The data behind Gold Demand Trends, our flagship quarterly report on global demand and supply for gold, often throws up interesting stories about demand sectors, supply trends or individual countries’ gold markets. This quarter the stand-out story has been Turkey, where exceptional demand has had a material effect on global gold flows. Bar and coin demand, central bank gold holdings and OTC flows were all noticeably affected by what has happened in Turkey during the year so far.

As an upper-middle income emerging market, Turkey has long played an important, arguably outsized, role in the global gold market. The country has a long history of domestic gold ownership in both jewellery and investment form, and is the fifth largest gold market globally.1 As the world’s 11th largest economy,2 Turkey has seen rapid economic growth, high inflation and regular currency depreciation over the past few decades; a combination that has fuelled healthy growth in retail gold demand in recent years.

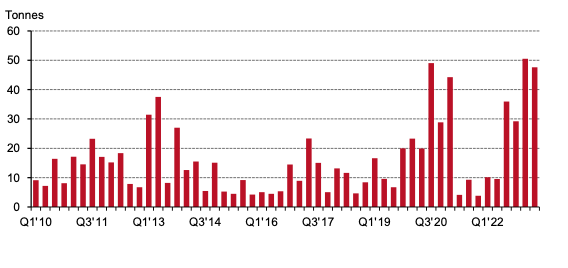

In the second quarter, however, this strength became overpowering (Chart 1). Bar and coin demand increased fivefold in Q2’23, boosting H1 demand to 98t, a record for our series. Quarterly jewellery demand posted a fourth consecutive double-digit percentage increase, up 23% y/y to 10t and H1 demand was lifted to 20t, up 25%y/y and a five-year high.

Chart 1: Quarterly Turkish bar and coin demand*

To put this into context, since the start of 2020 Turkish bar and coin demand has made up, on average, 9% of the global total, more than double the 4% share between 2010 and 2020.

The recent surge in Turkish gold demand has its roots in a major economic policy change made in 2021. On 20 September that year Turkey started to experiment with what can charitably be called ‘unconventional’ monetary policy. At President Erdogan’s insistence, the Turkish Central Bank (TCMB) started to lower policy interest rates, following a theory that high interest rates caused inflation.3 At the time of the shift both consumer price inflation and policy rates were 19%. But once rate cuts started, inflation began to climb. As the policy rate was cut – eventually driven down to a recent low of 8.5% in February 2023 – CPI gradually soared to reach 85% y/y by October 2022 (this is the official figure but CPI was unofficially measured at 185% y/y by the independent economists’ formed organisation ENAG).4

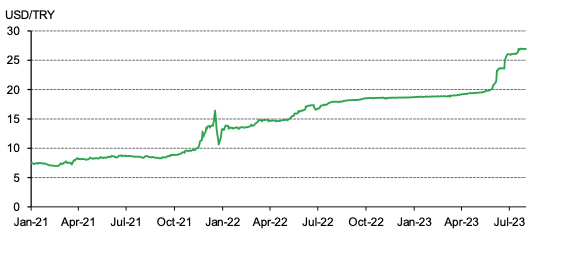

The combination of low interest rates and high inflation prompted a move lower in the Turkish lira. In the three months following the policy shift USD/TRY nearly doubled, moving from 8.60 to 17.15 between September and December 2021. Although central bank intervention briefly pared back some of the lira’s losses, it weakened again. In mid-2022 USD/TRY eventually settled at about 17, where it remained for almost a year until the presidential elections concluded on 28 May 2023 (Chart 2).

Chart 2: TRY jumped in response to Presidential elections*

Gold market impact

High inflation, low interest rates and fears of further lira depreciation triggered a surge in demand for tangible assets: real estate, new and used passenger vehicles, durable consumer goods and gold all saw strong demand growth over the past year. But it was the reaction in gold demand that triggered a government response.

The first move was from the Treasury, which implemented a partial suspension of gold imports in mid-February 2023 following the tragic earthquakes in eastern Turkey.5 Heightened investment demand caused by economic circumstance quickly translated into an increase in the premium for gold on the Borsa Istanbul. Prior to these developments, gold had traded at a premium of around US$5-7/oz to the London OTC price but this increased to around US$15/oz. Restrictions on gold imports were further tightened such that by the end of March only imports required for re-export were permitted and this drove premiums even higher.

But the government did not want to ban domestic gold purchases and plugged the shortage of available gold by central bank supply via the Borsa Istanbul. Between March and the end of May the TCMB sold 159t of gold via exchange, while premiums soared to levels between US$100 and US$150/oz.

Once the second round of the presidential elections had concluded on 28 May and the lira started to fall rapidly, demand for gold subsided a little, probably due to the removal of the key element of domestic uncertainty. This allowed the central bank to slow its rate of gold sales towards the end of May and, instead, allocate limited import quotas to Borsa Istanbul members. Slowed demand, together with the availability of limited import quotas, saw domestic premiums fall, down initially to US$30-40/oz and then, narrowing further, to US$10-15/oz by 7 June.

Freed from tight intervention controls, the currency slumped. USD/TRY moved from about 20 at the time of the second vote to 23.5 in mid-June and then lurched higher to 26 by the end of the quarter. Meanwhile, currency weakness and relative US dollar denominated gold price stability had lifted the lira-denominated gold price by 35% since 26 May, dampening demand and contributing to the fall in premiums. And at the beginning of July gold import regulations were normalised, helping to reduce premiums to around US$2-3/oz – albeit with no meaningful selling back despite record high local gold prices.

But in early August the Turkish gold market was once again rocked by government intervention.6 First, the government announced the reinstatement of gold import quotas in order to lower the current account deficit and replenish central bank reserves. And second, it applied additional taxation to some gold imports – those from non-EU countries and countries with no free trade agreements – in order to lower domestic demand. This sudden policy action resulted in soaring premiums: rising from US$8-10/oz to US$50-70/oz, almost overnight.

Consequences

Turkey’s surging investment demand accounted for 17% of global bar and coin demand in Q2’23. This helped mask the impact of slowing bar and coin demand from some important gold buying countries, notably Germany.

Non-retail investment purchases made a major contribution to global OTC purchases. Although there is insufficient data to make a precise estimate, purchases from institutions and corporations were a major contributor to Turkish gold buying in Q2’23.

Gold sales from the Turkish central bank resulted in a lower quarterly total for global net central bank demand than we've seen in recent quarters. But at 103t, Q2 net buying was still healthy, and contributed to the highest H1 in our data series.

Outlook

Forecasting the Turkish economy is unusually difficult due to the frequent intrusion of politics into economic policy over recent years. However, the appointment of a new central bank governor, Hafize Gaye Erkan, in June, appears to have set the country’s economy on a path towards more conventional economic policy. Interest rates have been raised quickly and the lira allowed to fall. But CPI stands at 38% and benchmark interest rates have been lifted to ‘only’ 17.5%, so it is likely that more work is needed: the TCMB appears to agree, hiking its year-end inflation forecast from 22% to 58%.

Against this backdrop it seems likely that Turkish investment demand will remain strong. The government is strictly controlling gold imports for now, but whether that continues – and whether the TCMB is again forced to sell gold domestically to satisfy unmet needs – depends upon the performance of the broader Turkish economy and the nation’s foreign exchange position. Needless to say, these issues will attract attention from global gold market followers.

With thanks to Çağdaş Küçükemiroğlu, consultant to our data partner, Metals Focus, for insights into recent development in the gold market and the background explaining these trends.