Summary

- The domestic gold price increased by 3.8% in December, ending the month at Rs54,556/10g1 and ending 2022 with a solid 14% gain; stronger than its peer in USD due to the weaker INR

- Sluggish retail demand drove the local price into discount for the entire month. The local market remained in an average discount of US$8/oz throughout 2022

- Indian gold ETFs witnessed marginal net outflows of 0.6t in December – as investors booked profits following the domestic gold price rise – and ended 2022 with an overall marginal inflow of 0.4t for the year

- The Reserve Bank of India (RBI) added 1.1t to its gold reserves during the month, increasing its total gold reserves to 787.4t.2 The RBI added 33.3t to its gold reserves in 2022 – 76% lower y-o-y.

Looking ahead

- Retail demand is expected to pick up when the wedding season starts in mid-January. Retail demand will continue to face headwinds due to the higher gold price but a correction in inflation should boost spending on gold

- Official gold imports may remain muted if the industry postpones purchases ahead of the Union budget on 1 February.

The monthly discount widened to its highest level since March

The international gold price shot up by 3% in December to US$1,812/oz, supported by expectations of a less-hawkish US Fed in the light of lower yields and dollar weakness.3 Gold’s performance was relatively strong in local currency terms (+3.8% m-o-m) as the INR depreciated by 1.4% against the USD during the month.

The local gold price ended the year with a solid 14% gain. The weak local currency, inflationary concerns and geopolitical uncertainties all contributed to this sizable increase. In contrast, the LBMA Gold Price AM in USD saw a mild decline of 0.4% over the year in the face of a strong dollar.

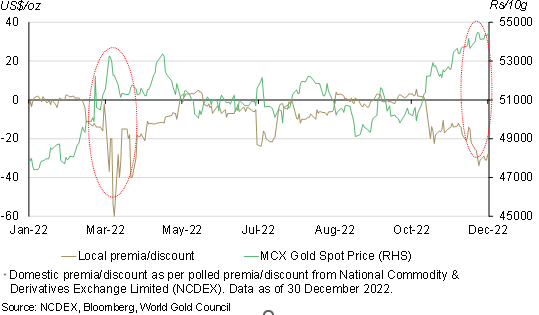

The local market remained in discount during the entire month as retail demand weakened following gold’s price jump and year-end holidays. With sluggish retail demand, the discount during the month widened to US$34/oz – its highest level since March (Chart 1).4 The local market has continued in discount during the first two weeks of January, averaging US$25/oz.

Chart 1: Sluggish retail demand pushed the local market discount to the highest level since March

Retail demand remained sluggish and imports tumbled during the month

Retail demand remained sluggish during the seasonally quiet month of December due to muted sentiment in the face of a higher domestic gold price and year-end holidays. Demand received mild support from year-end weddings and, in Kerala, purchases against advance bookings, but it was not enough to uplift the overall bearish sentiment.

When looking at Indian retail demand in 2022, two prominent themes emerge:

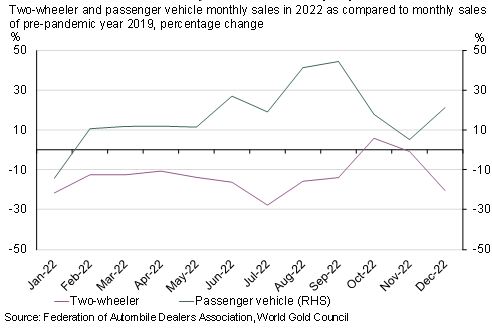

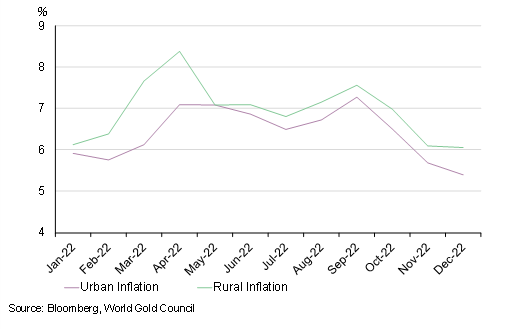

- Urban India remained the main driver of retail demand as economic activity normalised to pre-pandemic levels and was further fuelled by credit expansion. In contrast, the rural consumer’s discretionary spending was hit by higher inflation: interest rates on agricultural loans rose and the weaker local currency resulted in a higher local gold price (Chart 2)

- Studded jewellery continued to gain momentum as jewellery retailers embarked on effective marketing campaigns that encouraged urban consumers to make high value purchases. The higher sales of studded jewellery helped volume growth during the year.

Chart 2: Indian urban economy has recovered to pre pandemic levels

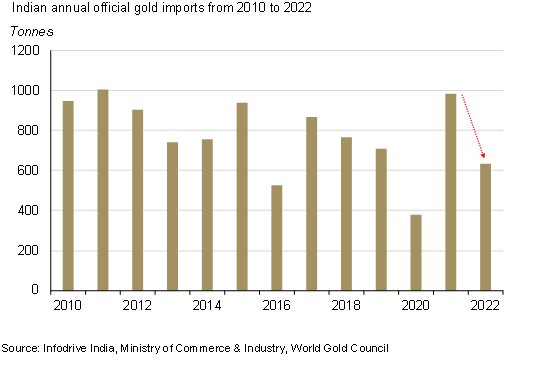

Mirroring the sentiment in retail demand, official imports tumbled during the month, declining 76% y-o-y to 20t. These flows were impacted by higher gold recycling volumes and a surge in unofficial imports of gold.

Looking at 2022 overall, total official imports were 632t, 36% lower y-o-y (Chart 3), driven by:

Chart 3: India gold official imports declined in 2022

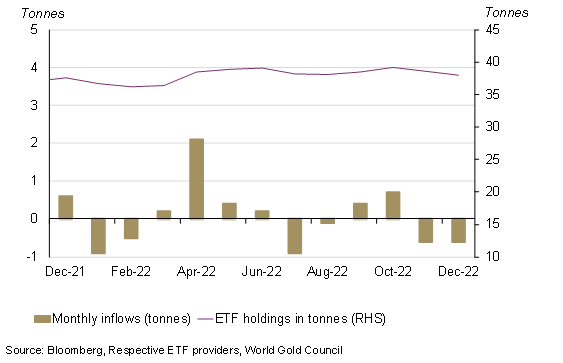

Indian gold ETFs witnessed marginal inflows in 2022

The 3.8% increase in the domestic gold price in November persuaded some investors to book profits, resulting in a net monthly outflow of 0.6t and a decrease in total gold holdings to 38.t (Chart 4). Overall, Indian gold ETFs saw marginal net inflows of 0.4t in 2022.

Inflows into Indian gold ETFs during the year were driven by tactical moves by investors. A higher domestic gold price due to the weak INR contributed positively to many investors’ portfolios and some viewed these gains as opportunities to book profits. Others increased their holdings amid the volatile equity market and some utilised gold price dips to enter the market.

Chart 4: India gold ETFs saw net outflows in December

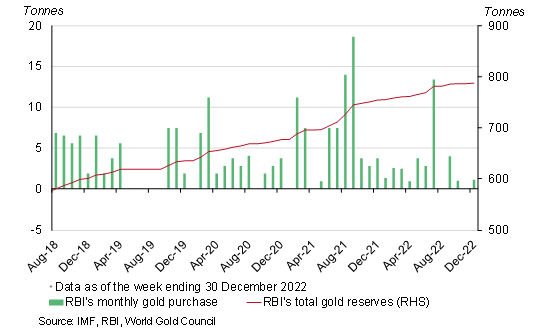

The RBI added 1.1t of gold to its reserves in December

After making no purchases in November, the RBI purchased 1.1t of gold during December increasing its total gold reserves to 787.4t at the end of 2022 (Chart 5). 5 India’s FX reserves slumped by US$70bn during the year due to the RBI’s intervention in the FX market in an attempt to defend the INR. With dwindling FX reserves, the RBI’s gold purchases of 33.3t during 2022 are 57% lower y-o-y. At the end of the year the RBI’s gold reserves stood at 8.1% of total FX reserves compared to 6.9% at the end of 2021.

Chart 5: RBI added 1.1t to its gold reserves in December

Looking ahead

Indian gold demand should receive support from the lower trajectory of retail inflation (CPI) and the decline in CPI – anticipated to be 5.1% in 2023 from 6.9% in 2022 – as supply chain bottlenecks ease. Further benefits may come from ongoing urban demand, a strong wedding season and the expectation of stability in the INR.

There are however challenges for Indian gold demand this year. A weaker economic outlook, a higher gold price and weak rural demand remain headwinds (Chart 6).

Chart 6: Higher rural inflation may impact rural consumer spending in 2023

Footnotes