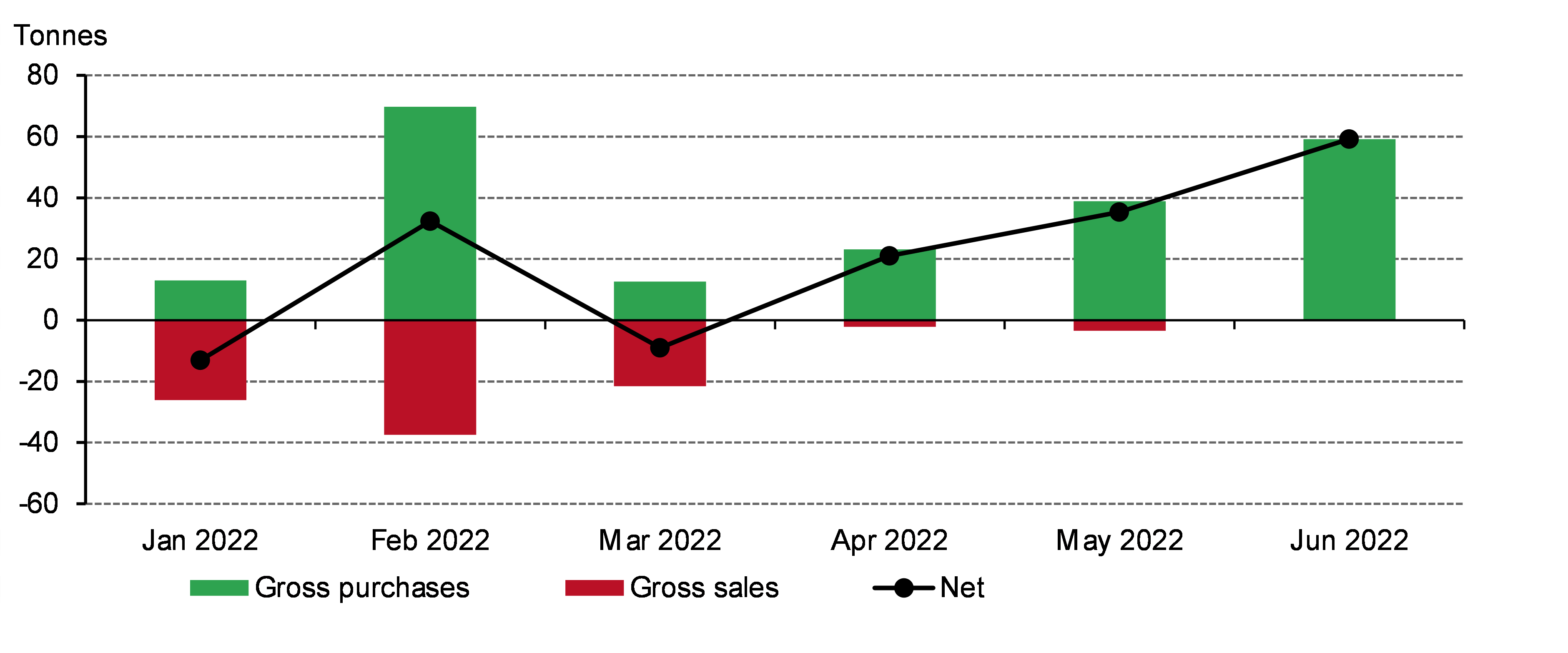

Last week we published our updated central bank gold statistics to include data reported for June. This new information shows that central banks added a net 59t to global gold reserves during the month. And it was also the first month this year to see no reported sales, based on currently available IMF data.1

Central bank buying strengthens in June

2 August, 2022

*Data to June 2022 where available.

Source: IMF IFS, Respective central banks, World Gold Council

The Central Bank of Iraq was the largest purchaser in June, adding 34t to its gold reserves. This is Iraq’s first addition since September 2018 (7t) and lifts total gold reserves to 130t, 11% of total reserves. Uzbekistan (9t), Turkey (8t), Kazakhstan (4t) and India (4t), all regular buyers, were the other significant purchases during the month.

In all, central bank net purchases for Q2 stand at 180t, pushing the H1 total to 270t as reported in our recently published Gold Demand Trends.2 This is a continuation of the strong buying that we saw last year and we now expect full-year central bank demand for 2022 to be on a par with 2021 levels.

- Our data set is based on IMF data but is supplemented with data from respective central banks where it is available and not reported through the IMF at the time of publication. This data may be revised in our next monthly update should more data become available.

- This figure is based on both IMF data and Metals Focus estimates