Highlights:

- After setting a record close in 2023, gold prices retreated and ended January 1.2% down at US$2,053/oz.1 The strong US dollar, high bond yields and fund outflows from global ETFs were contributing factors.

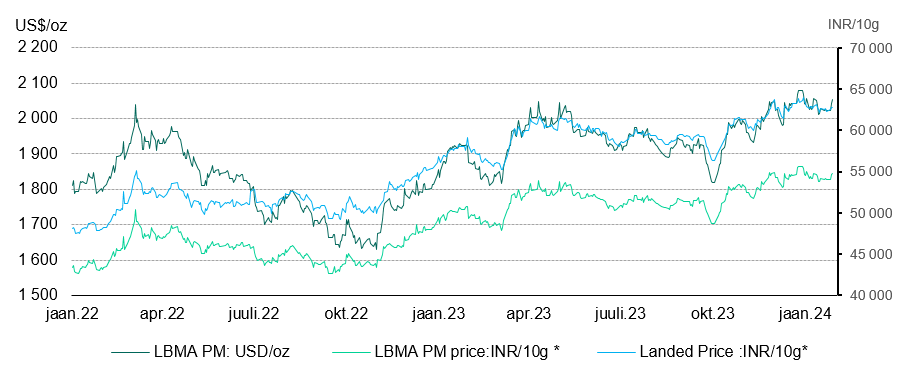

- Domestic Indian price of gold saw a similar decline to international prices owing to the relative stability of the domestic currency. Notwithstanding the moderation, the landed price of gold hovered around INR62,600/10g.2

- The domestic gold price began to trade at a premium relative to international price in late January, following nearly three months of trading at a discount.

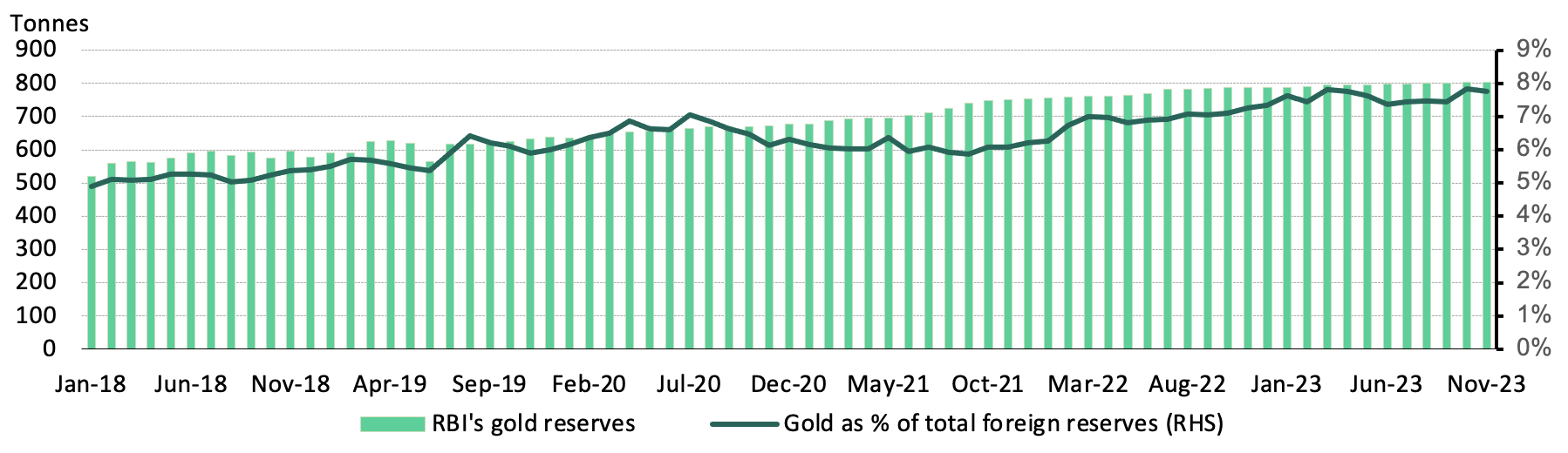

- The RBI made the highest monthly gold purchase in eighteen months in January following two months of pause in buying.

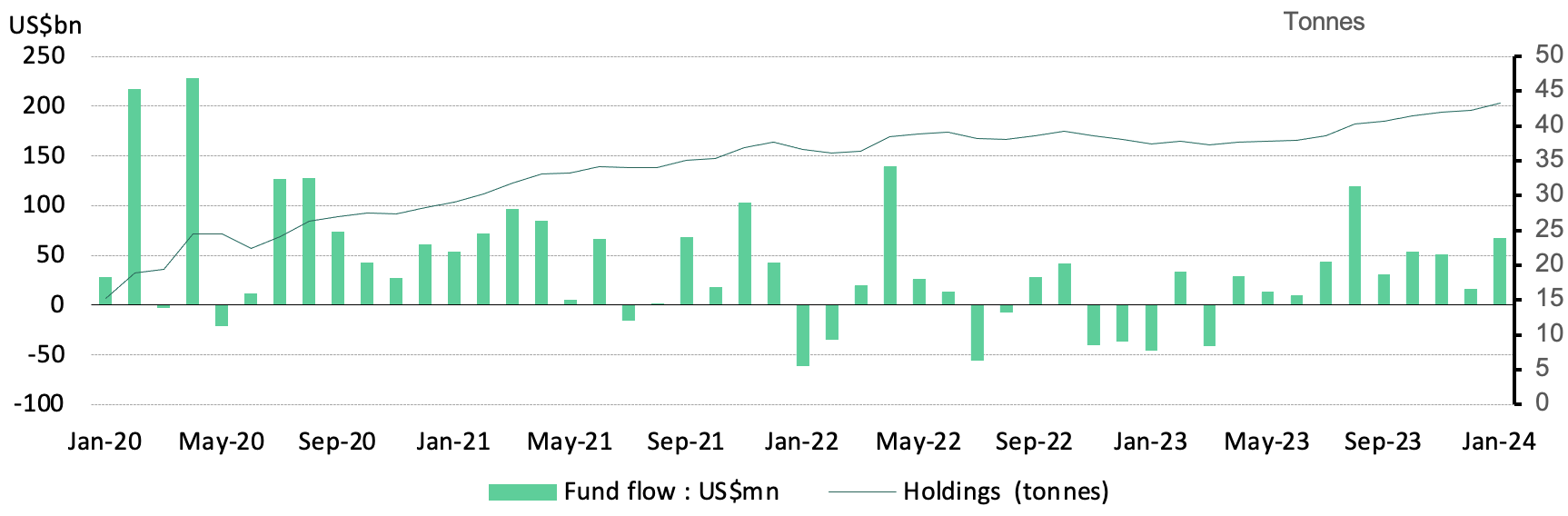

- Indian gold ETFs have seen consistent inflows for the last 10 months. January saw US$66.7mn (Rs6.5bn) in net inflows – the highest since August.

- Gold imports both in value and volume terms have moderated following the spike in October weighed down by high prices and soft demand for gold jewellery.

Looking ahead

- Gold jewellery demand is likely to remain subdued for the next couple of months. A pickup in demand in the near term could be gradual and limited in the absence of a significant drop in price levels. Moreover, this period (February - March) is traditionally a lean period for jewellery sales.

- At the same time, investment demand, which accounts for a quarter of consumption demand, is likely to fare better. The prevailing global geopolitical and economic uncertainty, favourable domestic economic prospects and growing investment inflows into the domestic financial markets could support investment demand for gold.

Gold price moderates but stays range bound

After a record annual closing, international gold prices ended January 1.2% down at US$2,053/oz. The domestic landed price witnessed a similar decline, as a strong rupee offset the impact of US dollar appreciation against major currencies. Domestic gold prices nevertheless have been range bound and stayed around the levels of INR62,600/oz.

The strong US dollar, high bond yields and fund outflows from global ETFs have been contributing factors that weighed on international gold prices. To add to this, expectations of early monetary policy easing were scaled down. At the same time, the prevailing uncertainties and concerns over geopolitical stability, political scenario in various countries on account of elections and volatility in the equity markets has been sustaining investor interest in gold limiting its fall.

Chart 1: Gold retreats in January

LBMA price and domestic landed price by month, US$ and INR *

India’s economy: strong footing

India’s economic growth has been stronger than expected, driven by higher public investment and domestic demand. GDP growth for FY24 has been forecast by the National Statistics Office at a healthy 7.3%. This growth momentum is expected to continue in the coming financial year too (RBI projection of 7% growth in FY25). Consumption has been led by urban demand which is supported by growing income levels and affluence. The agriculture sector despite being faced with unfavourable weather has seen higher activity and is expected to support rural demand. High frequency economic indicators have been seeing a consistent expansion/growth.3

With the general election due in April-May, the government announced an interim budget for FY25 in which tax policies were left unchanged, capital expenditure was raised by 11% and the fiscal deficit was reduced to 5.1% of GDP from 5.8% in the ongoing fiscal year. The gross market borrowings are reduced to Rs14.13 lakh crore (US$ 170.4 bn) from Rs15.43 lakh crore in FY24. The proposed lower market borrowings have led to a sharp drop in yields on government securities. The lower yields and resultant lower cost of credit in the system bodes well for economic growth and consumption.

The domestic gold market: high prices lead subdued demand in the near term

Still high prices have been impacting jewellery demand. Anecdotal evidence suggests gold consumer demand has been weak and jewellers are currently trying to reduce stock.

Indian gold jewellery demand is likely to be subdued in the absence of a significant drop in price levels: retailers are not optimistic for any meaningful return in demand over the next couple of months in the absence of a price correction. Moreover, wedding jewellery demand is likely to be tempered given the fewer number of auspicious wedding days in Q1 (16 versus 28 in Q1 2023). A gradual return in retail jewellery demand is expected in early May around the time of Akshaya Tritiya, which is a traditionally considered to be an auspicious period to buy gold. Jewellers too are expected to start accumulating stock ahead of this period.

At the same time, investment demand for gold is likely to get a boost, supported by the favourable domestic economic growth prospects and the trend of growing domestic investment inflows amidst the prevailing global geopolitical and economic uncertainty.

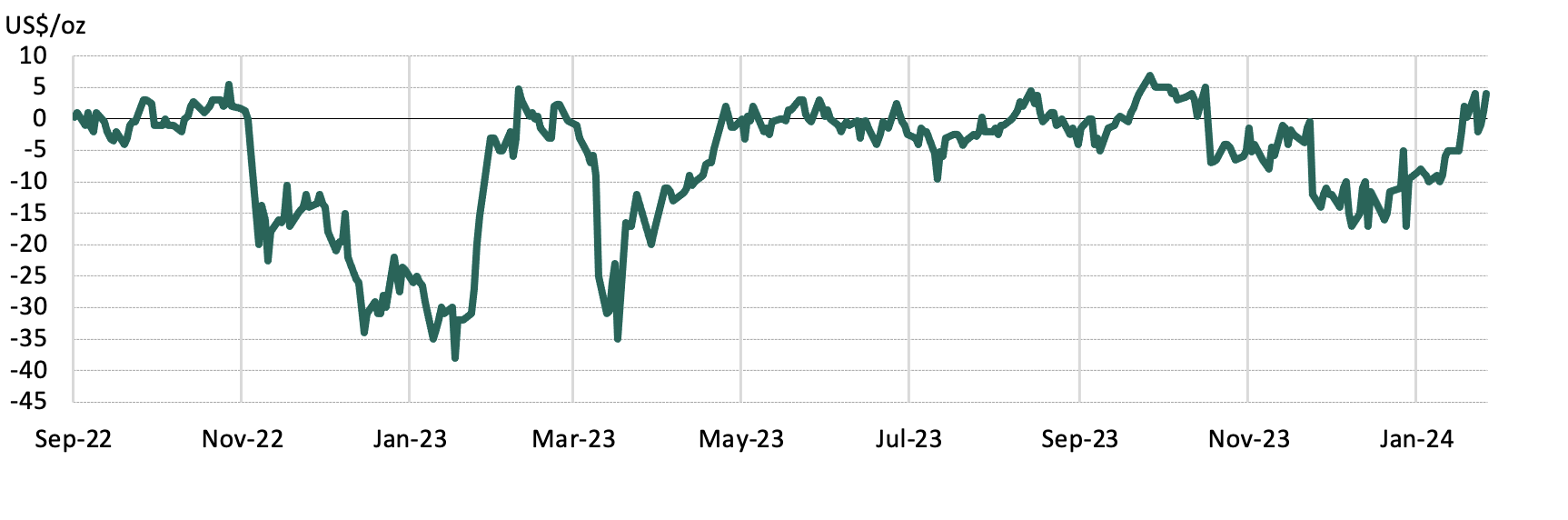

Gold prices in the domestic market move from discount to premium

After nearly three months, domestic prices have moved from a discount to premium relative to international prices since the fourth week of January. The premium compiled by NCDEX has ranged from US$0.25/oz to US$4/oz since then.4 This could in large part be attributed to the changes in supply-demand dynamics brought about by the increase in customs duty on gold findings and many domestic bullion refiners curtailing/stopping gold doré imports from the least developed countries (LDCs) at zero customs duty.5

The customs duty on gold findings was raised (on 23 January) from 10% to 15% (to align with the customs duty on gold bars). This move was aimed at eliminating the duty arbitrage used by some sections of trade that led to a surge in imports of gold findings in recent months. The resultant gold supply amid subdued jewellery demand in turn saw domestic gold prices trading at a discount to international prices. According to reported data,6 gold findings or parts imports during January-November 2023 soared to 6t compared with the imports of 0.98t a year ago. Another contributing factor to the premium is the lower imports from LDCs after the government instructed refiners to submit their original licenses for restricted imports (at zero customs duty) from these countries.

Chart 2: Domestic gold prices are now trading at a premium

NCDEX gold premium relative to the international price*

India gold ETFs: consistent inflows

Indian gold ETFs have been recording inflows since April 2023. January saw the highest net fund inflows in five months at US$66.7mn. In 2023, these funds recorded net inflows of US$309mn (Rs29bn), a more than ninefold increase from the net inflows of US$33mn (Rs4.5bn) a year ago, reflecting the growing investor interest in gold as a financial asset. As of end January, the assets under management (AUM) of Indian gold ETFs stood at Rs Rs277.78bn (US$3.3bn, 27% y/y) with 43.3t of holdings, a 15% y/y rise.

The surge in gold prices, growing appetite for tradeable financial products, increase in capital market investments and need for diversification, geo-political tensions, currency weakness and economic uncertainties have been fuelling the flows into gold ETFs.

The last twelve months saw the launch of five gold ETFs, two of which were in November and one last month. This takes the tally of India’s gold ETFs to 16. The introduction of the new gold ETFs is evidence of the potential for this segment. Corporates account for the largest share of gold ETF AUMs (55%), followed by high networth individuals (34%). The retail segment has a share of 11%. In terms of folios, retail makes up about 99% of the total folios.7

Chart 3: Indian gold ETF holding boosted by consistent inflows since Q1 2023

Monthly Gold ETF fund flows, US$bn, and total holdings, tonnes*

RBI resumes addition to reserves

After a gap of two months, the RBI added to its holding of gold reserves in January. RBI data and our estimates indicate that the central bank was a net buyer of 8.7t of gold during the month, making it the highest monthly purchase in eighteen months.8 This takes the RBI gold holdings to an all-time high of 812.3t as of end-January.9

The RBI’s net gold buying in 2023 at 16.2t was notably lower than the previous years wherein the annual net gold purchases by the central bank averaged 47t (2018 to 2022). Despite the lower purchase in 2023, the RBI was the sixth largest buyer of gold among central banks during the year, according to reported data. As a percentage of forex reserves, gold accounts for 7.7% as at the end of January, marginally higher than the 7.6% share one year ago.

Chart 4: RBI steadily adds to gold reserves

RBI’s monthly gold reserves, tonnes and as % of total reserves *

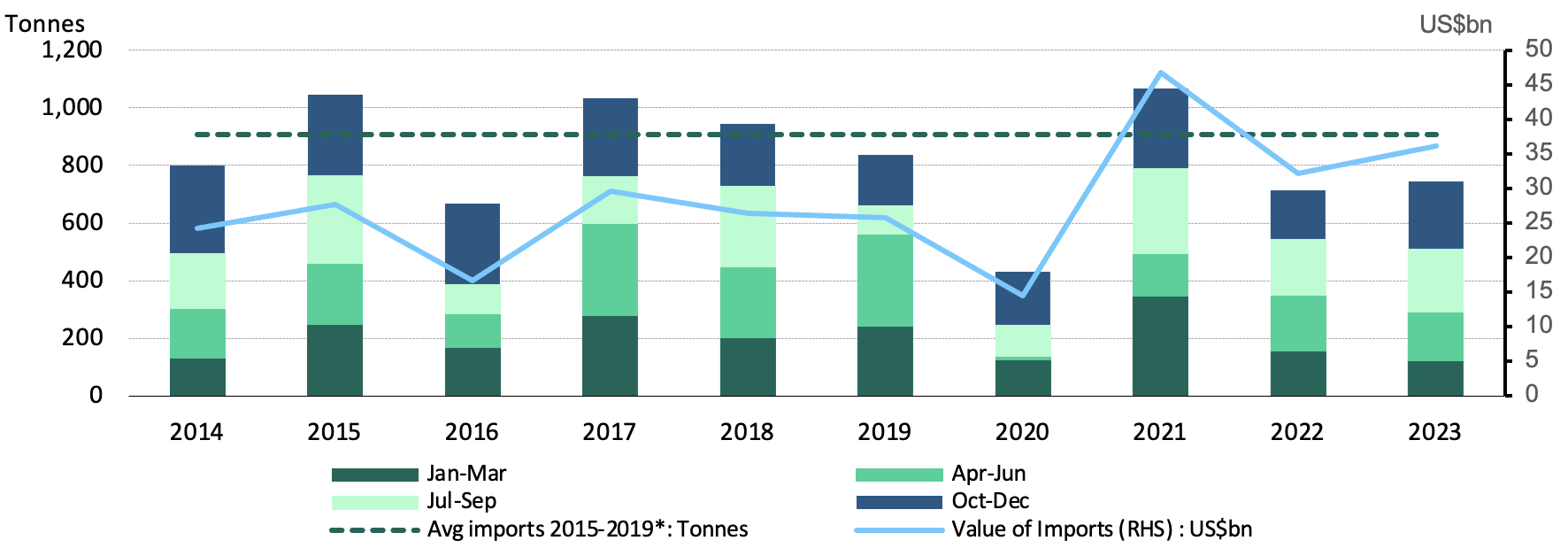

Decline in gold imports

Weighed down by high prices and soft demand, the gold import momentum at the start of Q4 has not been sustained. Following the October peak of 121t/US$7.23bn, gold imports both in volume and value terms declined in November and December. November's imports were almost half of the previous month's (US$3.5 billion/57t), and they fell even further to US$3 billion/55t in December.

Gold imports saw considerable fluctuations in 2023. Monthly import volumes during the year varied between 11t to 121t. However, despite the lower imports in H1 2023 (-17% y/y), the cumulative imports for the year were higher (4% y/y at 742t/ 16% y/y at US$42.6bn) in part owing to the substantial imports in October.

Although the amount of gold imported has decreased over the past two years, the value of imports has increased. The quantum of gold imports in the last two years has been 20% less than the pre-COVID five-year average (2015-2019) while in value terms, it has risen by 25%,10 due to the gains in the price of gold. Gold prices in 2022 and 2023 were 57% higher than in 2019.11

Chart 5: Gold imports stays below long term average

Quarterly and annual gold imports, tonnes and US$bn*

Footnotes

LBMA Gold Price PM as of 31 January 2024.

Landed gold price includes import tax but excludes GST.

PMI manufacturing/services, industrial output, electricity and energy consumption, goods movement, tax collections, vehicle sales among others.

Based on the NCDEX polled quotes of premium/discount of domestic gold price relative to international price. NCDEX polls gold importers, wholesalers etc for the premium/ discounts prevailing in the domestic market to arrive at the benchmark market premium/discount.

Gold findings or parts are small components such as hooks, clasps, clamps, pins, catches and screw back used to hold the whole or a part of a piece of jewellery in place.

Ministry of Commerce and Industry.

Folios are account numbers in a Mutual Fund Scheme, under which unit holdings in a mutual fund scheme are recorded in the Unit Holders’ Register.

RBI weekly statistical supplements.

Data to 2 February 2024

Average value of imports in 2022-2023 based on data from Ministry of Commerce and Industry and CMIE.

Average unit price (US$/kg) of import as published by the Ministry of Commerce and Industry for 2022 and 2023.