India's gold market update: Gains hold despite demand pressure

19 May, 2025

Highlights

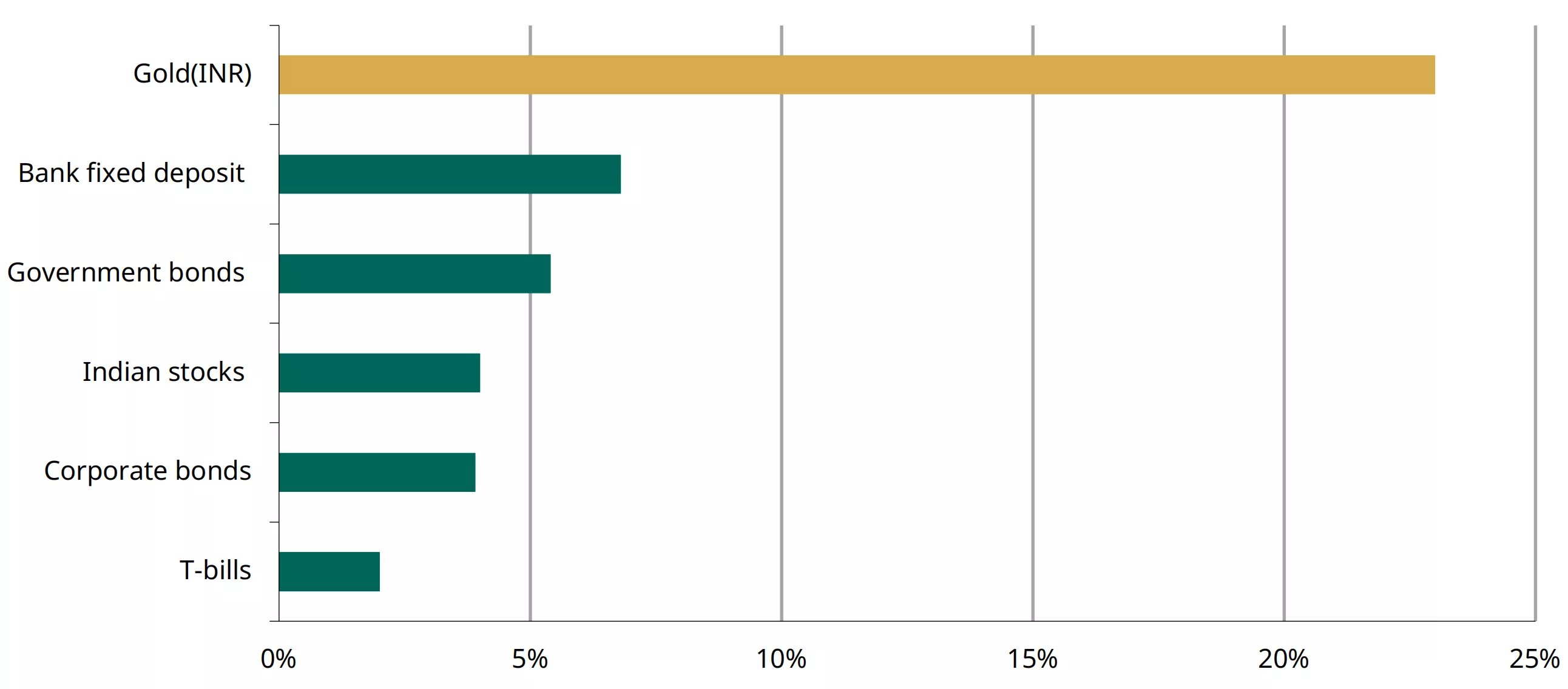

- Gold’s surge softens, yet y-t-d gains of 23% outperform other assets

- Gold demand remains soft overall; festival shows mixed response

- Heavy redemptions hit gold ETFs in April; AUM and investor base expands

- RBIs gold purchases slow amid record gold reserves

- Gold imports in April withstand price surge, demonstrating resilience.

Looking ahead

- Stability in prices could prompt a resurgence in demand. Consumer sentiment that the downside to gold prices is limited would reinforce gold’s appeal as a reliable investment.

Gold rallies to historic highs, then recedes

Gold’s momentum accelerated in April, surging to a record high of US$3,500/oz and marking its fourth consecutive month of gains, with a 6% increase. The speed and sharp rise were fuelled by a weakening US dollar, heightened geopolitical and economic uncertainties, and strong inflows into global gold ETFs. However, prices have since retreated, with the LBMA Gold PM price falling 8% so far in May.1 In India, domestic gold prices mirrored the global trend. Although, the May m-t-d correction was milder at 5%, cushioned by the appreciation of the Indian rupee.

Chart 1: Gold slides after four-month surge

Monthly LBMA Price PM and domestic spot price changes and movement*

*Based on the LBMA Gold Price PM in USD and MCX spot gold price as of 14 May 2025.

Source: Bloomberg, World Gold Council

So far in 20252 the LBMA gold price PM in USD has climbed by US$583/oz or 22%, to US$3,192/oz. The Indian domestic spot gold prices3 have also followed a similar trajectory, rising 23% y-t-d to INR93,407/10g. Despite the recent decline, gold outshines other major asset classes on a y-t-d basis (Chart 2).

Chart 2: Gold dominates other asset classes

% year-to-date returns in INR *

*Data as of 14 May 2025. Indices used MCX Gold Index, CRISIL Corporate Bond Index, Nifty Total Return Index, Clearing Corp of India Liquidity Weight T-Bill Index, ICE BofA govt bond index.

Source: Bloomberg, World Gold Council

Festive demand paints a mixed picture

Gold jewellery sales in India during April and early May remained subdued, except on the day of Akshaya Tritiya, due to high and volatile gold prices coupled with broader economic uncertainties. Anecdotal evidence suggests that consumers were deferring their purchases, waiting for price stability, or opting for lighter-weight jewellery to accommodate fixed budgets and need-based buying.

The festival of Akshaya Tritiya, which traditionally drives gold purchases, fell on 30 April this year. Overall demand during the festival was restrained and mixed as per market reports. While large and corporate retailers reported higher footfalls and sales – largely driven by aggressive promotional and marketing campaigns - small and independent jewellers experienced sharp declines in demand. The bullion segment, bars and coins, performed better than jewellery, with low weight coins (especially 5g) proving popular. These were bought as ‘token’ purchases for the festival, with a notable share of sales occurring through online and e-commerce platforms. This behaviour highlights a growing consumer shift towards organised players and investment-oriented gold products.

Regional trends also varied. The southern states recorded stronger sales compared to the other parts of the country, given the greater significance of Akshaya Tritiya is the region. This was followed by a moderate performance in the western parts of the country.

Despite a likely year-on-year decline in the volume of gold sold during Akshay Tritiya, the overall value of sales is expected to have increased, reflecting the nearly 30% rise in gold prices since last year. This indicates a degree of resilience in Indian gold demand.

Additionally, the exchange and recycling of old gold jewellery remained a prominent trend.

Gold ETFs see heavy redemptions, but AUM and investor accounts continue to grow

For the second month in a row, Indian gold ETFs recorded net outflows in April. According to data from the Association of Mutual Funds in India (AMFI), redemptions hit a record high of INR 16.69bn (US$195mn) in April, suggesting profit-taking with gold prices touching fresh record highs during the month.

The momentum of inflows into Indian gold ETFs has slowed significantly since the strong activity seen in January and February. The gross inflows in April stood at INR16.63bn (US$194mn), marking a 50% decline from the average of the first two months of the year. Anecdotal reports suggests that elevated and volatile gold prices have kept many investors on the sidelines. Nevertheless, inflows in April were 58% higher than in March, partially offsetting the impact of the high redemptions. As a result, net outflows in April narrowed to INR0.06bn (US$0.7mn) from INR0.8bn (USD8.9mn) in March. These figures differ from our initial estimates, which were based on preliminary and partial data.4

Notwithstanding the net outflows, the cumulative assets under management (AUM) of gold ETFs rose to INR614bn (~US$7.2bn), up 4% m/m and 87% y/y, aided by the high gold prices. However, collective gold holdings across the 20 gold ETFs declined marginally by 0.07t from a month ago to 64.4t.

Investor interest in this asset class was upheld with 0.18mn new investor accounts (or folios) added during the month. This brought the total number of gold ETF investor accounts to a record 7.1mn.

Chart 3: Gold ETF outflows persist, though at a reduced pace

Monthly gold ETF fund flows in INRbn, and total holdings in tonnes*

*As of end April 2025.

Source: AMFI, ICRA Analytics, CMIE, World Gold Council

RBI’s gold purchases slow; domestic holdings rise

So far this year, the Reserve Bank of India (RBI) has scaled back its gold purchases after the significant additions made in 2024 (73t). In the first four months of 2025, it added a more modest 3.4t, compared to 24.1t during the same period last year. Even so, the RBI’s gold reserves remain at a historic high of 879.6t as of end April-unchanged from the previous month. In value terms, gold now makes up 12% (US$81.8bn) of India’s total forex reserves, marking a 4% increase from a year ago and the highest share on record. This underscores the growing strategic importance of gold in the management of forex reserves.

The RBI's approach to managing its gold reserves continues to evolve. As of March 2025, 58% of its gold – about 512t – is reportedly held domestically, up from 38% in March 2023. The remaining 40% (349t) is stored with international institutions such as the Bank of England and the Bank for International Settlements. Since September, 1.52t have been added to the domestic holdings, while 25t were added to the international holdings.

Chart 4: RBI’s gold stock holds steady at record levels

RBI’s monthly net purchase and reserves, tonnes *

*As of 2 May 2025.

Source: RBI, World Gold Council

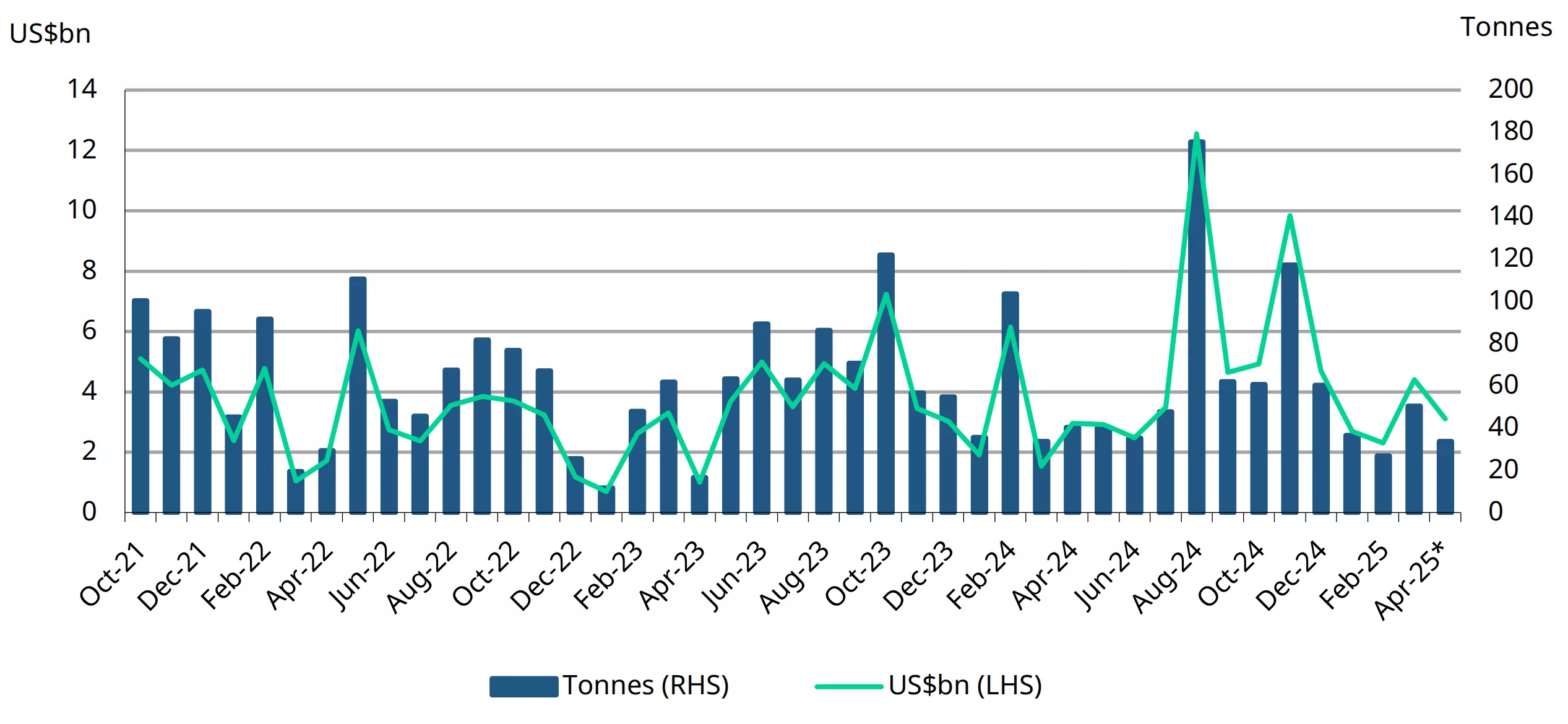

Imports resilient amid price headwinds

Notwithstanding the surge in prices to unprecedented levels, gold imports in April remained modest but resilient.

Imports stood at US$3.1bn – nearly a third lower than March but above the January – February average of US$2.5 bn and 5% higher year-on-year, according to Ministry of Commerce data. This points to continued underlying demand, even in a high-price environment, given that gold imports into the country are on consignment basis by nominated banks and agencies. Based on our estimates, import volumes for the month were in the range of 30t – 36t, down from 51t in March and 40t a year ago.

Chart 5: Gold imports show resilience

Monthly gold imports in tonnes and US$bn*

*Includes World Gold Council estimates.

Source: Ministry of Commerce and Industry, CMIE, World Gold Council

Footnotes

1As of 14 May 2025.

2As of 14 May 2025.

3MCX spot gold price.

4Our initial estimate based on partial information available at the time was inflows of US$182mn.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.