Central bank gold buying slowed in April

3 June, 2025

- Central banks added a net 12t to global gold reserves in April, the second consecutive month of slower accumulation

- The National Bank of Poland remains the leading buyer, both in April and year-to-date

- The Reserve Bank of India gave an update on where its gold is stored, while several African central banks look to add gold.

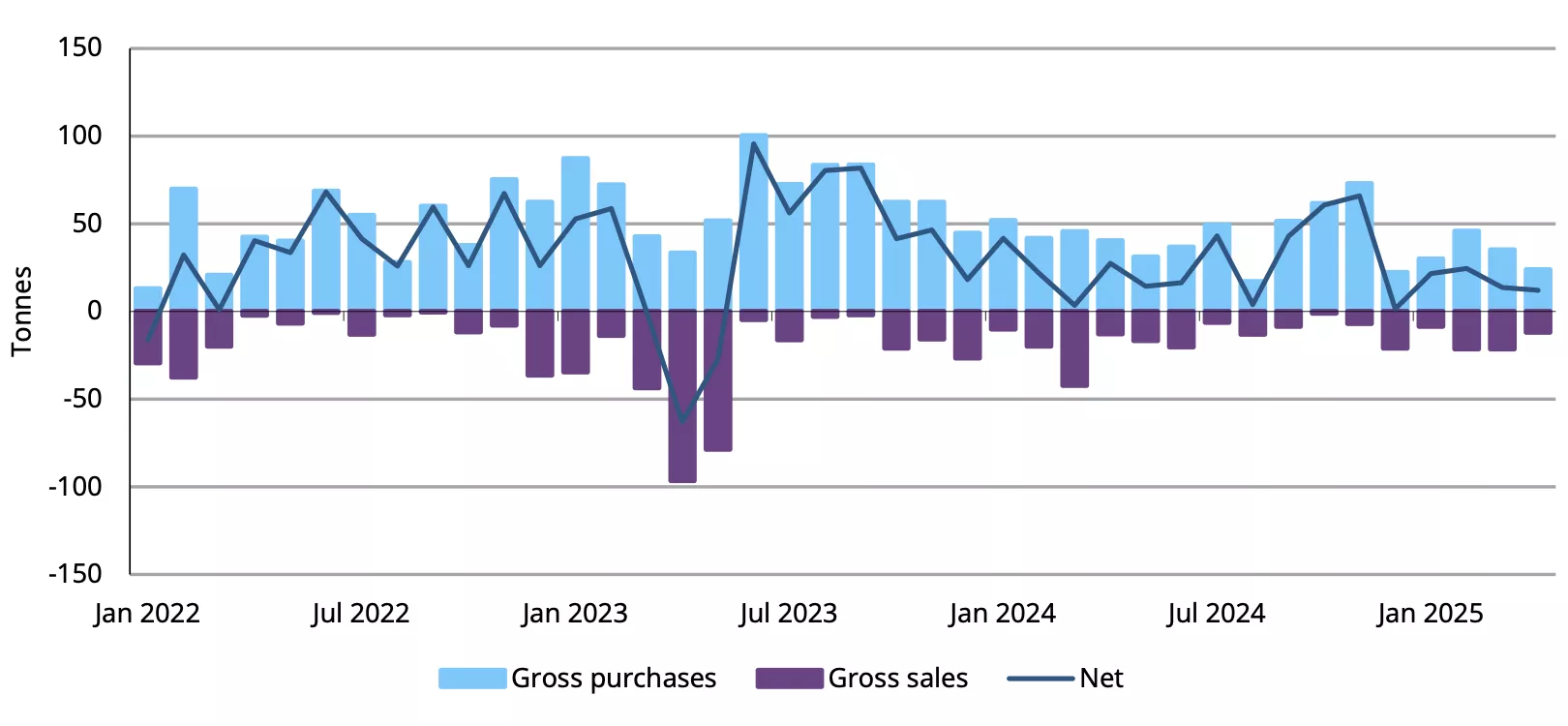

Global central banks bought a net 12t in April based on reported data, 12% lower than the previous month and below the 12-month average of 28t (Chart 1).1

What could be behind this recent decline in monthly purchases? It may, in part, be a response to the rapid appreciation in the gold price since the start of the year. While the rally to multiple new record highs is unlikely to deter central banks from buying gold – as they tend to be more strategic in nature – it could explain some of the deceleration in the pace of monthly net buying.

Chart 1: Central bank net purchases slowed in April for the second consecutive month

Monthly reported central bank activity, tonnes*

*Data to 30 April 2025 where available.

Source: IMF, respective central banks, World Gold Council

As the chart above shows, the data series are very volatile, meaning that activity in one month is not necessarily an indication of activity in subsequent months. What’s more, data can be released with, at times, a significant lag. As such, we caution against reading too much into this recent slowdown in reported purchases. And while higher prices may have pushed up gold allocations in some central bank portfolios, possibly closer to targets, we still expect overall buying to continue, given that the economic and geopolitical outlook remains highly uncertain.

Poland leads central bank gold purchases in April

In April, five central banks have reported changes (of 1t or more) to their gold reserves:

- National Bank of Poland (NBP) continued to be the largest buyer of gold amongst central banks. In April, the NBP added a further 12t to its gold reserves, lifting them to 509t, higher than gold reserves at the European Central Bank (507t). Since the start of the year, NBP gold reserves have increased by 61t, two-thirds of the 90t they added in 2024

- Czech National Bank reported that it had increased its gold reserves by a further 3t in April. It has now added gold for 26 consecutive months, over which time it has bought a total of 47t. Total gold holdings were nearly 59t at the end of April

- People's Bank of China data shows that its gold reserves increased by 2t in April - the sixth consecutive month of purchases. Y-t-d net purchases now total 15t, helping to lift gold reserves to 2,294t

- Central Bank of Turkey (Türkiye) reported a 2t increase in official (central bank + Treasury) gold holdings during the month, pushing gold holdings to 626t

- National Bank of the Kyrgyz Republic gold reserves rose by 2t in April, marking its first monthly net purchase since December. Y-t-d the bank is a net seller of 2t, with total gold holdings at 37t.

- National Bank of Kazakhstan added 1t to its gold reserves, nudging total gold held to 291t, 7t higher than at the end of 2024

- Central Bank of Jordan increased its gold reserves by almost 1t, to 73t

- Central Bank of Uzbekistan gold reserves fell by 11t in April, the third consecutive month of sales around that level. Y-t-d total gold holdings have fallen by 26t, to 356t.

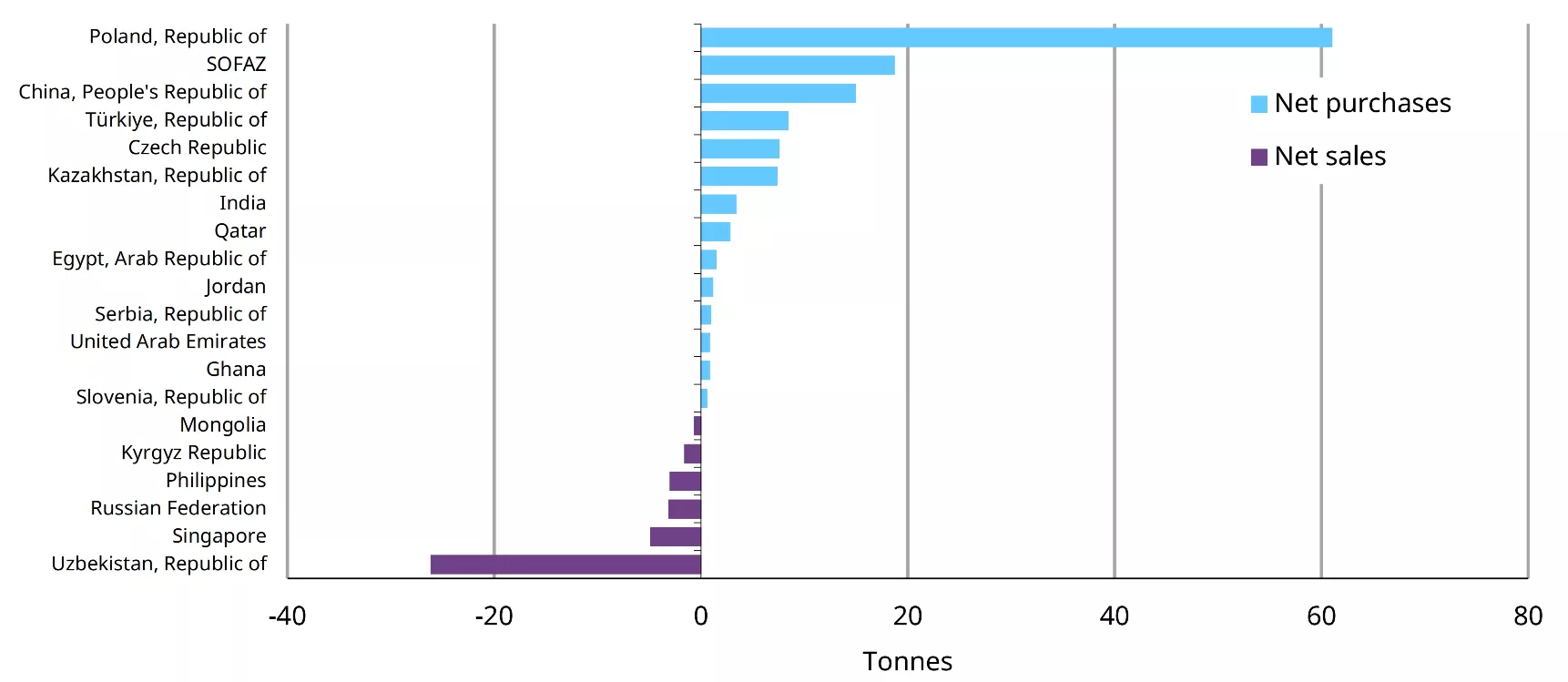

On a y-t-d basis, central bank buying continues to be broad based, although confined to emerging markets and dominated by the National Bank of Poland (Chart 2). By comparison, sales are less widespread, but similarly dominated by a single bank.

Chart 2: Central banks continue their broad accumulation of gold in 2025

Y-t-d central bank net purchases and sales, tonnes*

*Data to 30 April 2025 where available. SOFAZ represents the gold reserves of the State Oil Fund of Azerbaijan (SOFAZ)

Source: IMF, respective central banks, World Gold Council

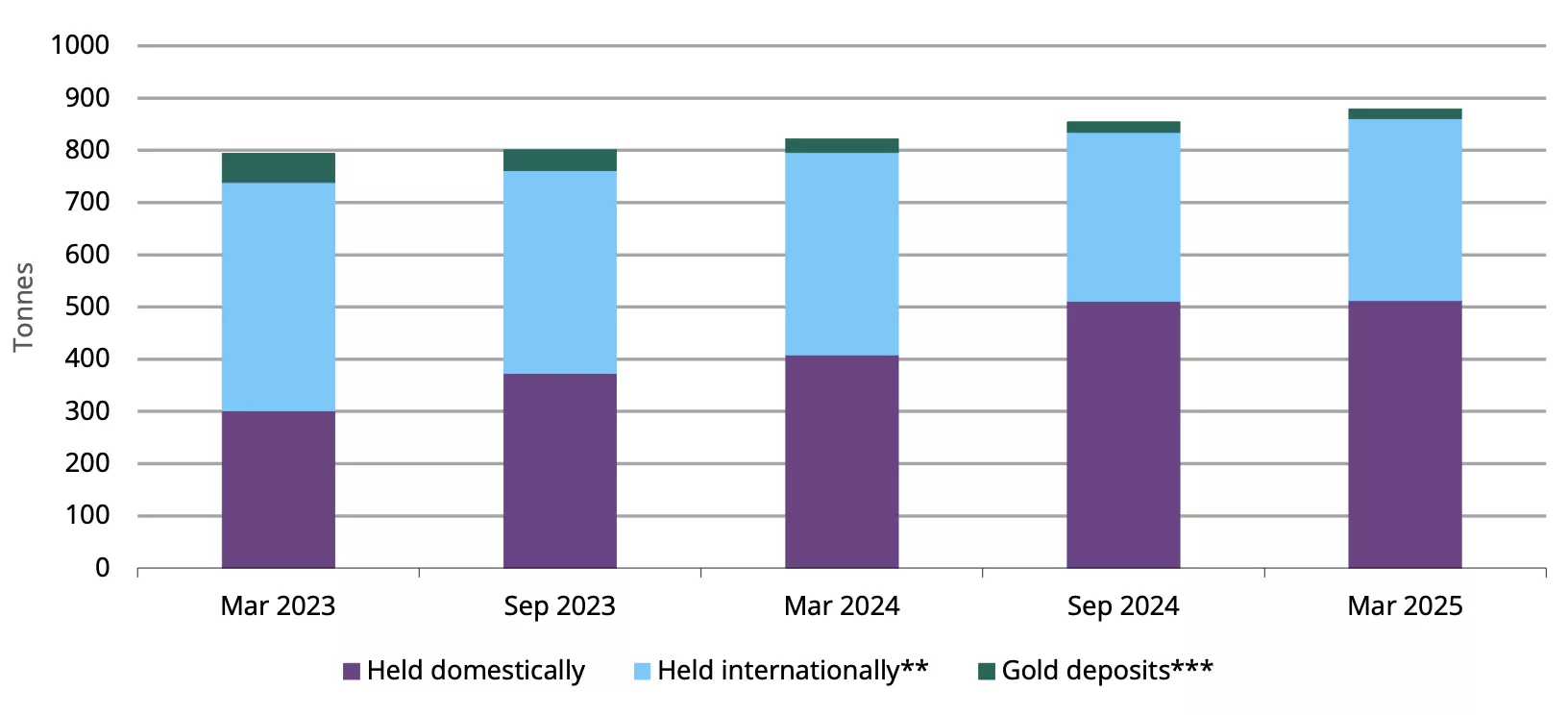

RBI maintains gold reserves and updates storage details

While the Reserve Bank of India (RBI) left its gold reserves unchanged at 880t in April, it did provide updated details on its reserves and where they are stored. In its half-yearly report the RBI stated that 512t (58%) was held domestically at the end of March, slightly higher on a tonnage basis (510t) but lower on a percentage basis (60%) compared to six months earlier (Chart 3). The RBI has made significant efforts in recent years to store a higher proportion of its gold reserves domestically – just two years ago it reported that only 38% of its gold reserves were held in India.

Chart 3: The RBI now holds almost two-thirds of gold reserves domestically

Semi-annual RBI gold holdings broken down by storage location, tonnes*

*Data to 31 March 2025.

**Gold held at the Bank of England and Bank of International Settlements.

***Gold held in the form of a financial instruments on which the RBI earns interest.

Source: Reserve Bank of India, World Gold Council

African banks plan on boosting gold reserves

At the start of May the Bank of Namibia announced plans to accumulate gold with the aim of increasing it to 3% of total reserves. The bank stated that this “aligns with global central banking trends, given gold’s strategic value in hedging against inflation and enhancing resilience during economic shocks”.2 According to the latest available IMF data (March 2019) the Bank of Namibia held no gold reserves.

The National Bank of Rwanda also announced during the month that it intends to build gold reserves. Governor Soraya Hakuziyaremye stated: “Similar to our peers, the central bank of Rwanda is conducting a study to see whether gold can be embraced as an additional asset that we can invest in given its ability to counter shocks on financial markets and as a hedging option in terms of external shocks”. The central bank has approved gold additions, starting from its new fiscal year in July.

Also in May, Bank of Uganda Govenor, Michael Atingi-Ego, told Bloomberg TV that the bank would be diversifying its reserves with gold sourced from artisanal miners. The aim was to use this gold accumulation to deal with maturing (cross currency) repos.

A statement from the Central Bank of Madagascar indicated that it will acquire 4t of gold as part of a plan to boost reserves and formalise gold exports.3

Elsewhere, Central Bank of Kenya Governor, Kamau Thugge, told Bloomberg TV in April that they are “actively considering” adding gold to their reserves for diversification purposes, although with no timeline as to when they might do so.4 As of March 2025 the bank held around 17kg of gold as part of its reserves, based on data reported to the IMF.

Footnotes

1Average monthly net purchases between April 2024 and March 2025.

2Namibia Joins Central Banks’ Gold Rush to Hedge Against Shocks, Bloomberg, May 2025

3Appel A Manifestation D’Interet Aux Operateurs Auriferes Candidats A L’Obtention D’Un Agrement De Comptoir De L’Or, Central Bank of Madagascar, May 2025

4Kenya Central Bank is ‘Actively Considering’ Buying Gold, Live Mint, April 2025

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.