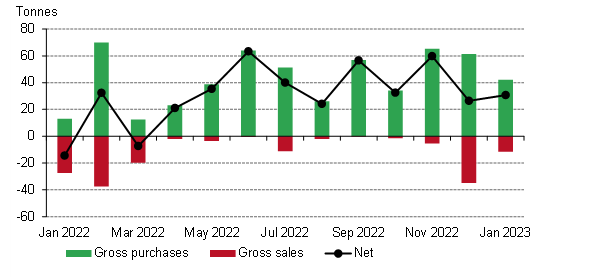

Central bank gold demand in 2023 picked up from where it left off in 2022. In January, central banks collectively added a net 31 tonnes (t) to global gold reserves (+16% m-o-m).1 This was also comfortably within the 20-60t range of reported purchases which has been in place over the last 10 consecutive months of net buying.

Central banks remained committed buyers of gold in January*

Activity was relatively concentrated during the month, with only three banks accounting for gross purchases of 44t and one bank offsetting this with 12t of sales. 2

The largest reported purchaser in 2022 was also the largest buyer in January: the Central Bank of Türkiye (Turkey) added 23t to its official gold reserves, which now stand at 565t . 3 People’s Bank of China (PBoC) also bought again during the month, adding 15t on top of the 62t of gold reported between November and December 2022. Its gold reserves now total 2,025t (3.7% of total reserves). The National Bank of Kazakhstan increased its gold reserves by a modest 4t in January, taking its gold reserves to 356t.

The European Central Bank (ECB) reported a near 2t rise In Its gold reserves In January, however It was not an outright purchase by the bank. This was related to Croatia joining the currency union, as the country was required to transfer the gold, as part of a larger transfer of reserve assets, to the ECB.4 For this, the country bought nearly 2t of gold in December.

The Central Bank of Uzbekistan was the only prominent seller during the month, reducing its official gold reserves by almost 12t (-3% m-o-m). Its gold holdings now total 384t, 66% of total reserves.

Focus on this sector of the gold market has been intense in recent months, owing to the record level of buying from central banks in 2022.5 We have faced questions from some investors on whether central banks will sustain this appetite for gold. As we noted in our latest Gold Demand Trends report:

“Looking ahead, we see little reason to doubt that central banks will remain positive towards gold and continue to be net purchasers in 2023. However, by how much is difficult to call, as evidenced by our expectations at the start of 2022. But it is also reasonable to believe that central bank demand in 2023 may struggle to reach the level it did last year.”

The healthy January data we have so far gives us little reason, at this time at least, to deviate from this outlook either.