Key highlights:

- Gold prices lost momentum in February. While the LBMA Gold Price AM in USD fell by 5%, the Shanghai Gold Price Benchmark PM (SHAUPM) in RMB saw only a 1% drop due to the RMB’s depreciation against the dollar

- The Shanghai-London gold price premium continued to pick up, reflecting strong gold demand during the month

- Gold withdrawals from the Shanghai Gold Exchange (SGE) totalled 169t last month, 30t higher m-o-m and 76t higher y-o-y

- Chinese gold ETFs saw a mild outflow of US$45mn (RMB313mn), bringing their collective holdings to 47.4t (US$2.8bn, RMB$20bn)

- The People’s Bank of China (PBoC) reported a further gold purchase of 25t, taking its total gold reserves to 2,050t by the end of February.

Looking ahead:

- Considering recent local gold demand strength and the approach of Q2, which is traditionally an off-season of gold consumption, we expect gold withdrawals from the SGE to remain strong in March and taper off in April

- In the longer run we remain cautiously optimistic about this year’s Chinese gold demand. The relatively conservative GDP growth goal of 5% set by policy makers is one of our key considerations – this could imply less-than-expected stimulus from policy makers and a challenging year of economic recovery. 1

- While an economic rebound off 2022’s low is likely to benefit local gold consumption, pent-up tourism spend following the end of COVID restrictions may impact consumers’ budgets for gold.

Gold prices fell, local premium rose

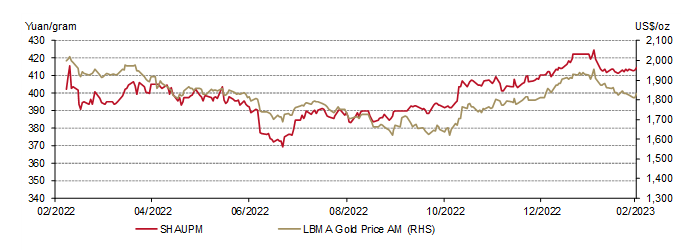

Gold prices weakened in February. There was a 5% decline in the LBMA Gold Price AM in USD during the month. Meanwhile, due to a 3% depreciation in the RMB against the dollar, the SHAUPM in RMB saw a smaller fall of 1% (Chart 1).

Chart 1: The RMB gold price saw a narrower decline than its USD peer

The SHAUPM in Yuan/gram and LBMA Gold Price AM in US$/oz*

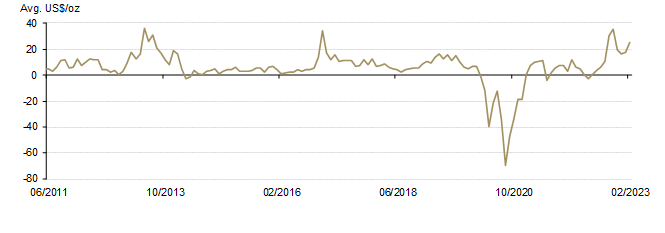

The local gold price premium continued to rebound last month, rising by US$8/oz m-o-m – a significant pick up (US$18/oz) compared to February 2021. This was primarily driven by continued vitality in China’s wholesale gold demand as discussed below.

Chart 2: The local gold price premium continued to pick up in February

The monthly average spread between SHAUPM and LBMA Gold Price AM in US$/oz*

February saw strong wholesale gold demand

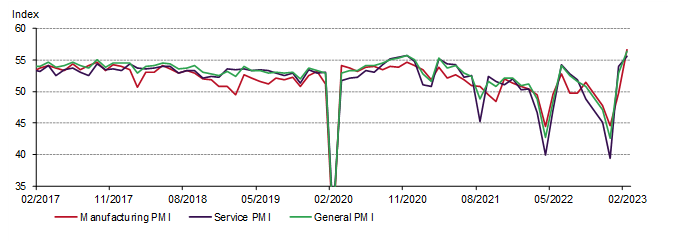

China’s economy continued to recover in February (Chart 3). The official Comprehensive Purchasing Managers Index (PMI) surged to 56.4 in February, the highest on record since 2017. While manufacturing activities expanded the most since April 2012 and the service PMI grew at the fastest pace for 22 months. With the pandemic receding and consumers’ pent-up demand releasing, China’s economy rebounded further.

Chart 3: China’s economic activities grew rapidly

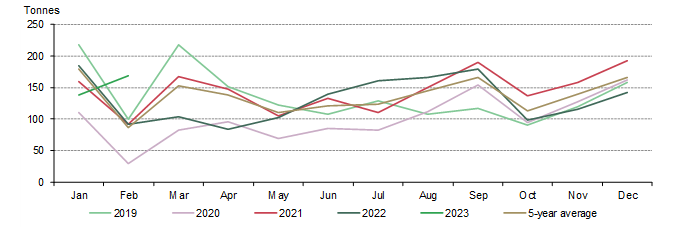

Gold demand continued to bounce back following the Spring Festival in January. Gold withdrawals from the SGE totalled 169t in February, a m-o-m increase of 30t and a 76t y-o-y rise. We believe the m-o-m increase is mainly driven by:

- Healthy consumption amid the economic recovery and the release of pent-up demand

- Retailers’ restocking activities after the Chinese New Year (CNY) holiday

- More working days than January

Gold withdrawals saw their strongest February since 2014. While the fact that the unusual early CNY holiday in January played a role, we believe that improving market sentiment and participants’ optimism following the end of the COVID pandemic were also key contributors. 2

Chart 4: Gold withdrawals saw the strongest February in nearly ten years

Collective holdings under Chinese gold ETFs held relatively steady

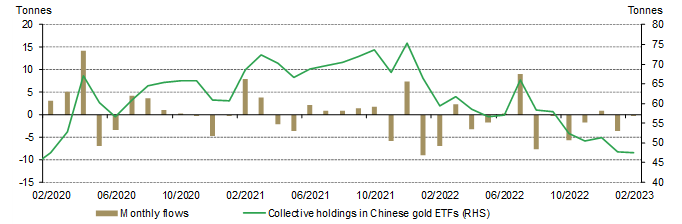

Chinese gold ETFs witnessed an outflow of US$45mn (RMB313mn) in February, to US$2.8bn (RMB20bn). Total holdings arrived at 47.4t by month end, a slight 0.3t loss m-o-m (Chart 5). Limited local gold price volatility may have disinterested investors, leading to only mild changes.

Chart 5: Chinese gold ETF holdings levelled off in February

Monthly tonnage flows and Chinese gold ETF holdings

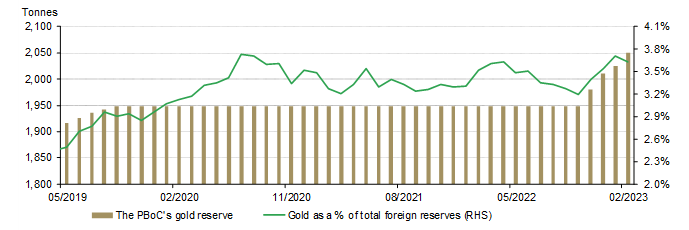

Another month of increasing gold reserves

In February, data from the State Administration of Foreign Exchange (SAFE) showed the fourth consecutive monthly gold reserve rise. China’s gold reserves totalled 2,050t by the end of February, a 25t increase m-o-m, accounting for 3.7% of China’s total official reserves. For the past four months the reported increases in the PBoC’s gold reserves amount to 102t.

Chart 6: China’s gold reserves increased for the fourth consecutive month

Footnotes