- Central banks added 39 tonnes (t) to global gold reserves in January

- Turkey and China again led the charge among buyers, while significant sales were virtually non-existent

- The themes underpinning central bank demand remain in play, and have in some cases intensified, likely keeping central bank demand well supported in 2024.

Our Full Year 2023 Gold Demand Trends report – published in January – confirmed another stellar year for central bank gold demand. While it fell slightly short of the annual record set in 2022, it was close. This generated even more attention as central bank gold demand has become a key support for gold.

Naturally, the focus has been not only on what has happened but also on what is to come. Will central banks continue to buy gold, and if so why and how much?

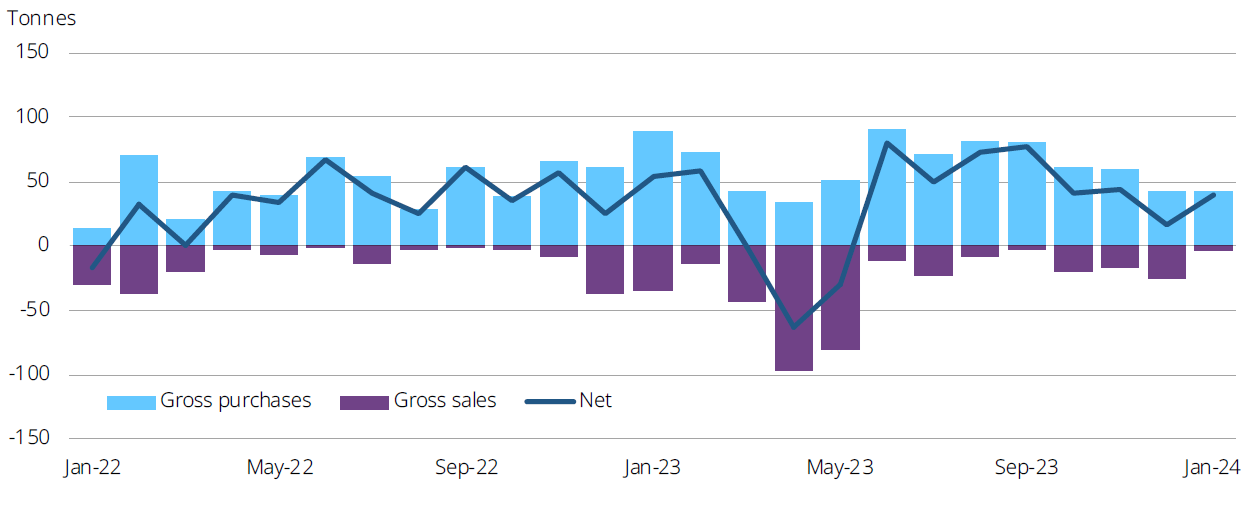

On the first and last of these questions, we have the beginnings of an answer. In January, central banks reported that they increased global official gold reserves by 39t. This was more than double the (revised) December net purchases of 17t, and the eighth consecutive month of net purchases.1

Central banks have now bought gold for eight consecutive months*

Six central banks increased their gold reserves (of a tonne or more) during the month; all six have been regular buyers of late:

- The Central Bank of Turkey was the largest buyer, increasing official gold holdings by 12t.2 This helped lift total gold holdings to 552 tonnes, just 6% off the all-time high of 587 tonnes back in February 2023

- Gold reserves at the People’s Bank of China rose by 10t – the 15th consecutive month of additions. Total gold holdings now stand at 2,245t, nearly 300t higher than at the end of October 2022 when the bank resumed reporting gold purchases

- The Reserve Bank of India added nearly 9t. This is the first monthly increase in its gold reserves since October 2023 and the largest since July 2022; its gold holdings now total 812t

- The National Bank of Kazakhstan bought 6t of gold, the first monthly addition since January 2023

- The Central Bank of Jordan bought 3t in January, the second consecutive month of additions, lifting total gold holdings to 75t

- The Czech National Bank added nearly 2t – the eleventh consecutive month of buying. Over that period gold reserves have surged from 12t to more than 32t (+170%).

Reported selling was limited in January, the only noteworthy sale coming from the Central Bank of Russia (CBR). Gold reserves at the CBR declined by 3t in a continuation of a pattern that has been in place since 2021: frequent 3t declines that are subsequently replenished. We believe this activity is related to the country’s coin minting programme.

January’s buying also lends support to our expectation that 2024 will be another solid year of central bank gold demand. Central banks, particularly those in emerging markets, have shown since 2010 that they have a long-term strategy towards gold accumulation.

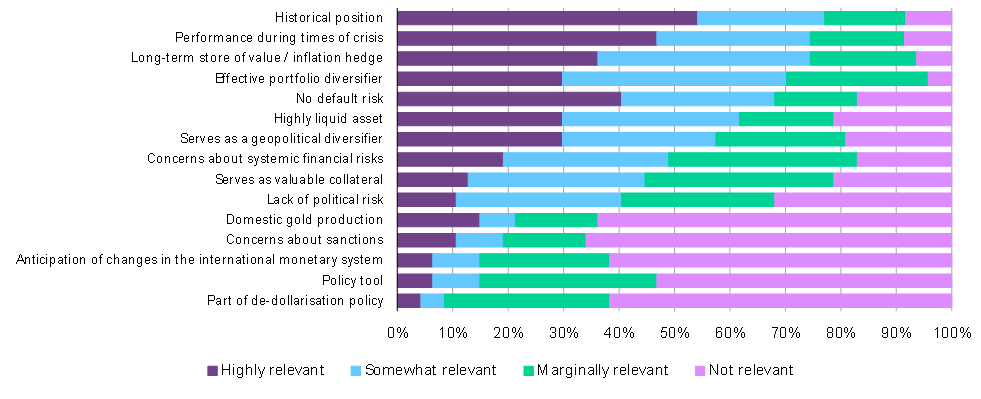

As for why central banks are continuing to add gold to their reserves, our Central Bank Gold Survey remains instructive. Last year central banks placed great emphasis on gold’s value in crisis response, diversification attributes and store-of-value credentials. A few months into 2024 the world seems no less uncertain meaning those reasons for owning gold are as relevant as ever.

How relevant are the following factors in your organisation’s decision to hold gold?