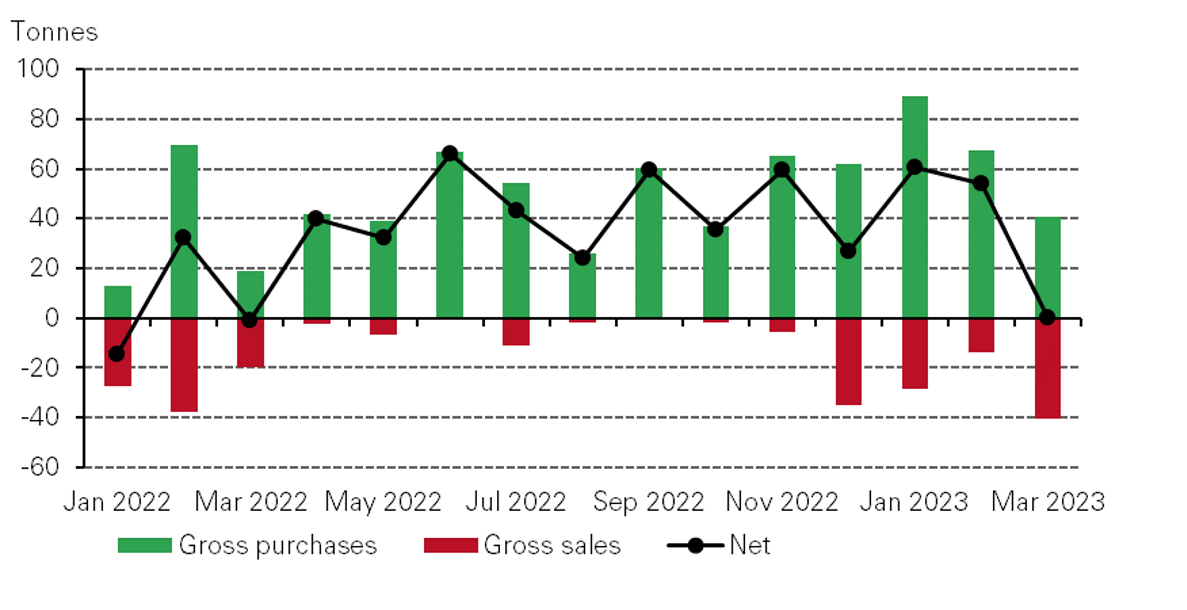

• According to the IMF, 1 reported global central bank gold reserves remained virtually unchanged in March.

• Available data shows purchases almost perfectly offset sales, resulting in a net increase of 0.2 tonnes.

Global central bank gold reserves remained flat in March

3 May, 2023

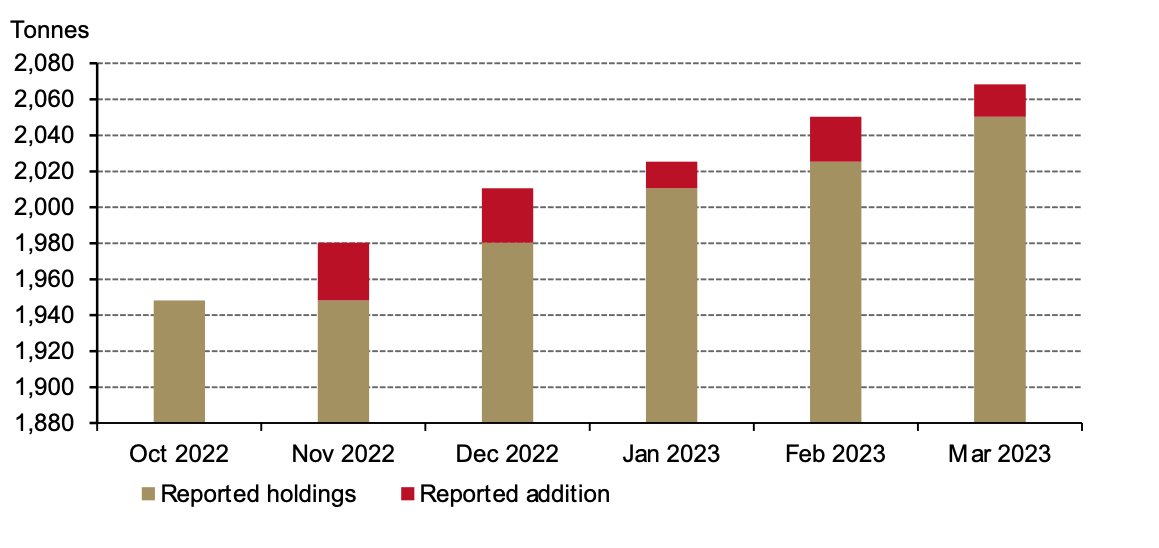

China reported its fifth consecutive increase to its gold reserves, adding 18 tonnes in March.

Reported PBoC gold reserves have now increased for five consecutive months*

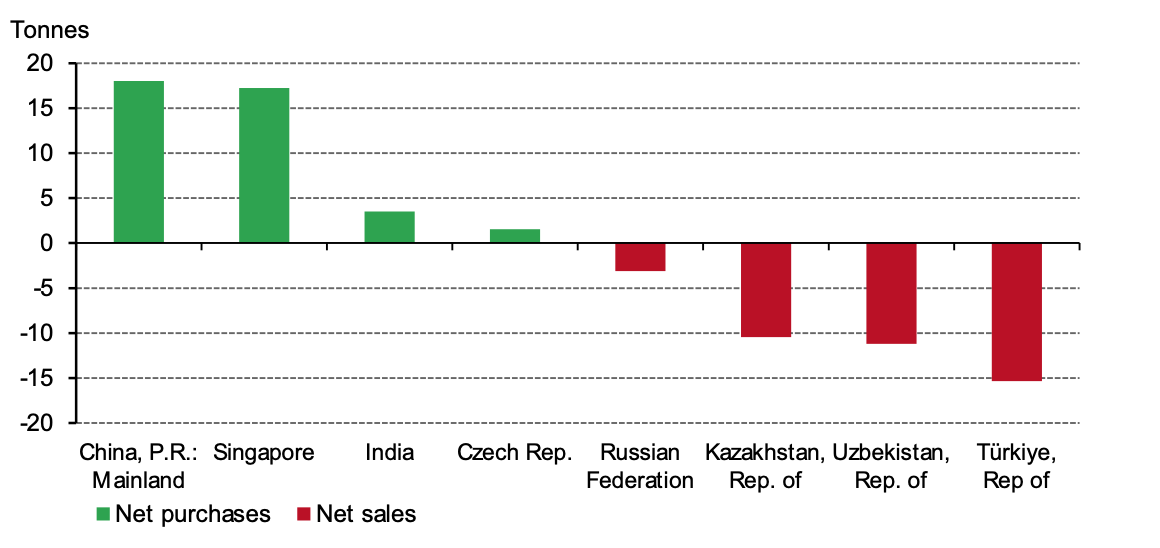

Singapore followed with a reported increase of 17t, bringing its total reserves to 222t – 45% higher than at the end of 2022. In addition, India and the Czech Republic reported a more modest 4- and 2-tonne increase, respectively.

Reported sales of gold in March were driven primarily by Türkiye (15 tonnes), 2 Uzbekistan (11 tonnes) and Kazakhstan (10 tonnes). Türkiye sold the gold into the domestic market following a temporary partial ban on gold bullion imports. Further, it is not uncommon for central banks that purchase gold from domestic sources, such as Uzbekistan and Kazakhstan, to be frequent sellers of gold.

China and Singapore purchases helped offset heavy sales from Türkiye, Uzbekistan and Kazakhstan in March*

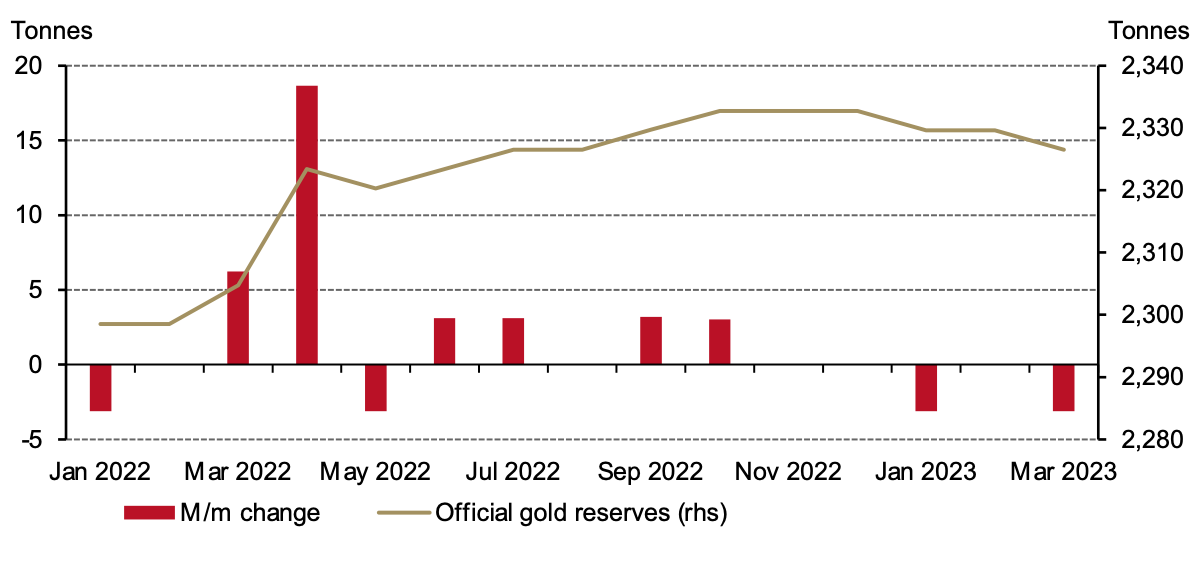

Russia also showed a 3 tonne fall in official gold reserves in March after submitting previously unreported information dating back to February 2022.

Stay tuned for our Gold Demand Trends Q1 report, to be published on 5 May, which will contain more detailed information on gold demand by central banks and other official institutions.3

Monthly changes in Central Bank of Russia gold reserves*

Footnotes

1Based on IMF IFS data and supplemented with data from respective central banks where available and not reported through the IMF at the time of publication. IMF IFS data is reported with a two-month lag, and while most institutions report on a regular basis, some may report with a – sometimes significant – delay. Figures may be subsequently revised as more data becomes available. The data used here informs but is distinct from the central bank demand estimates we report in Gold Demand Trends. Please see footnote 3 for more information.

2Türkiye official sector gold reserves are the sum of central bank-owned gold and Treasury gold holdings. This is equivalent to gross gold reserves less all gold held at the central bank in relation to commercial sector gold policies (such as the Reserve Option Mechanism (ROM), collateral, deposits and swaps). For information on this methodology, see: Central Banks Methodology Note

3For purposes of Gold Demand Trends, central bank demand is defined as net purchases (i.e. gross purchases less gross sales) by central banks and other official sector institutions, including supra national entities such as the IMF and sovereign wealth funds where applicable. Our central bank demand data is sourced from Metals Focus, whose proprietary estimates of official sector activity incorporate various sources, including IMF IFS reports, international trade data, and others. As such, IMF IFS data is a subset of what is included in Gold Demand Trends. Both data sets are subject to revision as new information is made available and/or to accommodate late or updated data reported by official institutions.