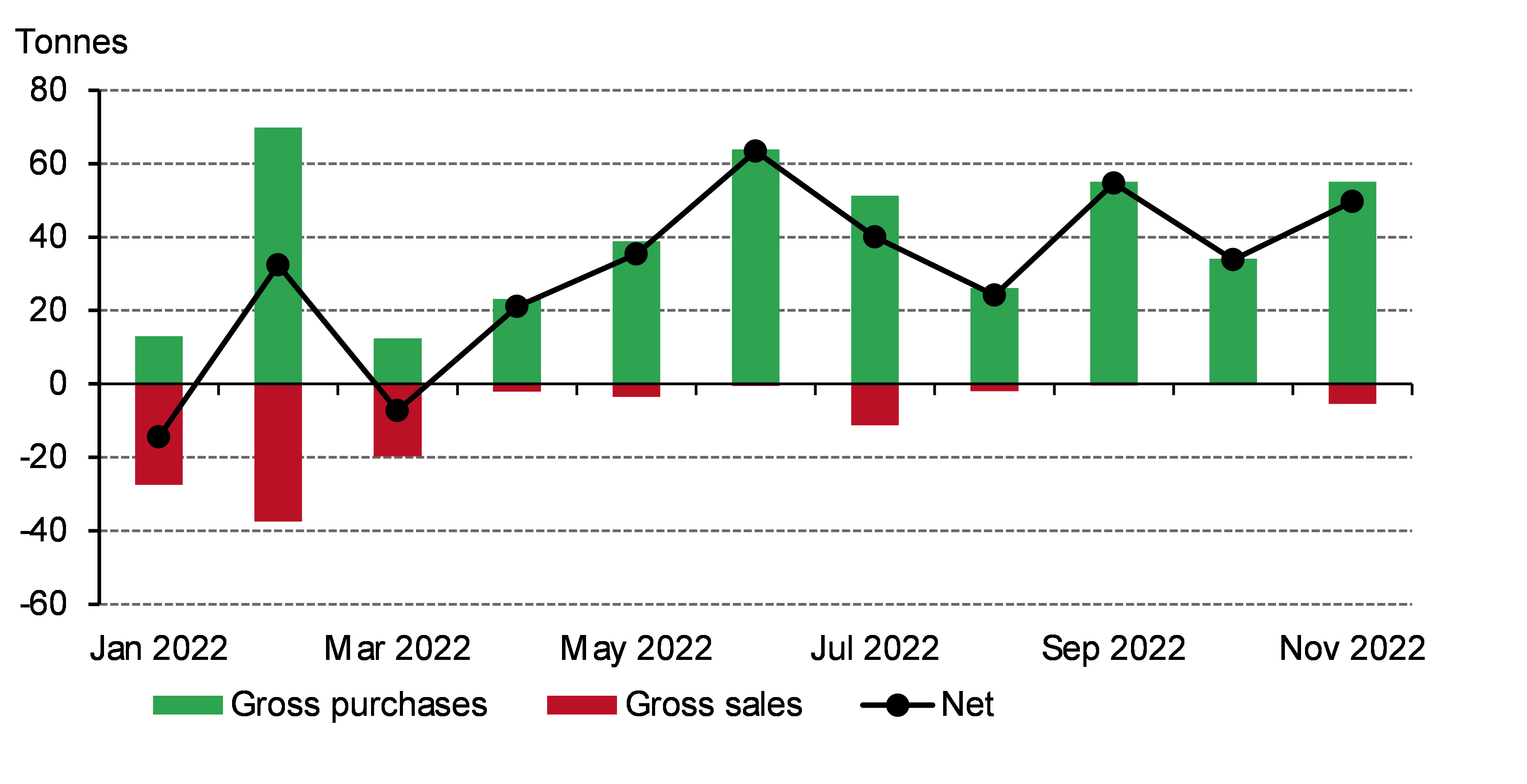

I've spoken before about central banks' sizeable appetite for gold during 2022 in this blog series, and November was no different. Central banks bought a further 50 tonnes (t) on a net basis during the month, a 47% increase from October's (revised) 34t.1 Of this net total, three central banks accounted for gross buying of 55t, while two largely contributed to gross sales of 5t , showing the strength of demand.

Central banks added a further 50t to global official reserves in November*

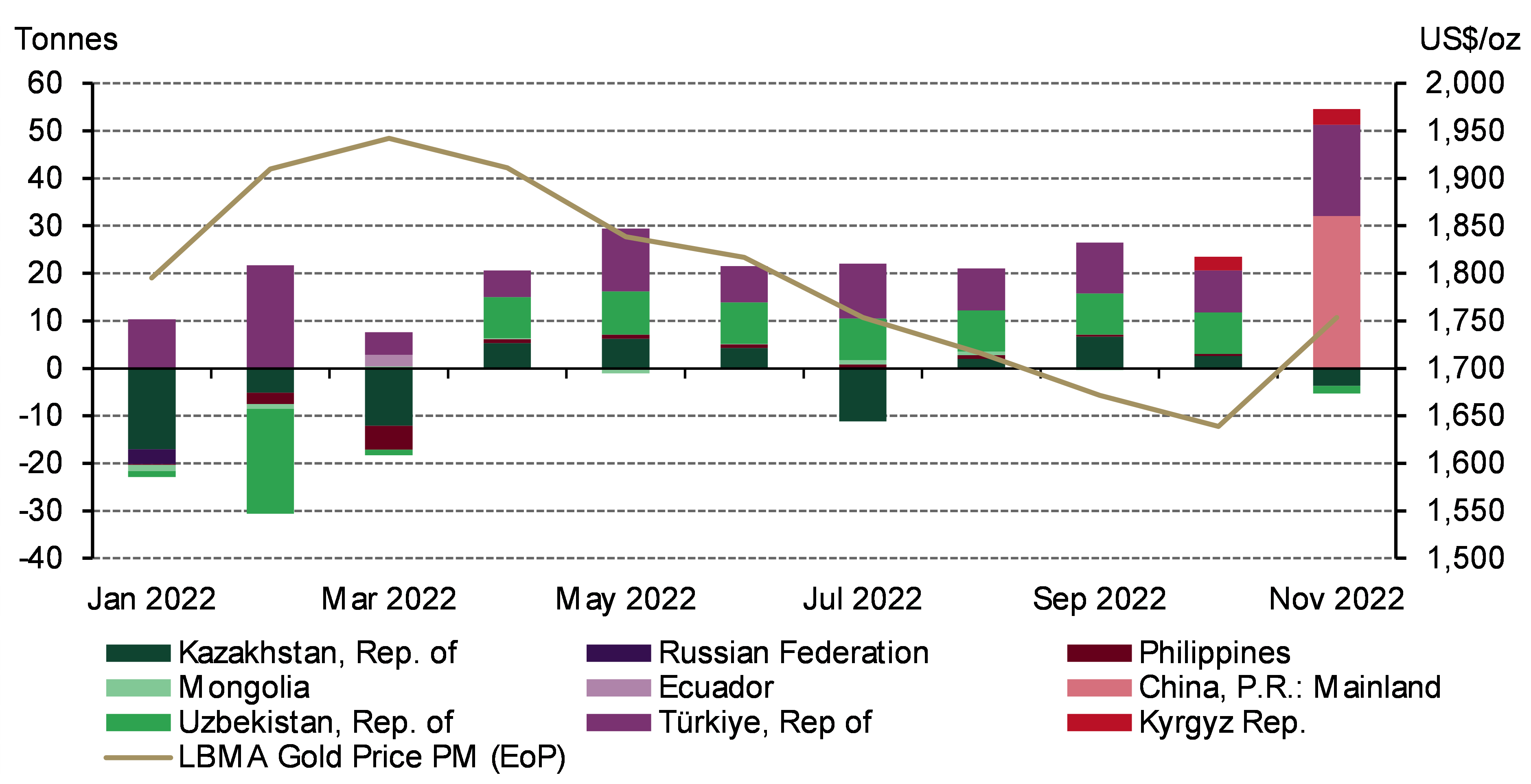

The biggest announcement of the month came from the People's Bank of China (PBoC). It reported an increase of 32t, the largest reported purchase in November and the first announced increase in its gold reserves since September 2019. This announcement is significant given China's historic position as a large gold buyer, having accumulated 1,448t between 2002 and 2019. It remains to be seen whether this is followed up with reports of continued buying in December. At the end of November, PBoC gold reserves stood at 1,980t (3.4% of total reserves).

The Central Bank of Türkiye continued to buy gold in November, adding a further 19t to its official (central bank + Treasury) reserves.2 This lifts its YTD net purchases of gold to 123t – the largest reported by any country – and its official gold reserves to 517t (27% of total reserves). The Central Bank of the Kyrgyz Republic added to its gold reserves for the first time this year, buying 3t in November to increase its total gold reserves to 16t (+61% YTD).

On the sales side, the National Bank of Kazakhstan and the Central Bank of Uzbekistan were the largest sellers. Kazakhstan reduced its gold reserves by around 4t to 380t (-5% YTD), while Uzbekistan’s gold reserves fell by almost 2t to 397t, 10% higher YTD. We have noted previously that it is not uncommon for central banks who purchase gold from domestic sources - as both Kazakhstan and Uzbekistan do - to also be frequent sellers of gold.

Gold purchases/sales by the central banks of gold producing nations in 2022 *

The central bank sector has been one of the highlights of the gold market in 2022, having bought a net 673t between Q1 and Q3 .3 Looking ahead to the full year picture, it's likely that central banks accumulated a multi-decade high level of gold in 2022. How much exactly? Stay tuned for our Gold Demand Trends report which will be published at the end of January to find out.