (material or otherwise) in LBMA Gold Price information, or for any damage, expense or other loss (whether direct or indirect) you may suffer arising out of or in connection with LBMA Gold Price information or any reliance you may place upon it.

LBMA Gold Price information provided by the World Gold Council may be used by you internally to review the analysis provided by the World Gold Council, but may not be used for any other purpose. LBMA Gold Price information provided by the World Gold Council may not be disclosed by you to anyone else.