Summary

- Japan’s 2023 spring wage negotiation sees the largest pay increase in 30 years

- While this helps ease the pain of rising living costs, it may contribute to inflationary pressure

- Coupled with the possibility of slower growth, the risk of stagflation could hit Japanese investors

- Historical data shows that gold outperforms all other major assets during stagflationary periods

Japanese employees could see the biggest overall pay rise for 30 years

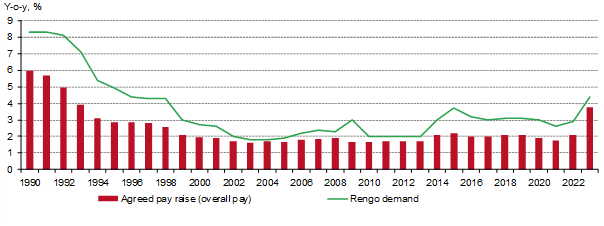

The 2023 “Shunto” sent positive signals to Japanese employees regarding possible pay increases amid a backdrop of elevated inflation in the region. Shunto – the wage negotiations between major corporations and unions that take place every March – provides pay level guidance for all Japanese employers, large and small. This year, the main labour unions and employers agreed on a 3.8% pay rise, the highest since 1993 (Chart 1). In addition, the basic wage will increase 2.3% this year, the highest increase since 2015, when Rengo, or the Japanese Trade Union Confederation, began to publish such data.

And while final Shunto results and actual pay rises across Japan may differ from the initial negotiations, the trend is clear: Japanese employees’ earnings are rising. The Fast Retailing Co. announced pay rises of up to 40% in January, and other enterprises including Nintendo, Toyota and Panasonic are giving their employees wage bumps not seen for years. 1

Chart 1: 2023 Shunto result sees the highest overall pay rise for 30 years

Pay increases may alleviate some cost of living pain but they may contribute to sustained inflationary pressure

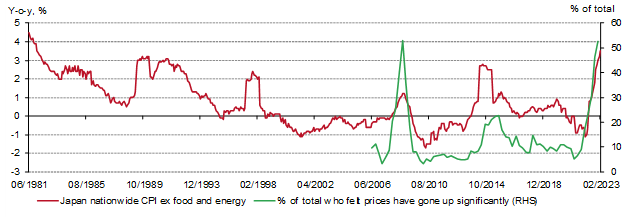

There is no doubt that these pay increases will help relieve pressure on local households from rapidly rising living costs. Japan’s core inflation grew at 3.5% y-o-y in February, the fastest since January 1982 (Chart 2). According to the Bank of Japan’s (BoJ) opinion survey, more and more households are feeling the current economic pressure and nearly 90% blamed high inflation; more than 50% felt that price levels have gone up significantly.

Chart 2: Japan’s inflation pressure remains elevated – local households feel the pain

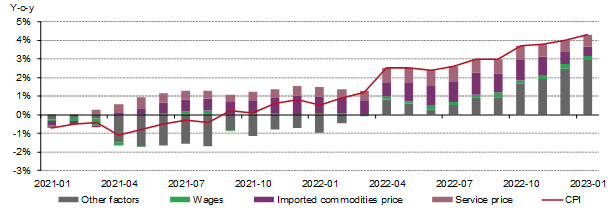

But higher wages could contribute to inflationary pressures in Japan. Our analysis finds that every 1% y-o-y increase in wages leads to a 0.1% rise in y-o-y CPI (Chart 3). And the former BoJ governor Kuroda also noted that a 3% wage increase would be needed for local inflation to sustainably rise above the target - although he didn’t clarify which type of wages. 2

Furthermore, supply-side inflationary pressures remain a concern, particularly as crude oil prices have rallied in the recent OPEC+ output cut 3 and over 90% of Japan’s energy resources rely on imports. 4

Chart 3: Wages positively impact inflation growth in Japan

Stagflation risk is rising

Meanwhile, Japan’s economic recovery is facing challenges. For instance, the increasing risk of a global recession and systemic turmoil in the global financial sector, fuelled by the recent banking industry crisis, could weigh on Japan’s recovery as it is highly dependent on external demand. And the aforementioned wage rises, if not transmitted into sustainable economic growth, may intensify stagflationary risks.

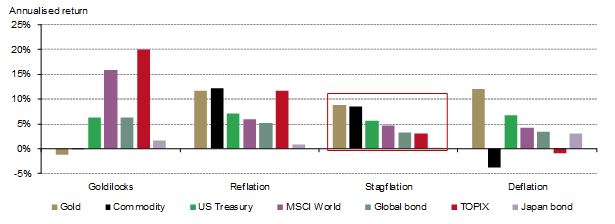

This possibility of slower growth and rising inflation, or stagflationary pressure, is likely to make Japanese investors restless. After all, financial assets in Japan have performed poorly during past stagflationary times. But gold has outperformed all other major assets during stagflationary periods in Japan (Chart 4). These periods are typically characterised by heightened financial market volatilities, elevated inflation and sluggish growth that keeps interest rates low. All of these lay a foundation in which gold thrives.

Chart 4: Gold, in yen, thrives in various economic scenarios, one of which is stagflation*

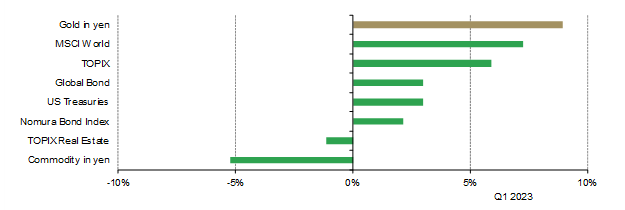

Gold, in yen, has already outperformed major assets in Q1 2023 in the face of heightened concern around a possible global recession (Chart 5). Looking ahead, while recession may be inevitable, the risks mentioned above add further challenges to Japanese portfolios. Gold, a safe-haven asset with low correlation to risk, often rewards investors with superior returns and portfolio protection during such periods.

Chart 5: Gold, in yen, saw a 9% return in Q1 2023, outperforming major assets