Summary

- Both the volatility and yields of Japanese Government Bonds (JGBs) rose, driven by intensifying expectations that the end of the Bank of Japan’s (BoJ) negative interest rate policy is nearing

- While JGBs remain a key strategic asset in local investors’ portfolios, we believe gold could be an effective supplement against the current backdrop

- Our analysis shows a 5% gold allocation could help improve the performance of a Japanese portfolio that invests in bonds and equities

Expectations for the end of the BoJ’s negative policy rate intensified

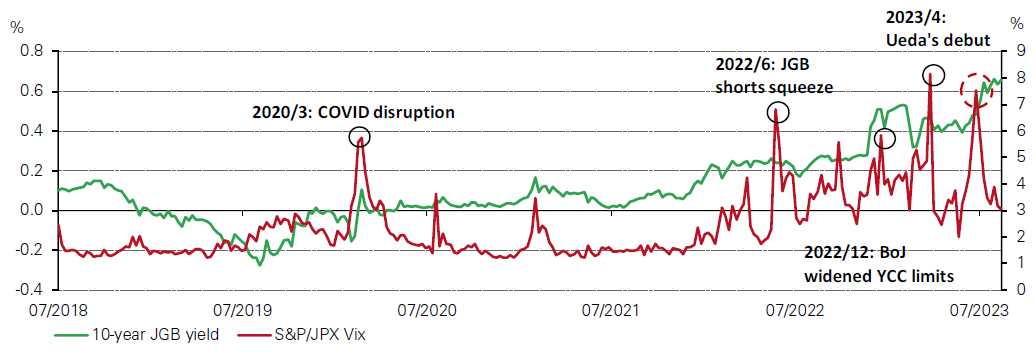

The BoJ relaxed its yield curve control (YCC) program in late July. Governor Ueda’s first surprise move since taking the wheel: he effectively doubled the YCC’s upper limit to 1%, while keeping the policy rate unchanged at -0.1%.1 This led to surges in both the 10-year JGB yield and its volatility (Chart 1).

Chart 1: JGBs are becoming more volatile*

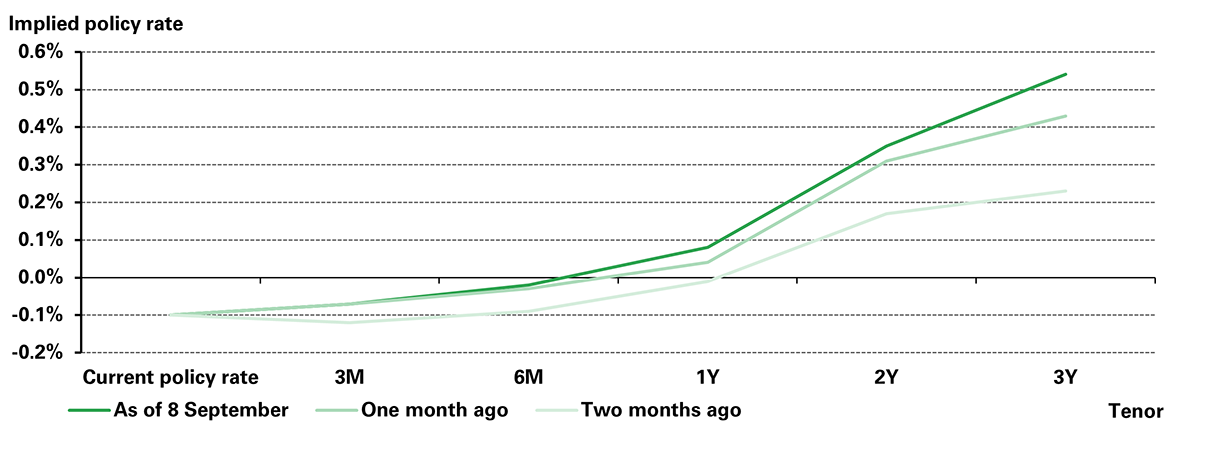

And last weekend, Ueda noted that should prices and wages continue to rise by the year-end, ending the BOJ’s negative interest rate policy is among the options available.2 As a result, the 10-year JGB yield soared and investors’ expectations of a pivot in the BOJ’s current ultra-easing monetary policy intensified (Chart2).

Chart 2: Investors’ policy rate expectation kept rising

Japanese OIS implied policy rate, 8 September vs 8 August vs 7 July

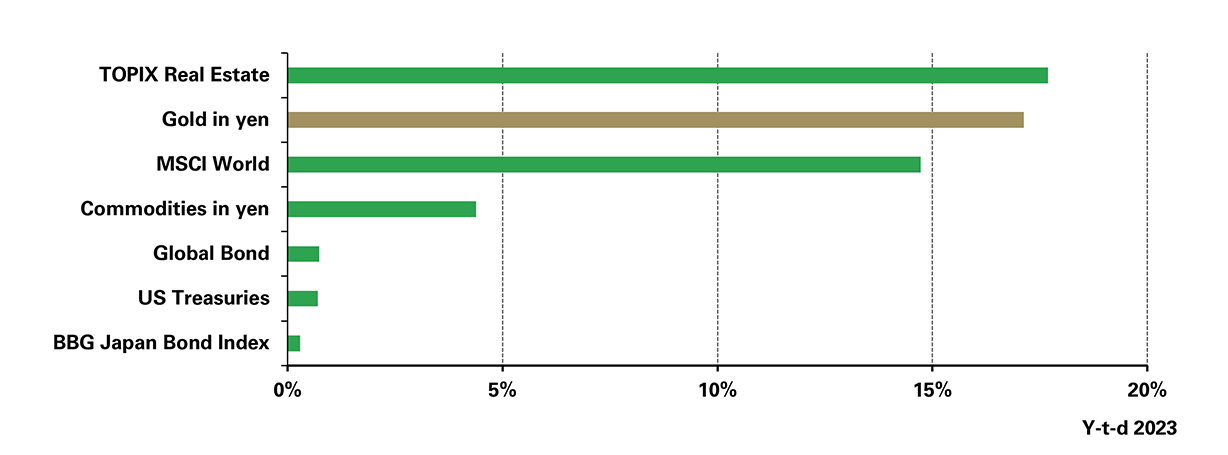

JGBs felt the pain. Surging JGB yields have suppressed their prices, leading to a lousy performance so far in 2023 (Chart 3). And during the recent three months, Japanese bonds’ weaknesses were far more apparent, suffering a decline of over 2%. With interest rates’ upside potential unlocking, JGBs’ downside price risk may negatively impact local portfolios.

Chart 3: JGBs’ y-t-d gain narrowed significantly while gold in yen delivered a robust return*

JGBs are important assets in portfolios, gold is an effective complement

That being said, there is no denying that bonds play a vital role in many Japanese investor portfolios. For life insurance asset managers, bonds are key to match their liability durations. For others, bonds are safe-haven assets that can help reduce overall portfolio volatility. And for some, the rising yields of JGBs mean more attractive holding-to-maturity gains.

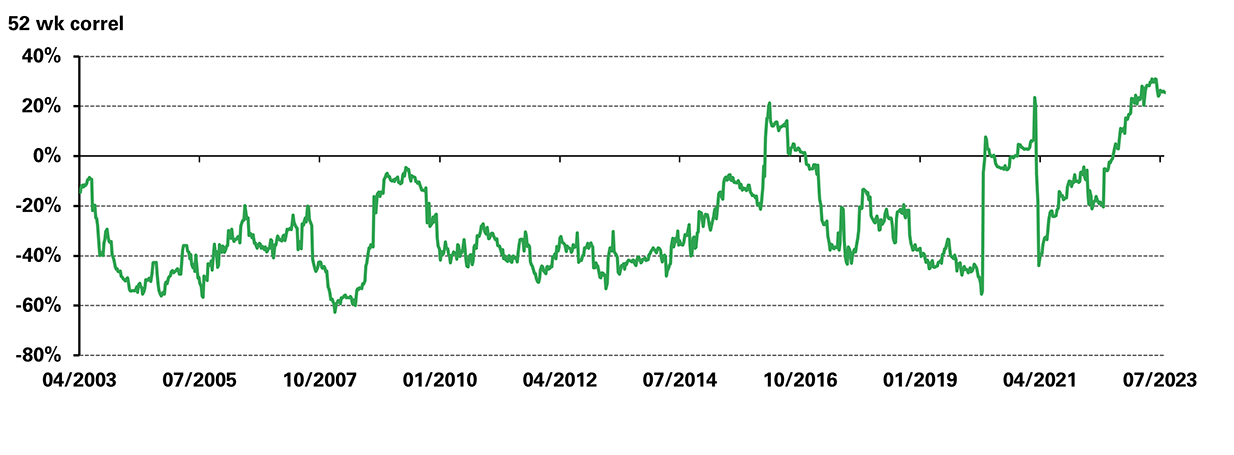

But this latest action from the BoJ may undermine the role of JGBs as a safe-haven asset. The rolling one-year correlation between 10-year JGBs and Japanese equities is at its highest for decades (Chart 4). One of the key reasons is investor expectation of further policy normalisation from the BoJ, which would push up bond yields and weigh on equities – as is usual when interest rates rise.

And should inflation pressure persist – and continue to beat expectations – JGBs may see higher volatilities in its price and yield, both from a potential acceleration in the BoJ’s policy normalisation moves and higher nominal yields.

Chart 4: The correlation between JGBs and local equities rose to its highest in decades

52-week rolling correlation between 10-year JGBs and Nikkei 225*

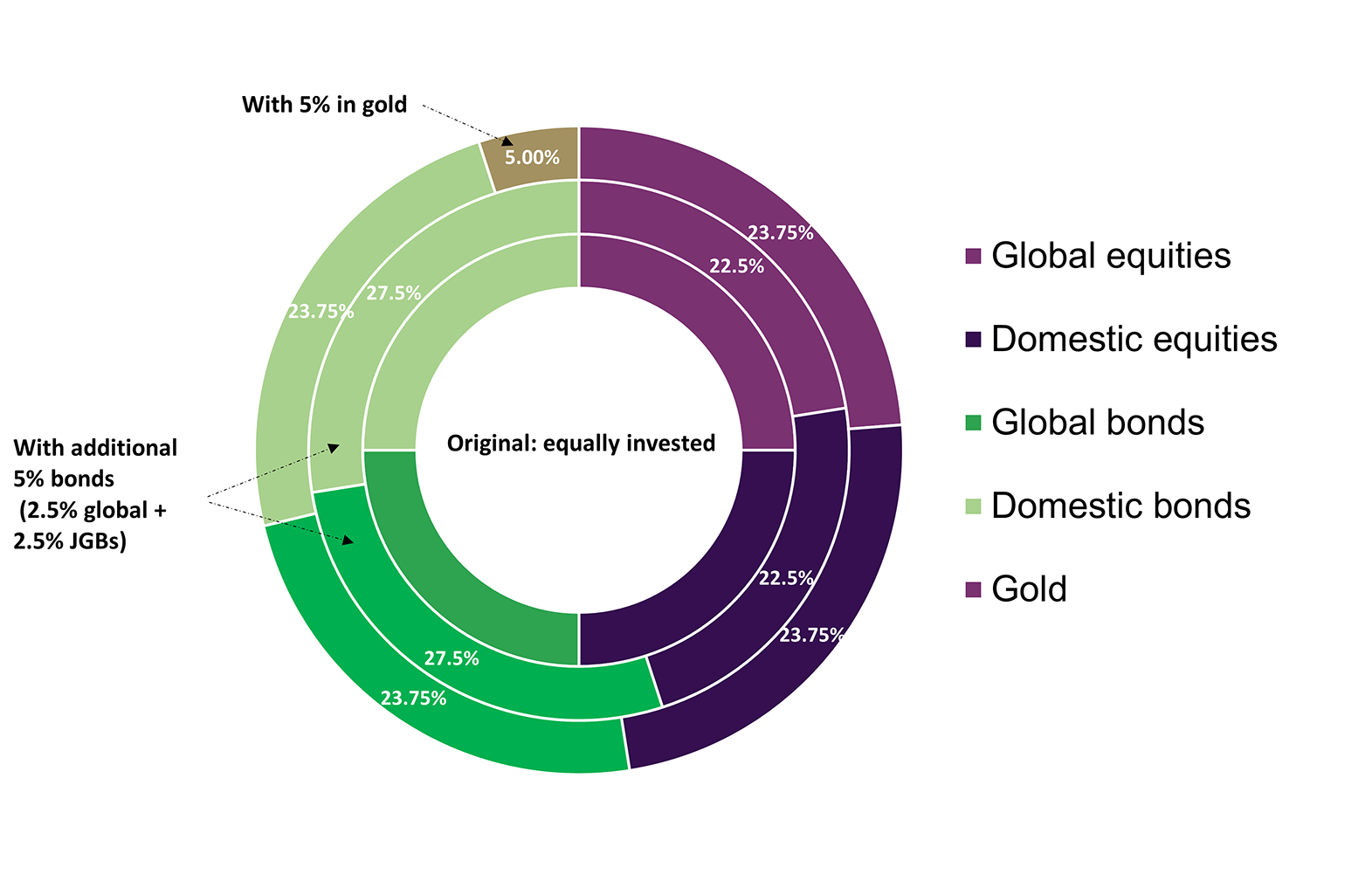

Gold, as a non-JPY asset and a hedge against risks, is an effective supplement to Japanese portfolios. We created a hypothetical portfolio equally divided into global equities, domestic equities, global bonds and domestic bonds. We then compared the performance of this portfolio with two other hypothetical portfolios: one with an additional 5% allocation to bonds and one with a 5% allocation to gold (proportionally reducing the allocation to other asset classes) (Chart 5).

Chart 5: Three hypothetical portfolios

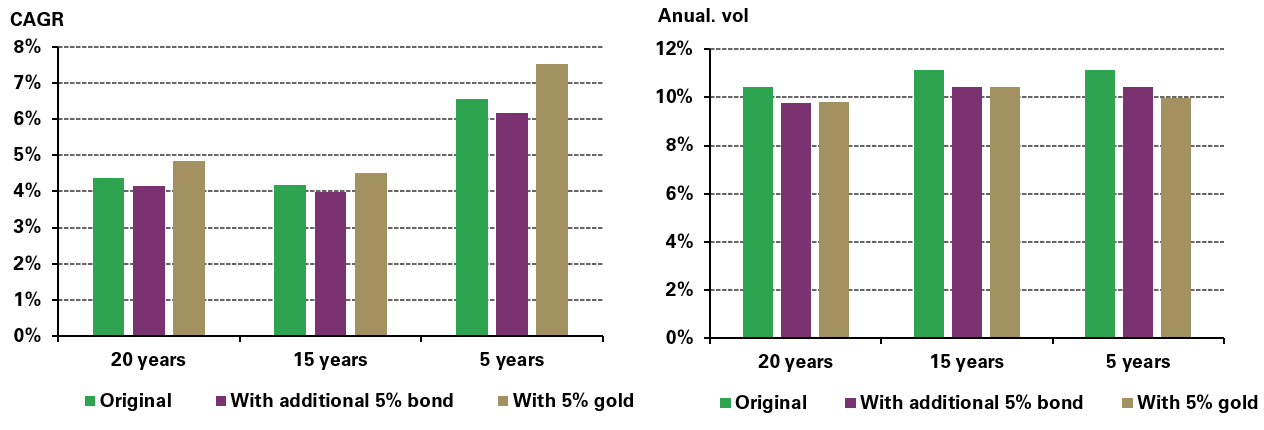

Comparing the performance metrics of the three portfolios over various time periods showed that:

- Adding more bonds to a portfolio that already includes fixed-income assets will reduce the overall volatility further, but will also supress returns

- Adding gold to the equally invested portfolio not only improves its return, it also lowers the portfolio’s risk; this has been particularly evident over the past five years.

Chart 6: Adding gold to a portfolio that already invests in bonds improves return and lowers risks

Performance of the three hypothetical portfolios over different time periods*

Summary and outlook

Gold’s independence from Japan’s economy and monetary policies, as well as its stable supply and demand dynamics, have rewarded investors with effective risk-hedging and long-term returns. For instance, gold, in yen, has delivered a stunning 17% return during the first eight months of 2023 (Chart 3) outperforming major assets, following a 16% gain in 2022. And in our 2023 Mid-year Gold Outlook we noted that in the market consensus economic scenario, gold’s performance in 2023 is likely to be in line with its long-term return.

As our above analysis shows, the inclusion of gold in a JPY portfolio already investing in bonds could help improve its performance whilst reducing volatilities further. We believe this, together with lucrative returns in JPY, could make gold an effective complement to JGBs for Japanese investors.