Central bank gold buying picks up in May

2 July, 2025

- Central banks added a net 20t to global gold reserves in May, an uptick from the previous month, though overall pace has moderated slightly

- The National Bank of Kazakhstan led buying this month (7t), followed by Turkey and Poland each with 6t net purchases, meanwhile the Monetary Authority of Singapore (MAS) reported sales of 5t over the same period

- In our recently released Central Bank Gold Reserves Survey 2025, 43% of central bankers surveyed stated their own central bank would increase their gold reserves and 95% believed that official gold reserves would continue to increase in the next 12 months, citing gold’s attributes as a diversifier and hedge during crisis and inflation as key factors influencing their decision to hold gold. This sentiment was echoed in the Official Monetary and Financial Institutions Forum (OMFIF) Global Public Investor 2025 where 32% of central banks expect to increase gold holdings in the next 12–24 months.

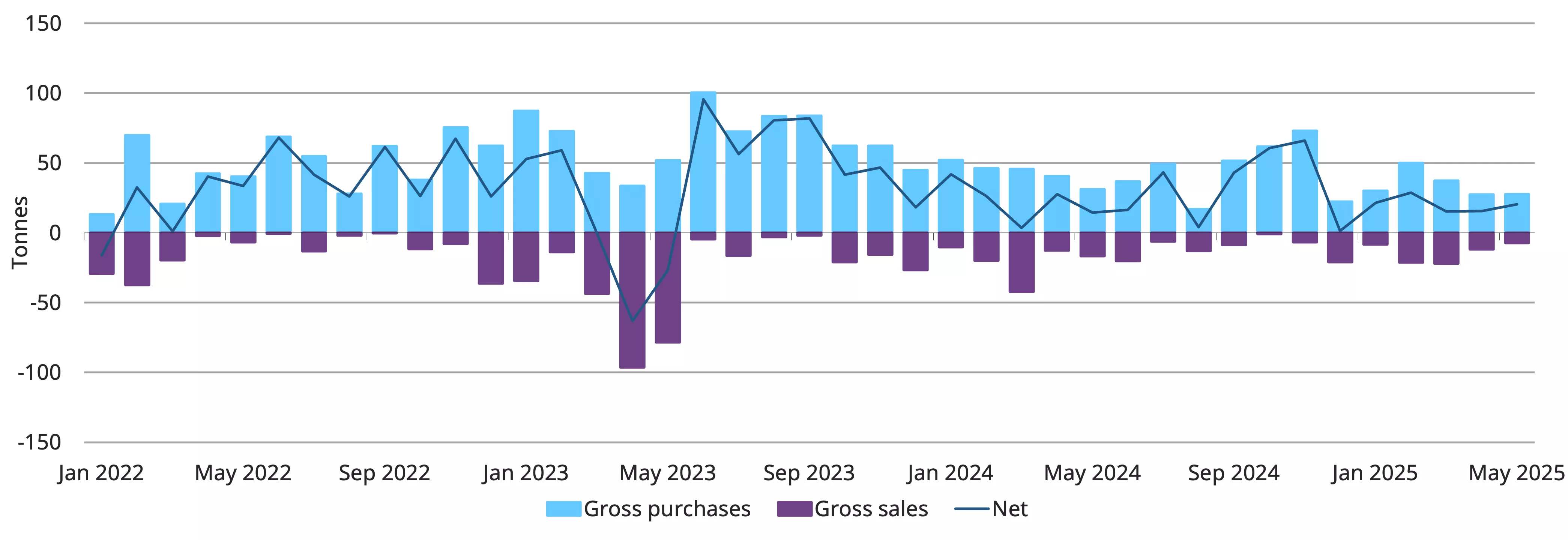

Global central banks bought a net 20t in May based on reported data, close to but still below the 12-month average of 27t (Chart 1).1 Fresh tensions in the Middle East may have reinforced the strategic appeal of gold for central banks looking to safeguard reserves against geopolitical shocks. This continued interest in gold was also highlighted in our recently released Central Bank Gold Reserves Survey 2025. Gold remains a focus for central banks worldwide with 95% of respondents believing that official gold reserves will continue to increase, up from 81% last year. A record 43% of central bankers also indicated that their own gold reserves would rise over the next 12 months.

Chart 1: Central bank net purchases ticked up in May

*Data to 30 May 2025 where available.

Source: IMF, respective central banks, World Gold Council

Kazakhstan leads central bank gold purchases in May

In May, these central banks have reported changes (of 1t or more) to their gold reserves:

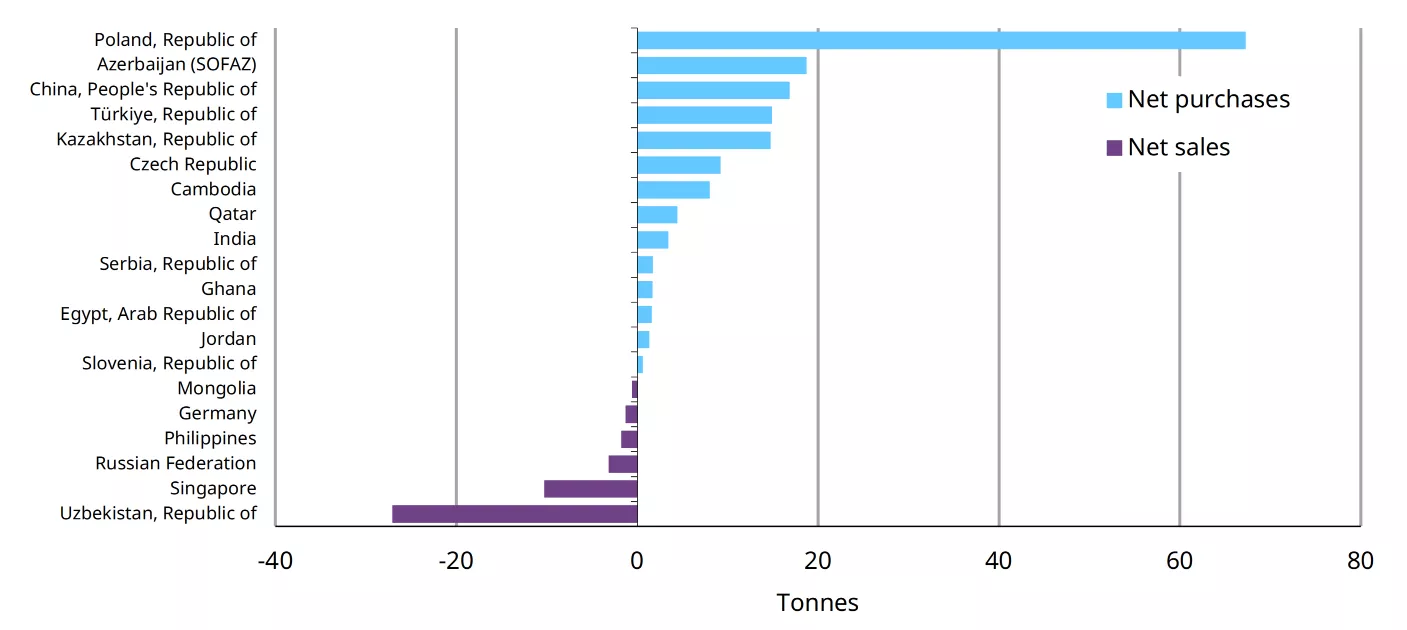

- National Bank of Kazakhstan (NBK) reported adding 7t of gold to their reserves in May, lifting them to 299t. Since the start of the year, NBK gold reserves have increased by 15t

- Central Bank of Turkey reported 6t of gold purchases this month, lifting their y-t-d gold accumulation to 15t

- National Bank of Poland also added 6t of gold to their reserves in May; the NBP remains the largest net purchaser of gold in 2025, adding 67t

- People’s Bank of China and Czech National Bank both added 2t of gold respectively this month, followed by three other central banks which added 1t of gold each this month: National Bank of the Kyrgyz Republic, National Bank of Cambodia, the Central Bank of the Philippines and the Bank of Ghana

- The Monetary Authority of Singapore led sales this month with 5t, followed by Central Bank of the Republic of Uzbekistan and the Deutsche Bundesbank, each sold 1t of gold this month.2 On a y-t-d basis, Uzbekistan remains the largest net seller (27t) followed by Singapore (10t) (Chart 2)

- Updated data for April 2025 also showed that the Qatar Central Bank purchased 2t of gold, bringing global net purchases that month to 16t.

Chart 2: Central banks continue their broad accumulation of gold in 2025

Y-t-d central bank net purchases and sales, tonnes*

*Data to 30 May 2025 where available. SOFAZ represents the gold reserves of the State Oil Fund of Azerbaijan (SOFAZ).

Source: IMF, respective central banks, World Gold Council

Central banks continue to hold favourable expectations on gold

Our recently released Central Bank Gold Reserves Survey 2025 reinforces gold’s relevance to the central bankers worldwide, with key insights highlighted below:

Record participation and growing engagement

a. A record 73 central banks participated in our survey reflecting continued interest in gold as a strategic reserve asset

Accelerated accumulation trends

a. Over the past three years, central banks have purchased more than 1000t of gold annually, compared to just 400t-500t per year in the prior decade

Optimism towards gold holdings

a. 95% of respondents expect global central-bank gold reserves to rise in the next 12 months

b. 43% anticipate an increase in their own holdings – up from 29% in 2024 – a record high; EMDE banks show stronger intent than advanced economies

Structural shift in reserve portfolios

a. 76% project gold will constitute a moderately or significantly higher share of total reserves over five years (up from 69%)

b. 73% expect a reduced share of US dollar reserves in the same period

Enhanced active management

a. 44% now actively manage gold separately (up from 37% in 2024)

Footnotes

1Average monthly net purchases between May 2024 and April 2025.

2The Bundesbank sale is likely related to its longstanding coin-minting programme.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.