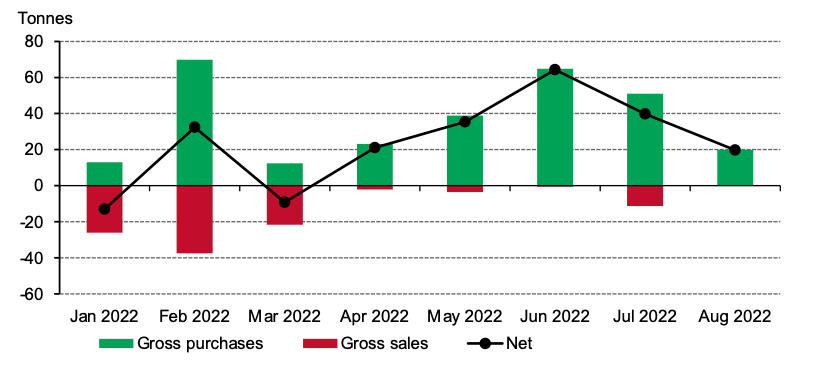

Central bank net purchases of gold slowed to 20t in August, halving m-o-m.1 This is the fifth consecutive month of net purchases from the central banking sector.

Summer slowdown for central bank net purchases

29 September, 2022

Gold-related activity among central banks was muted in August; only a handful of banks meaningfully contributed to the overall monthly total. Three banks published an increased to their gold reserves by a tonne or more, while there were no notable sellers by the same measure in the available data.

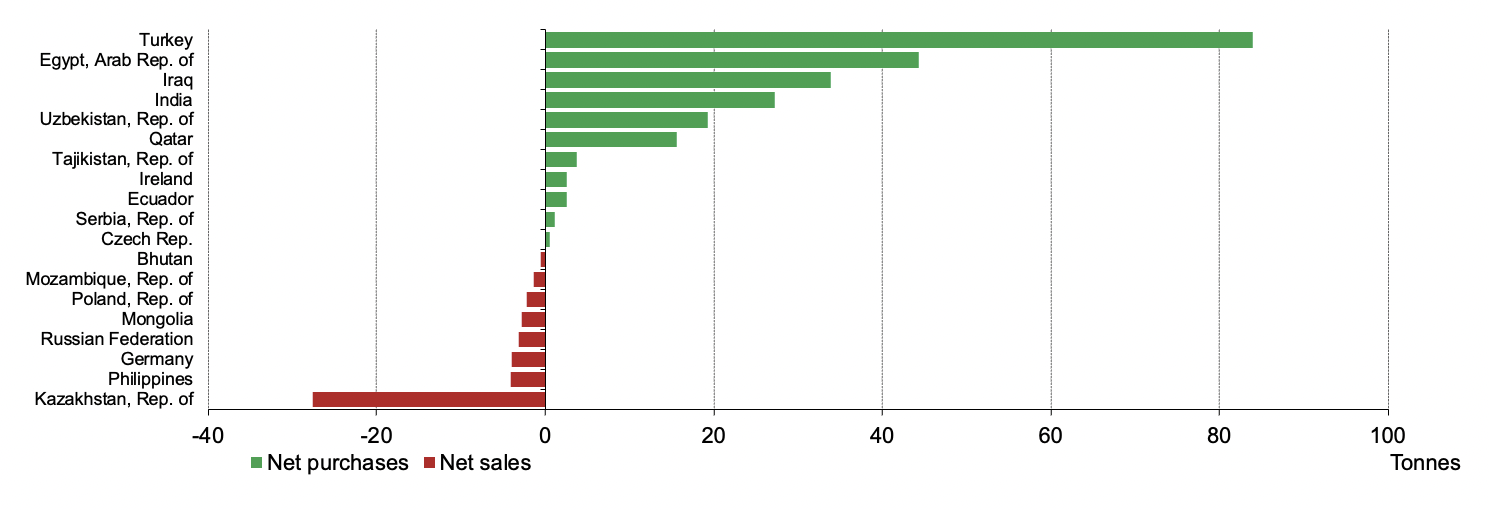

Turkey – the largest gold buyer so far this year – bought another 9t during the month. This increased its total gold purchases to 84t y-t-d, lifting its official gold reserves (central bank plus treasury holdings) to 478t – the highest level since Q2 2020.

Uzbekistan also added 9t tonnes to its reserves in August, the same amount as the previous two months. This brings its y-t-d net purchases to over 19t despite having begun the year by selling almost 25t in Q1. Its gold reserves now total over 381t (59% of total reserves). In addition, following a reduction of 11t in July, Kazakhstan switched to net purchases in August, incrementally increasing its gold holdings by 2t. Its total gold reserves are now just shy of 375t, down almost 28t since the start of the year. As we have noted before, it is not uncommon for banks which buy from domestic production – such as Uzbekistan and Kazakhstan – to switch between buying and selling.

Finally, preliminary data published by the Qatar Central Bank suggests a further addition to its gold reserves during August. But as the precise tonnage increase has not yet been reported in the IMF IFS database, we have decided to exclude from our data. If confirmed, it would be the fifth consecutive month in which Qatar’s official gold reserves have risen. Total gold reserves stood at 72t at the end of July, up 16t (+27%) since the start of the year.

We will analyse the full Q2 and y-t-d picture, as well as update our outlook of central bank net gold purchases in the next Gold Demand Trends report. This will be published at the end of October.

Year-to-date central bank net purchases and sales*

Footnotes

1 Our data set is based on IMF data but is supplemented with data from respective central banks where it is available and not reported through the IMF at the time of publication. This data may be revised in our next monthly update should more data become available.