- Last year’s bumper buying by central banks prompted a look back at history to compare and contrast attitudes and behaviour towards gold as a reserve asset

- We maintain our outlook for continued buying by this sector, with emerging market countries leading the charge as their allocations languish behind those of advanced economies.

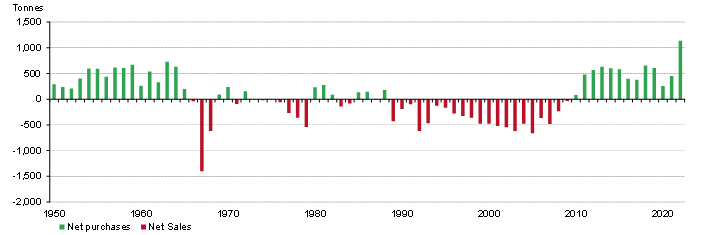

2022 was a record-breaking year for central bank gold buying. The 1,136 tonne total grabbed headlines and attention – particularly when accompanied by this eyebrow-raising chart.

Central bank gold buying broke records in 2022

Not surprisingly, we’ve fielded a flurry of questions from investors and analysts on this topic in recent weeks – around what is driving this buying and what the future may hold. And, crucially, whether the extended period of net buying that kicked off in 2010 will give way to significant net sales, as we saw in the late 1960s?

The short answer to that final question is no, we don’t expect this to happen. In fact, we’re confident that central banks will continue to build their official gold holdings. And not just because they have suggested as much.

To understand our view, the context of the 1960s is vital: a form of Gold Standard was still in operation at that time. Under the Bretton Woods system, the US – and a syndicate of European central banks – was committed to defending a fixed price of gold, which was convertible to the US dollar at US$35/ounce.

The hefty sales we saw in 1967 were a consequence of this price peg coming under attack as investors piled into gold. The influx was driven by safe-haven motives (fuelled by jitters that a devaluation of sterling signalled a possible currency collapse) and the lure of potential profit as speculators bet that the dollar would be next to fall and the gold price would be unleashed . 1

The banks in question avoided this scenario by selling vast quantities of gold – around 2,000 tonnes in total over 1967/68. But the episode effectively signalled the end of the Bretton Woods system and the last remnants of the Gold Standard.

Fast forward to 2022 and the picture is vastly different. The gold market is deeper and more liquid. It is structurally different – take the liberalisation and growth of both India and China and the launch of gold ETFs, for example. But the most important difference is in the behaviour of central banks themselves, namely:

- A structured programme of controlled sales during the noughties vastly reduced Western central banks’ ‘over-allocation’ to gold, while Emerging Market (EM) central banks are still relatively under-allocated, even after sizable additions in recent years

- There has been a concerted shift away from over-reliance on the US dollar as a reserve currency, in an environment of non-existent real yields on sovereign debt.

Upon expiry of the last Central Bank Gold Agreement in 2019, the – largely European – signatories reaffirmed that ‘Gold remains an important element of monetary reserves’. 2 Words that have been backed up by a distinct lack of further selling.

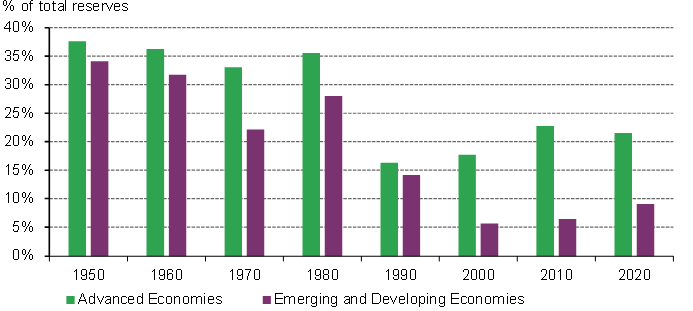

Meanwhile, despite significant buying in recent years, emerging market banks remain relatively under-allocated. According to IMF data, EM countries have a collective allocation to gold of below 10%, less than half that of advanced economies. But even this figure is distorted by a few markets with towering allocations to gold, often bought from domestic production. The central banks of Kazakhstan and Uzbekistan, for example hold around 60% of their portfolios in gold. Thus the average for those without such domestic buying programmes is likely significantly lower than the chart below suggests.

Gold’s share of Emerging Market reserves lags far behind that of Developed countries

What is driving today’s gold buying …and will it continue?

Central banks have different strategic objectives to institutional investors. Official reserves must be invested in assets that are safe and liquid. Investment guidelines for emerging and developing country central banks are often very narrow, limited to gold, SDRs, IMF reserve balances, highly-rated sovereign debt and deposits.

This makes central banks disproportionately exposed to advanced economy government debt. But the real yield on many of these sovereign bonds is still very low, if not negative. What’s more, as we saw during the Eurozone debt crisis, these countries are far from immune from default risk. And rising sanctions risks could make bonds in some markets less appealing. Currency wars also remain a threat.

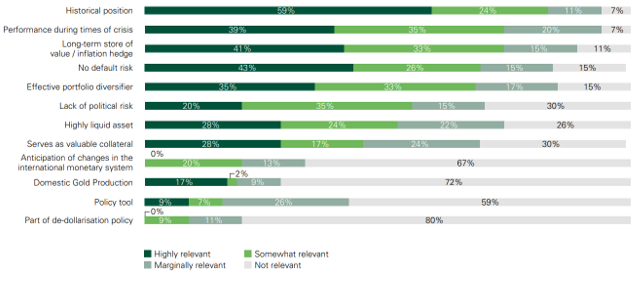

In this environment gold looks very attractive compared to other reserve assets. It has no political risk, it can’t be de-based and it can’t be talked down in a currency war of words. Our comprehensive central bank surveys confirm that gold is an important reserve asset – valued for its performance in times of crisis, its long-term store of value and lack of default risk. And it confirms that central bankers expect further growth in global gold reserves.

Central banks prize gold’s hedging and diversification benefits, and its lack of default risk

There are, of course, risks. The last few years have reduced the overall reserves of some central banks, meaning they have less to allocate to gold. A steep rise in the gold price could curb some buying, as well as encouraging sales from banks based in gold-producing countries. But, overall, we expect further buying, with EM banks at the forefront of this trend as they continue to redress the imbalance in gold allocations with their developed market peers.