Summary

- The domestic gold price increased by 4.8% in November, ending at Rs52,574/10g 1

- Soft retail demand in November drove the local price into discount for the majority of the month

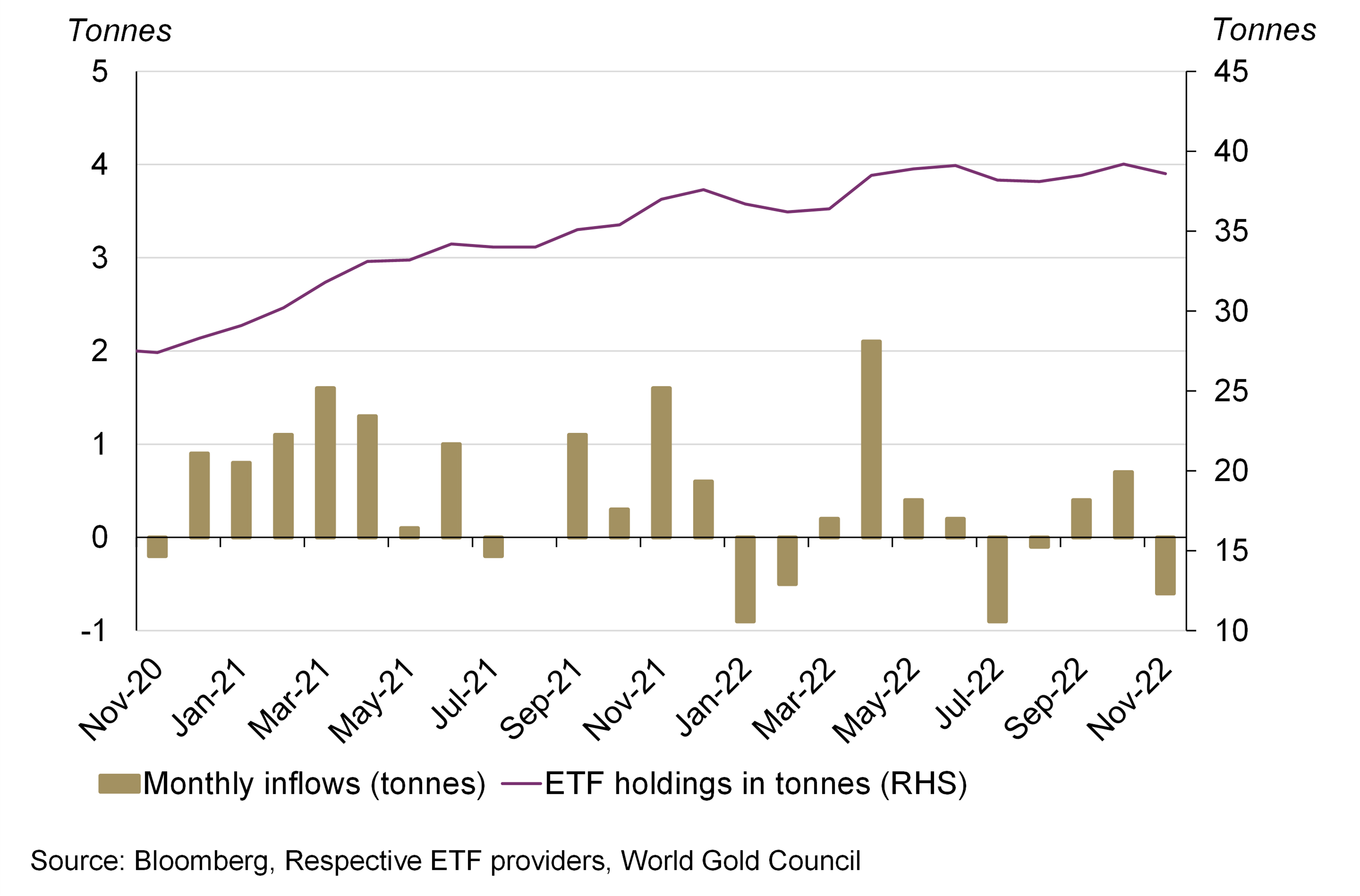

- Indian gold ETFs witnessed marginal net outflows of 0.6t in November as investors booked profits following the jump in the domestic gold price

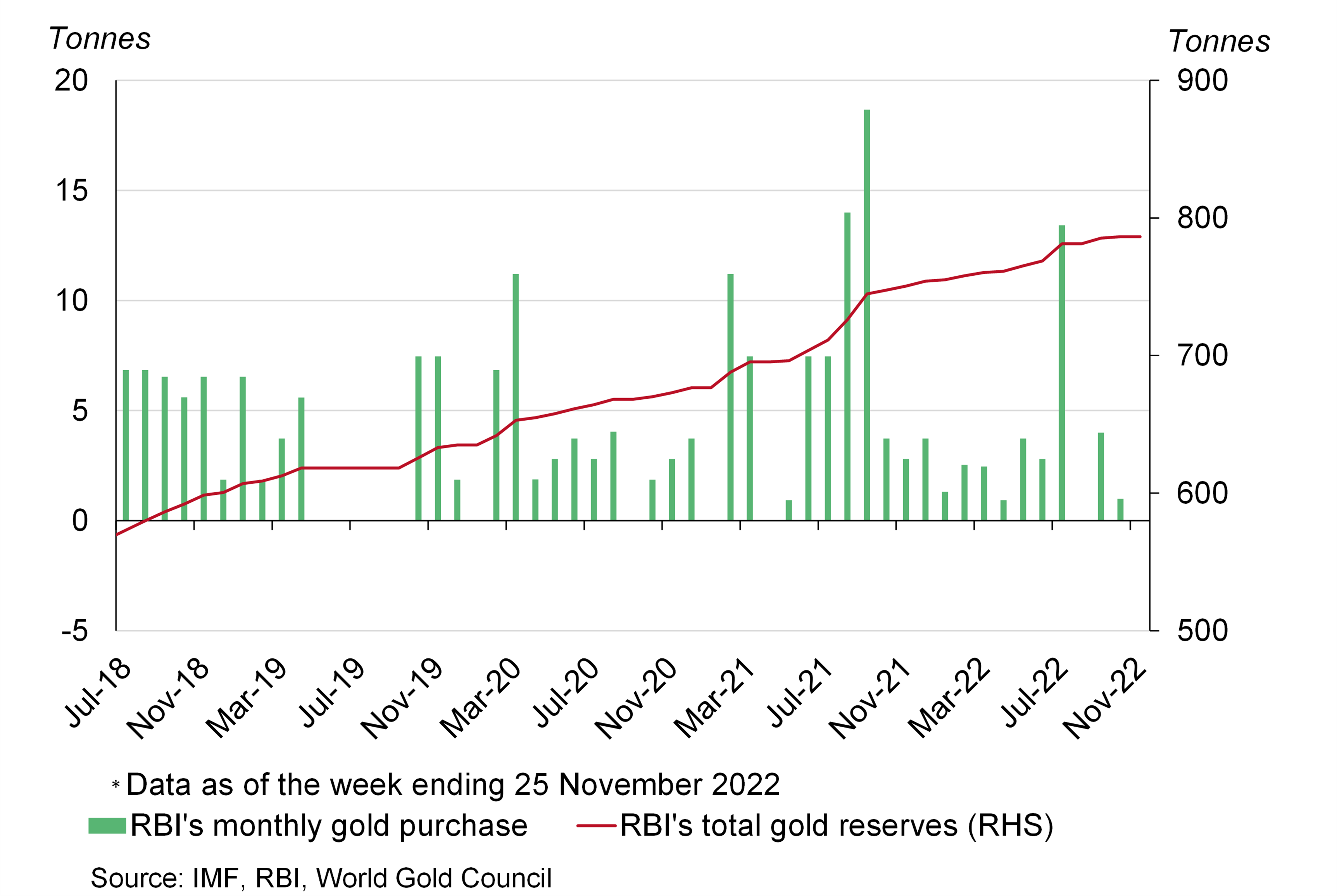

- The Reserve Bank of India (RBI) made no gold purchases during the month, keeping its gold reserves constant at 786.3t. 2

Looking ahead

- Retail demand is expected to slow from mid-December to mid-January as this will be an inauspicious period for weddings in many parts of the country

- Retail demand will continue to face headwinds due to the higher gold price but a correction in inflation should boost spending on gold.

The local market remained in discount for most of the month

The international gold price jumped by 7.4% in November to US$1,760/oz, boosted by lower yields and dollar weakness.3 Gold’s performance was relatively weak in local currency terms (+4.8% m-o-m) as the INR appreciated by 1.7% against the USD during the month.

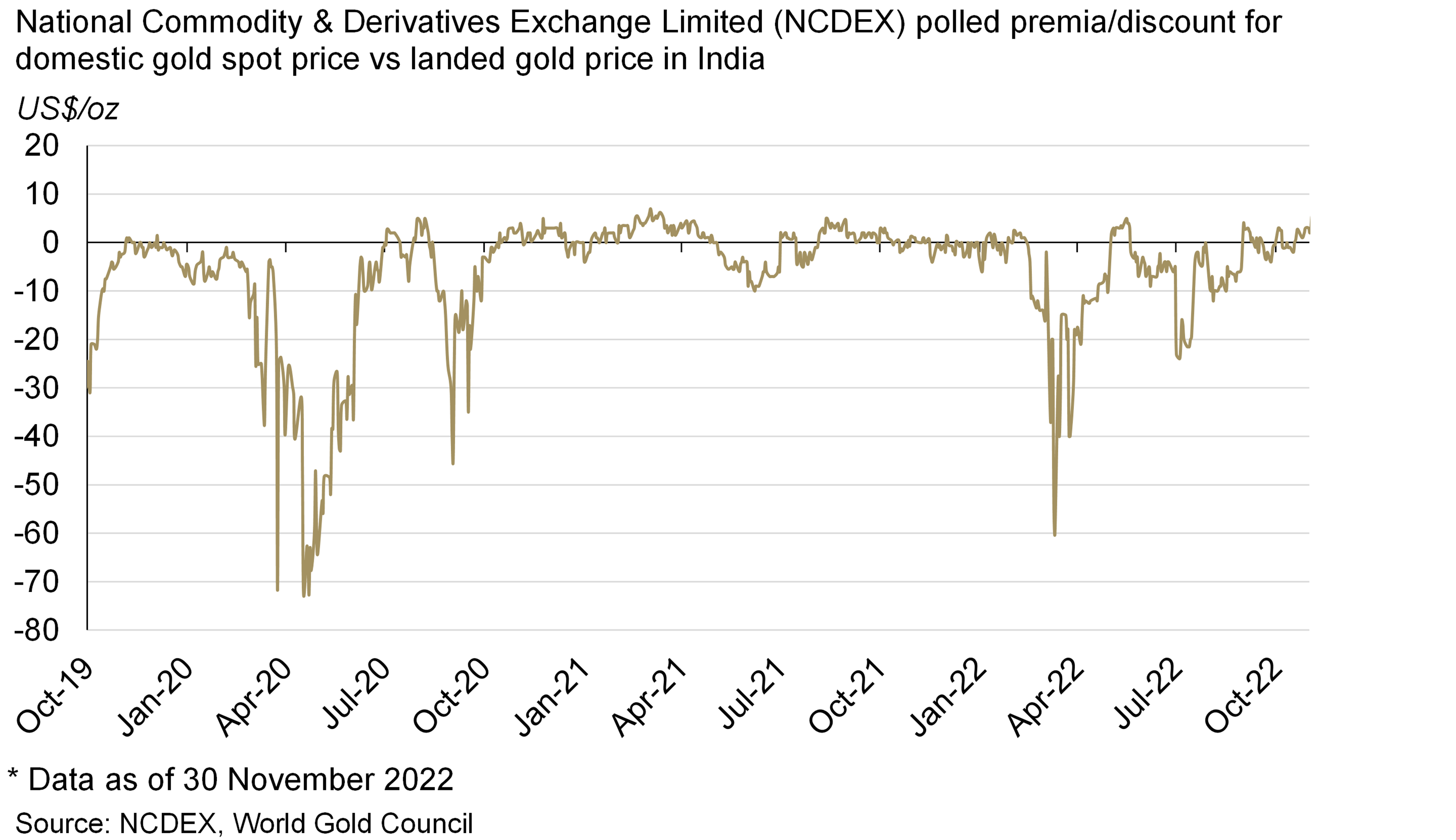

The local market remained in premium during the first week of the month but it went back into discount after retail demand weakened following the price jump and bullion imports at concessional duty under the India-UAE Comprehensive Economic Partnership Agreement (CEPA) also weakened during the month.4 The local market remained in discount for most of the month, falling to a discount of US$20-25/oz (Chart 1). 5 The local market has continued in discount over the first two weeks of December, averaging a discount of US$15/oz.

Chart 1: Weak retail demand kept the local market in discount for most of the month

The rupee appreciated m-o-m for the first time this year

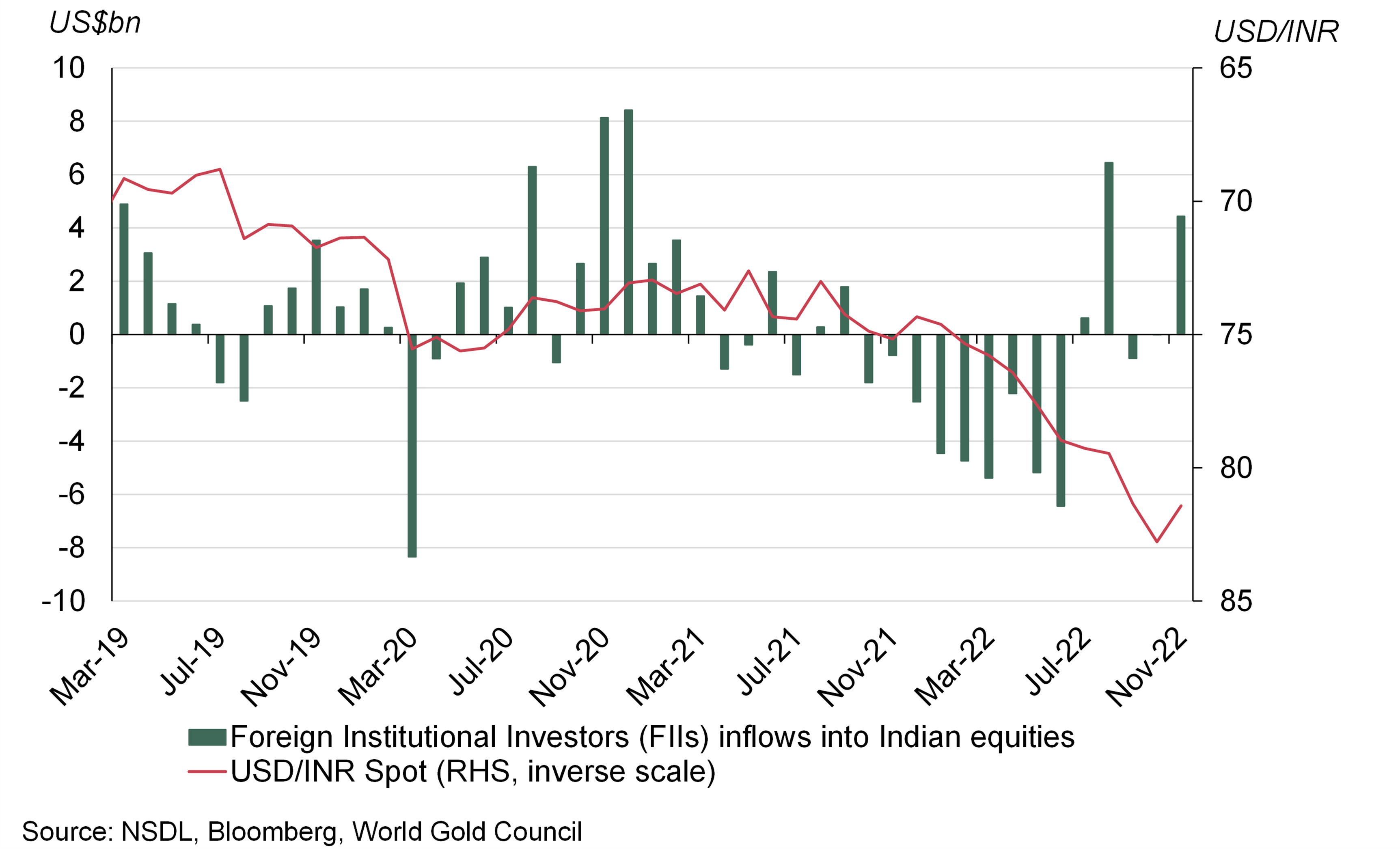

The rupee appreciated by 1.7% in November – the first increase this year (Chart 2). The appreciation was led by strong foreign institution inflows (FIIs) into the Indian equity market (US$4.4bn) and a depreciation in the dollar index (DXY). The Indian rupee had been depreciating since the beginning of the year in the face of a strong dollar and net outflows from FIIs in the Indian equity market. 6

Chart 2 : Rupee appreciated m-o-m for the first time this year

India’s retail inflation slumped to an 11-month low

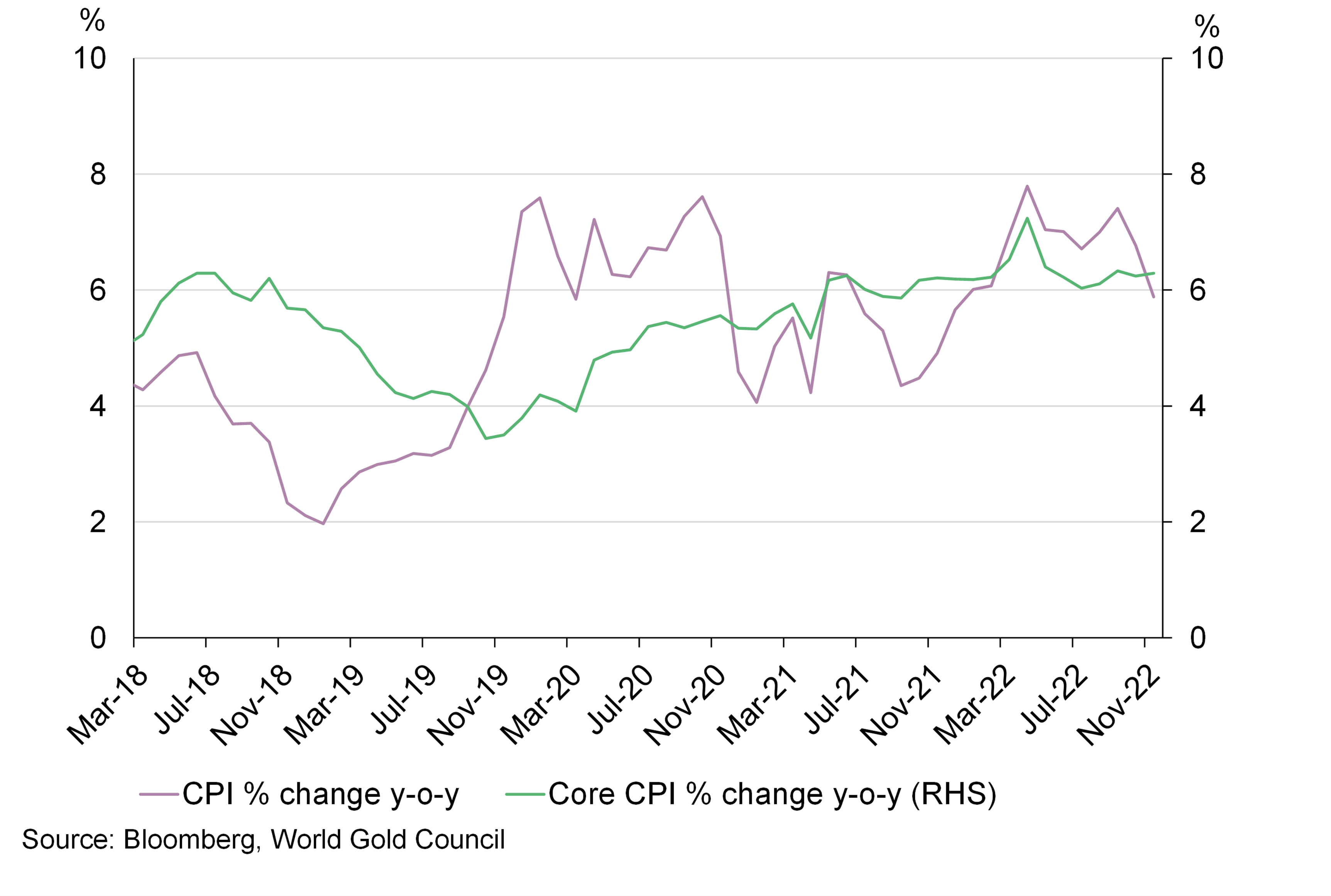

India’s headline retail inflation (CPI inflation) declined to an 11-month low of 5.88% y-o-y in November from 6.77% y-o-y in October (Chart 3). The fall was driven by food inflation, which plummeted to 4.67% in November from 7.01% in October.

This sharp fall should be a relief for the RBI, which has been hiking interest rates since May. With CPI now below the upward target range of 6%, many economists think that the monetary policy committee (MPC) may be near the end of its tightening cycle. After the recent increase in the policy rate of 35bps, which was made at the December MPC meeting by the RBI, economists believe that a final rate hike may take place in February 2023. Some economists are also of the view that the MPC may even start to cut interest rates in H2 2023, due to slowdown in the economy in 2023. A fall in inflation and lower interest rates should boost disposable income and support gold demand going forward.

Chart 3: Indian retail inflation slumped to 11-month low in November

Retail demand softened and imports declined during November

After a healthy demand during Dhanteras, retail demand slowed during November, impacted by a jump in the local domestic gold price and a slowdown in consumer discretionary spending. 7 Retail demand was supported by wedding purchases in the month, but regular purchases remained muted due to the higher gold price, which enticed some consumers to exchange gold-for-gold. Interaction with the trade highlighted a rise in recycling volumes too.

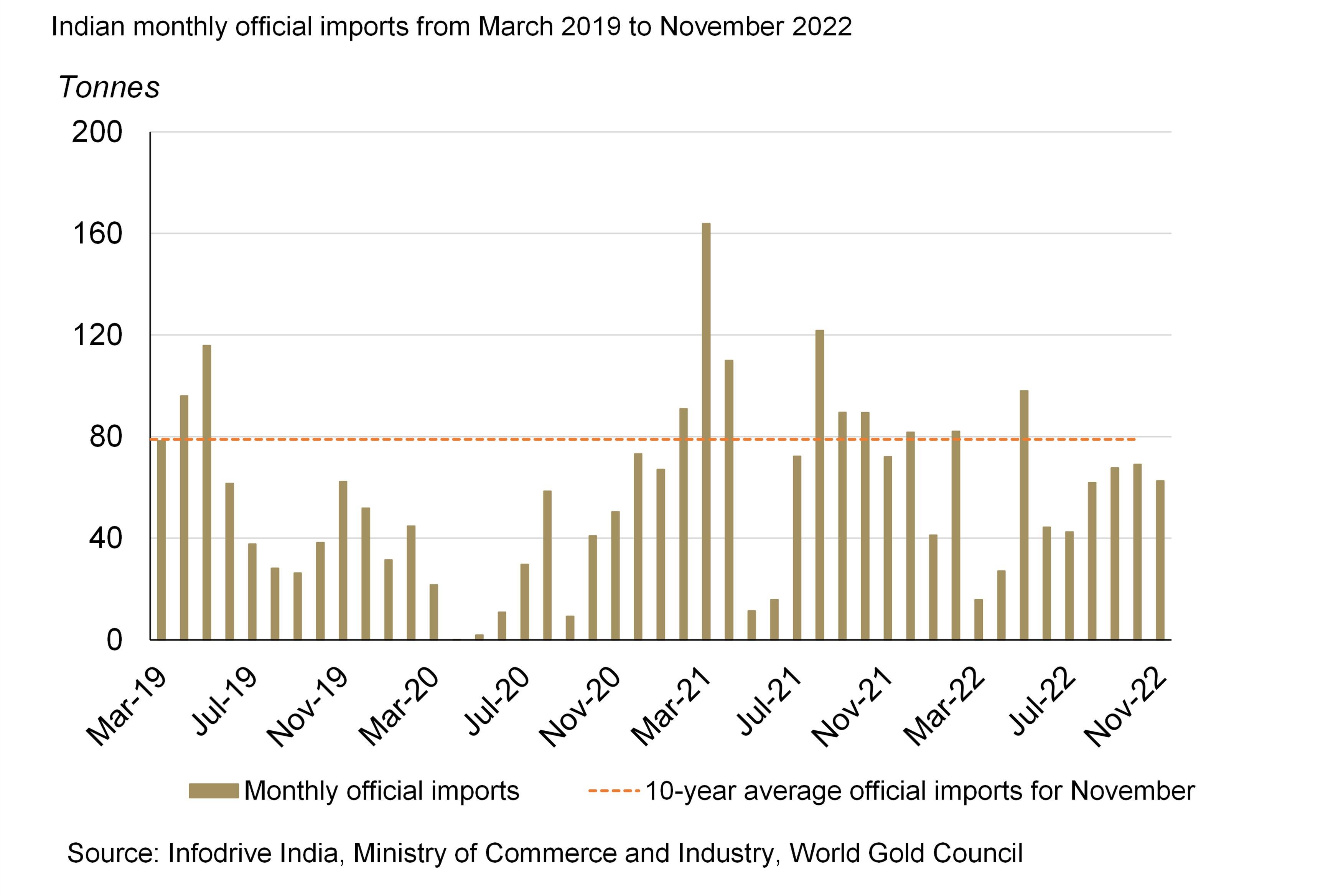

As retail demand slowed, official imports declined to 62.6t in November – 13% lower y-o-y and 9% lower m-o-m (Chart 4). Official imports were also impacted by a surge in unofficial imports of gold.

Looking ahead, retail demand is expected to slow between mid-December and mid-January as this will be an inauspicious period for weddings in many parts of the country. Retail demand will continue to face headwinds due to the higher gold price but a correction in retail inflation should boost consumer spending on gold.

Chart 4: Indian gold official imports declined in November

Indian gold ETFs witnessed net outflows in November

With a 4.8% increase in the domestic gold price in November, investors booked profits, resulting in a net monthly outflow of 0.6t.8 This decreased total gold holdings to 38.6t (Chart 5). Overall, Indian gold ETFs have seen small but meaningful net inflows of 1t y-t-d.

Chart 5: Indian gold ETFs saw net outflows in November

The RBI made no gold purchases in November.

After purchasing 1t of gold in October, the RBI kept its gold reserves constant during November, leaving its total gold reserves at 786.3t (Chart 6).9 India’s FX reserves have slumped by US$83bn this year due to the intervention in the FX market by the RBI in an attempt to defend the INR.10 With dwindling FX reserves, the RBI’s y-t-d gold purchases of 32.2t are 56% lower y-o-y. In November, the RBI’s gold reserves stood at 8% of total FX reserves compared to 6.9% at the end of 2021.

Chart 6: RBI made no gold purchases in November

Footnotes